Options trading can be a lucrative way to speculate on the stock market, but it’s crucial to understand the requirements before getting started. Level 2 options trading offers advanced features and tools, but it also comes with stricter eligibility criteria. In this comprehensive guide, we will delve into the intricate world of Level 2 options trading, exploring the requirements, strategies, and risks involved.

Image: www.youtube.com

Before embarking on the path to Level 2 options trading, it’s essential to assess your eligibility and meet the necessary qualifications. These requirements ensure that traders possess the requisite knowledge, experience, and financial stability to navigate the complexities of Level 2 trading.

Eligibility Check: Walking the Path to Level 2

The Financial Industry Regulatory Authority (FINRA) has established specific criteria that traders must satisfy to qualify for Level 2 options trading. These requirements include:

- Completion of the Series 7 Exam: This comprehensive exam tests your knowledge of general securities topics, including options trading principles.

- Submission of Form 4: This form provides detailed information about your trading experience, financial status, and investment objectives.

- Approval by Your Brokerage Firm: Your brokerage firm will thoroughly review your Form 4 and may request additional documentation before granting approval.

Unveiling Level 2 Options: A World of Enhanced Possibilities

Level 2 options trading opens the door to a range of advanced features and tools that can enhance your trading strategies. These include:

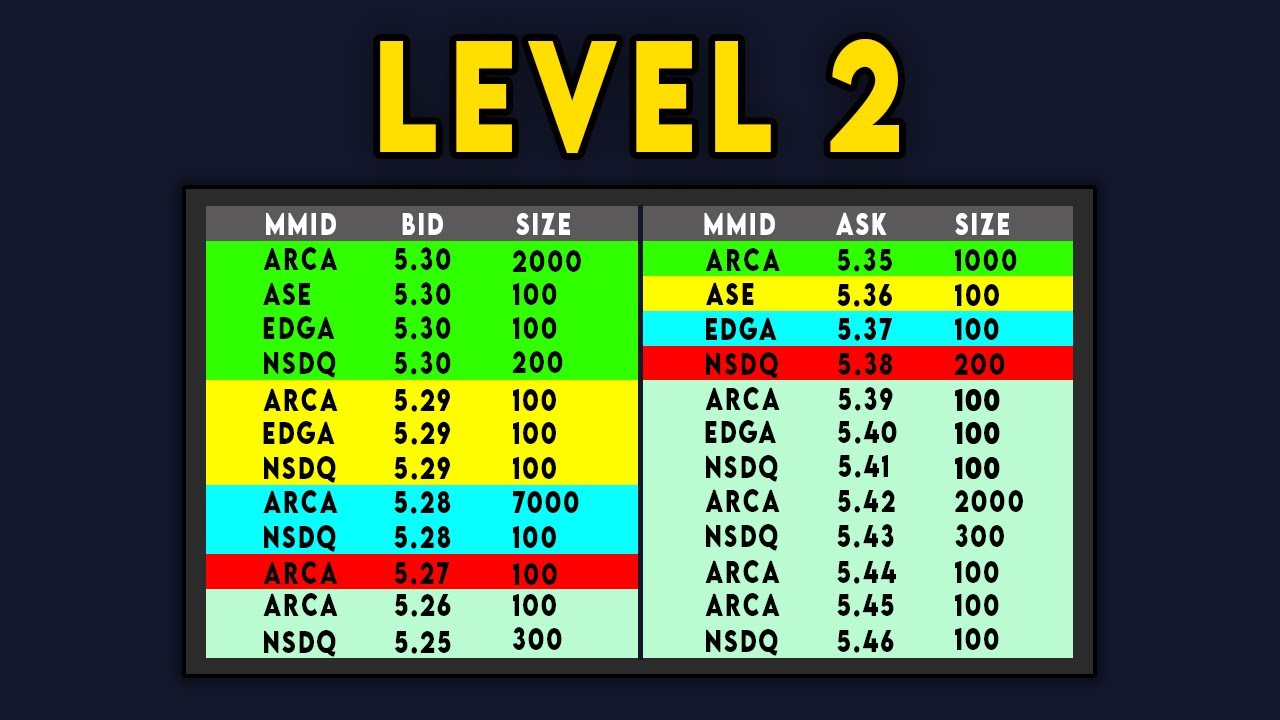

- Real-Time Market Data: Level 2 traders have access to real-time quotes and market depth, enabling them to stay on top of market movements.

- Tiered Margin: Margin requirements for Level 2 options are typically lower, allowing traders to use leverage more efficiently.

- Option Depth of Market (Option DOM): The Option DOM provides a visual representation of all outstanding orders, enabling traders to analyze market sentiment.

While Level 2 options trading offers enhanced features, it’s crucial to remember that it also involves greater risks. Traders should thoroughly understand the risks and develop sound trading strategies before venturing into this complex realm.

Navigating the Nuances: Tips and Expert Advice

To succeed in Level 2 options trading, it’s crucial to heed the advice of seasoned experts. Here are some valuable tips to guide your journey:

- Enhance Your Knowledge: Continuous learning is paramount. Study financial markets, options trading strategies, and market analysis techniques.

- Start Small: Begin trading with small positions until you gain confidence and develop a proven strategy.

- Practice Risk Management: Understand risk management principles and implement stop-loss orders to limit potential losses.

- Don’t Overtrade: Avoid excessive trading that can lead to emotional decision-making and poor outcomes.

Remember, Level 2 options trading requires discipline, patience, and a commitment to constant learning. By embracing these principles, you can increase your chances of success.

Image: www.projectfinance.com

FAQs: Clearing the Common Queries

Q: What are the benefits of Level 2 options trading?

A: Level 2 options trading offers access to real-time market data, tiered margin, and advanced tools like the Option DOM, enhancing trading capabilities.

Q: What are the risks associated with Level 2 options trading?

A: Level 2 options trading comes with higher risks, such as volatility, margin calls, and complex strategies that require a deep understanding.

Q: How do I qualify for Level 2 options trading?

A: You must pass the Series 7 Exam, submit Form 4, and obtain approval from your brokerage firm.

Level 2 Options Trading Requirements

Conclusion

Level 2 options trading offers a world of exciting possibilities but also demands a profound understanding of the requirements, strategies, and risks involved. By meeting the eligibility criteria, leveraging advanced tools, and adhering to expert advice, traders can navigate this complex realm and potentially reap the rewards it offers. Are you ready to embark on this challenging and potentially rewarding journey?