In today’s tumultuous financial landscape, the allure of option trading captivates many investors seeking exponential gains. However, understanding the complexities and potential risks involved is crucial before venturing into this market. If you’re considering applying for option trading within your account, it’s imperative to embark on a thorough evaluation process to determine its suitability.

Image: brokerchooser.com

Assessing Suitability for Option Trading

Option trading, a sophisticated investment strategy, involves buying or selling contracts with the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. While it presents opportunities for substantial profits, it also carries significant risk of loss. To ensure your eligibility for option trading within your account, brokerage firms meticulously evaluate various factors, including:

- Investment Experience: Most firms require applicants to demonstrate a substantial understanding of investment concepts, including risk tolerance, market volatility, and trading strategies.

- Account Size: Option trading often requires a minimum account balance to cover potential losses or margin requirements.

- Risk Assessment and Tolerance: Brokerage firms assess your risk tolerance to ensure your trading strategies align with your financial goals and comfort level with potential losses.

- Knowledge Test: Some firms administer knowledge tests to evaluate your grasp of option trading strategies, risks, and terminology.

Benefits and Risks of Option Trading

Option trading offers several potential benefits, such as:

- Income Generation: Selling options can generate premiums, providing a potential source of income.

- Hedging: Options allow investors to manage risk by safeguarding against adverse price movements.

- Leverage: Options provide leverage, enabling investors to control large positions with a relatively small amount of capital.

However, option trading also carries substantial risks, including:

- Unlimited Losses: Unlike investing in the underlying asset, losses in option trading can be potentially unlimited.

- Time Decay: Option premiums erode over time, which can significantly reduce the value of your contract if the underlying asset doesn’t move as expected.

- Market Volatility: Extreme market volatility can result in substantial price fluctuations, making it difficult to predict the direction of the underlying asset.

Image: zufabodoryteb.web.fc2.com

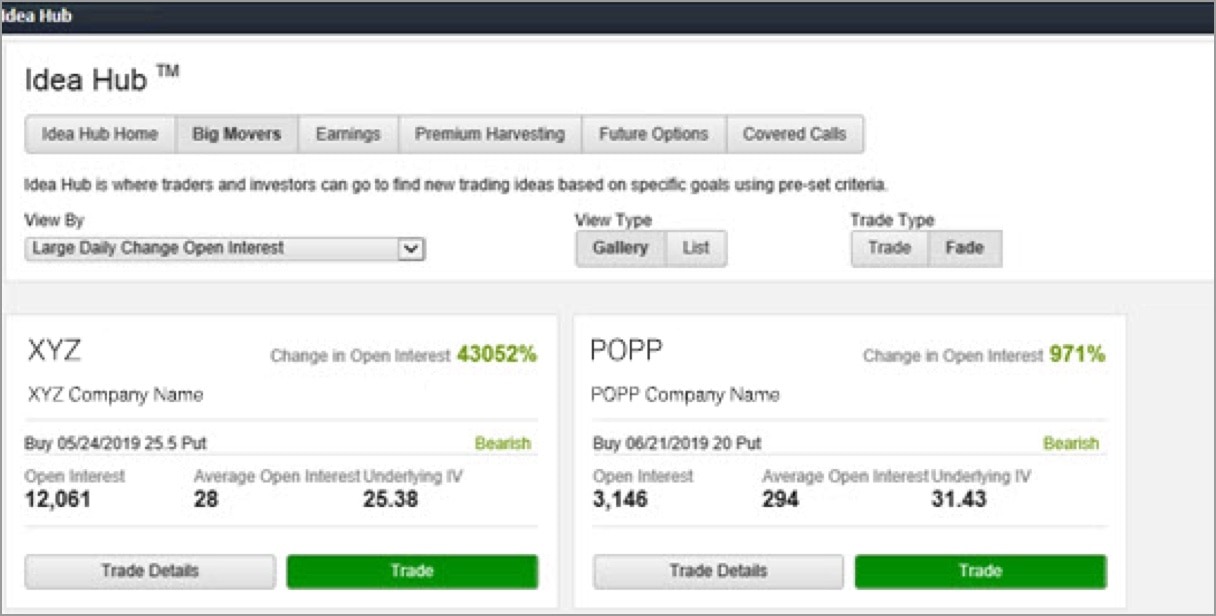

Should I Apply For Option Trading Within This Account

Image: www.schwab.com

Conclusion

Applying for option trading within your account requires careful consideration of your investment experience, risk tolerance, and account balance. While option trading presents potential opportunities for high returns, it also carries significant risks. It’s crucial to thoroughly understand the intricacies of this sophisticated strategy and ensure it aligns with your financial goals and risk appetite. By conducting thorough research and seeking guidance from experienced financial professionals, you can make an informed decision on whether option trading is the right choice for you within your current account.