Introduction:

Small stocks have often been overlooked by options traders in favor of the more liquid and well-known large-cap stocks. However, small stocks can offer unique opportunities for traders seeking outsized returns and diversification. In this detailed guide, we will delve into the world of small stocks for options trading, exploring the intricacies, benefits, and strategies to maximize your trading outcomes.

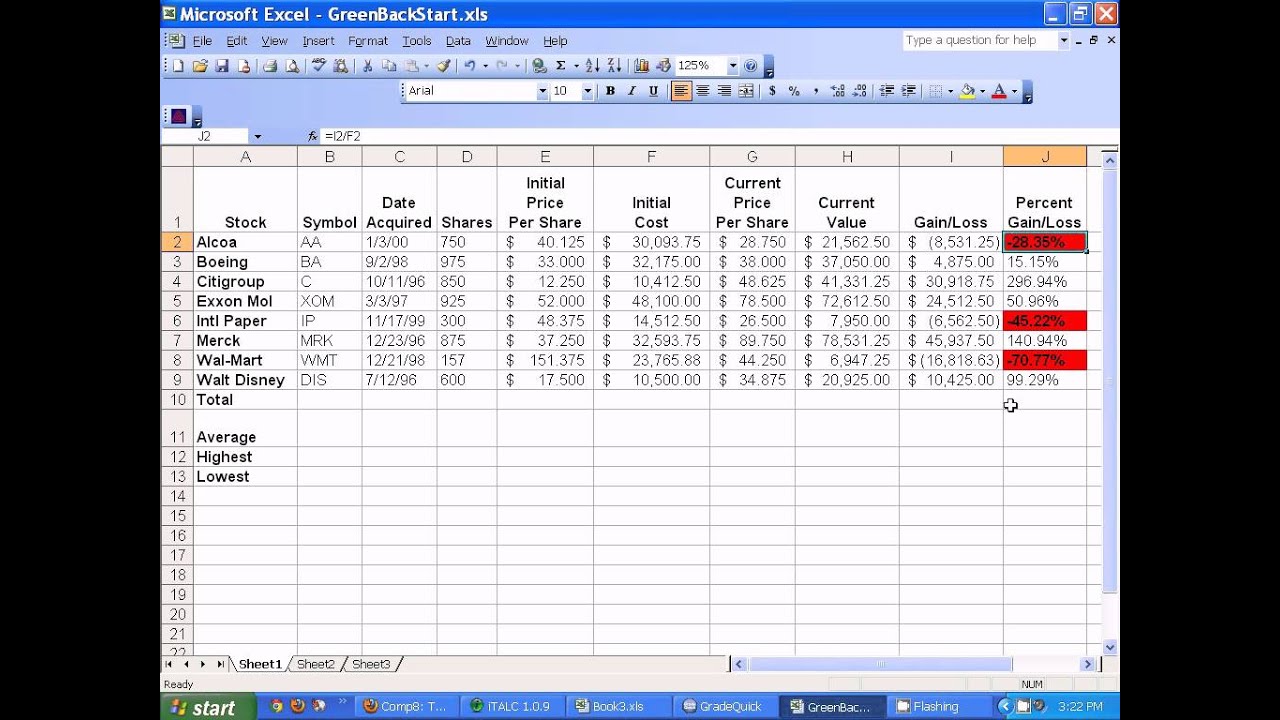

Image: iwysuhod.web.fc2.com

Understanding Small Stocks:

Small stocks, also known as micro-cap or nano-cap stocks, are shares of small companies with a generally lower market capitalization than large-cap or mid-cap stocks. They typically have limited financial resources, a narrower product or service offering, and a smaller number of employees. While small stocks may be less liquid than their larger counterparts, they often exhibit higher volatility and growth potential, making them attractive for options traders.

Benefits of Trading Options on Small Stocks:

- Higher Volatility: Small stocks tend to fluctuate more sharply than larger stocks, particularly during market swings. This increased volatility presents opportunities for traders to capitalize on price changes and generate substantial profits through options trading strategies.

