Introduction to Option Trading

In the world of finance, options trading presents an alluring blend of potential profits and calculated risks. An option, in essence, is a contract between two parties that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This unique characteristic differentiates options from stocks, which represent ownership shares in a company and fluctuate in value based on market supply and demand.

Image: niyudideh.web.fc2.com

Understanding the intricacies of option trading is paramount to harnessing its lucrative potential while managing the inherent risks. In this exhaustive guide, we will delve into the history, mechanisms, and strategies of option trading, empowering you with the knowledge and confidence to navigate this captivating arena.

Understanding Option Terminology

Before embarking on our journey into option trading, let’s illuminate key terminology:

- Call Option: A call option grants the buyer the right to buy an underlying asset (e.g., a stock or commodity) at a specific price (the strike price) on or before the expiration date.

- Put Option: Conversely, a put option provides the buyer with the right to sell an underlying asset at the strike price.

- Premium: The premium is the amount paid by the buyer to acquire the option contract, which entitles them to the aforementioned rights.

- Expiration Date: The expiration date marks the ultimate day on which the option contract can be exercised by the buyer.

- Intrinsic Value: The intrinsic value of an option represents the difference between the strike price and the current price of the underlying asset.

- Time Value: The time value of an option captures the premium paid for the remaining time until expiration, assuming the underlying asset price remains unchanged.

Strategic Options Trading

To effectively engage in option trading, a nuanced understanding of trading strategies is essential. Let’s explore some popular approaches:

- Covered Call: In a covered call strategy, the trader owns the underlying asset (e.g., stock) and simultaneously sells (writes) a call option against it. This strategy aims to generate income by collecting the premium while exposing the trader to limited upside potential in the underlying asset.

- Cash-Secured Put: Similar to a covered call, a cash-secured put involves selling (writing) a put option while holding sufficient cash to purchase the underlying asset should the option be exercised. This strategy provides downside protection while offering the chance to acquire the asset at a discount.

- Delta-Neutral: A delta-neutral strategy seeks to achieve a neutral position by balancing long and short positions in both the underlying asset and options. The goal is to minimize price fluctuations while potentially profiting from time decay.

- Straddle: A straddle involves buying both a call and a put option for the same underlying asset, with the same strike price and expiration date. This strategy benefits from significant price volatility, whether upward or downward.

Evaluating Option Value

Assigning an accurate value to an option is crucial for informed trading decisions. Traditionally, the Black-Scholes model has been widely used to calculate option valuation. This mathematical formula considers factors such as the underlying asset price, strike price, risk-free interest rate, time to expiration, and volatility.

While the Black-Scholes model offers a widely accepted valuation framework, it’s worth noting that it incorporates certain assumptions and limitations. The complex nature of markets and the variables at play often warrant customized valuation approaches tailored to each trader’s risk tolerance and investment goals.

Image: moneypip.com

Managing Risk in Option Trading

The potential rewards of option trading come hand in hand with inherent risks. Prudent risk management strategies are vital to mitigate losses and preserve capital in volatile markets:

- Understanding Leverage: Options magnify the potential impact of underlying asset price movements. Traders should exercise caution when utilizing leverage and carefully consider their risk appetite.

- Hedging with Options: Options can serve as hedging instruments to offset risk in existing portfolio positions. By employing strategies like protective puts or collars, traders can enhance portfolio resilience amid market downturns.

- Monitoring Volatility: Volatility is a fundamental factor influencing option pricing and risk. Traders should diligently monitor volatility levels and adjust strategies accordingly to navigate market fluctuations.

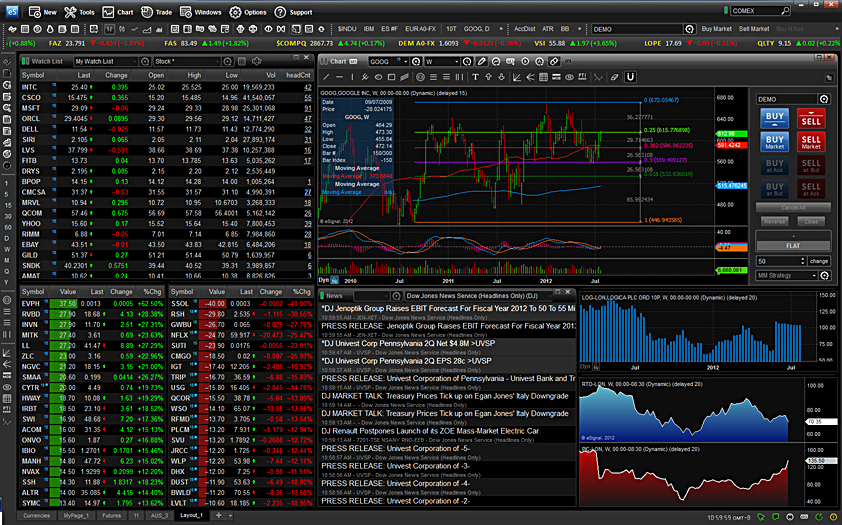

Stock For Option Trading

Image: financebreakout.com

Conclusion

Option trading offers an alluring blend of opportunities and challenges. By grasping the fundamental concepts, terminologies, and trading strategies involved, traders can unlock the potential of this multifaceted financial instrument. However, vigilance and a thorough understanding of risk management principles are paramount to successful and sustainable trading.

Embarking on the journey of option trading empowers you with a powerful tool to navigate the complexities of financial markets. Whether you seek to enhance returns, hedge against risk, or simply grasp a deeper understanding of market dynamics, the world of option trading awaits your exploration. As always, thorough research, calculated decision-making, and prudent risk management will serve as your compass on this captivating path.