- Potential for Outsized Returns: Small stocks, due to their higher growth potential and sensitivity to market events, can offer the possibility of booming returns. Traders with a strong understanding of small-cap investing and the ability to identify undervalued companies can leverage options to magnify their gains.

- Diversification: Adding small stocks to an options portfolio can help diversify risks. Small stocks often have different drivers and correlations compared to large-cap stocks, offering traders a way to reduce overall portfolio volatility and enhance risk-adjusted returns.

- Tailwind of Economic Growth: Small businesses tend to expand quickly during periods of economic growth. This growth positively influences the stock prices of small companies, providing opportunities for traders to capture momentum and ride the upside.

Options Strategies for Small Stocks:

- Long Call Options: When traders anticipate a rise in the stock price, they can buy long call options. This strategy allows them to profit from price appreciation while limiting the risk to the premium paid for the options.

- Long Put Options: In case of expected stock price declines, traders can purchase long put options. These options provide the right to sell the underlying stock at a predefined price, allowing traders to profit from a drop in value.

- Covered Calls: This strategy involves selling call options against an existing position in the underlying stock. It offers limited but consistent returns while providing downside protection, making it suitable for balanced traders.

- Iron Condor: This advanced strategy involves buying an out-of-the-money call option, selling a higher out-of-the-money call option, buying an out-of-the-money put option, and selling a lower out-of-the-money put option. It aims to profit from a low-volatility, range-bound market environment.

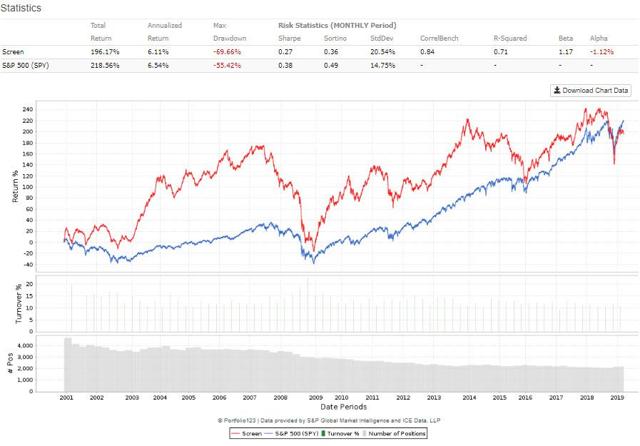

Image: seekingalpha.com

Selecting Small Stocks for Options Trading:

- Fundamental Analysis: Examine financial statements, industry trends, and company news to identify small stocks with a strong potential for growth and stability. Look for companies with consistent revenue growth, healthy margins, and low debt-to-equity ratios.

- Technical Analysis: Utilize technical indicators such as moving averages, support and resistance levels, and chart patterns to identify potential entry and exit points for options trades. Determine trend strength and identify potential inflection points in stock prices.

- Market Sentiment: Monitor overall market sentiment and economic conditions. Identify sectors and industries that are experiencing tailwinds or headwinds and align your trading strategy with these trends.

Managing Risks in Small Stock Options Trading:

- Position Sizing: Carefully calculate the appropriate size of your options positions based on your risk tolerance and account balance. Avoid risking more than you can afford to lose.

- Stop-Loss Orders: Implement stop-loss orders to protect your capital in case of adverse price movements. Determine risk levels and set stop-loss prices to limit potential losses.

- Hedging: Employ hedging strategies such as protective puts or collars to reduce overall portfolio risk. Hedging can help mitigate the effects of market volatility and enhance capital preservation.

Small Stocks For Options Trading

Image: www.pinterest.com

Conclusion:

Trading options on small stocks can be a rewarding endeavor for investors seeking outsized returns, diversification, and volatility exposure. Understanding the unique characteristics of small stocks and implementing effective options strategies are crucial to maximizing trading outcomes. By conducting thorough research, managing risks wisely, and aligning with market trends, traders can leverage small stocks to enhance their investment portfolios and generate significant gains.

Remember, successful options trading requires a comprehensive understanding of the markets, astute stock selection, and skillful risk management. Embrace the challenges of small stock options trading with a well-defined strategy to unlock the potential for substantial rewards and expand your trading horizons.