Introduction

Image: www.youtube.com

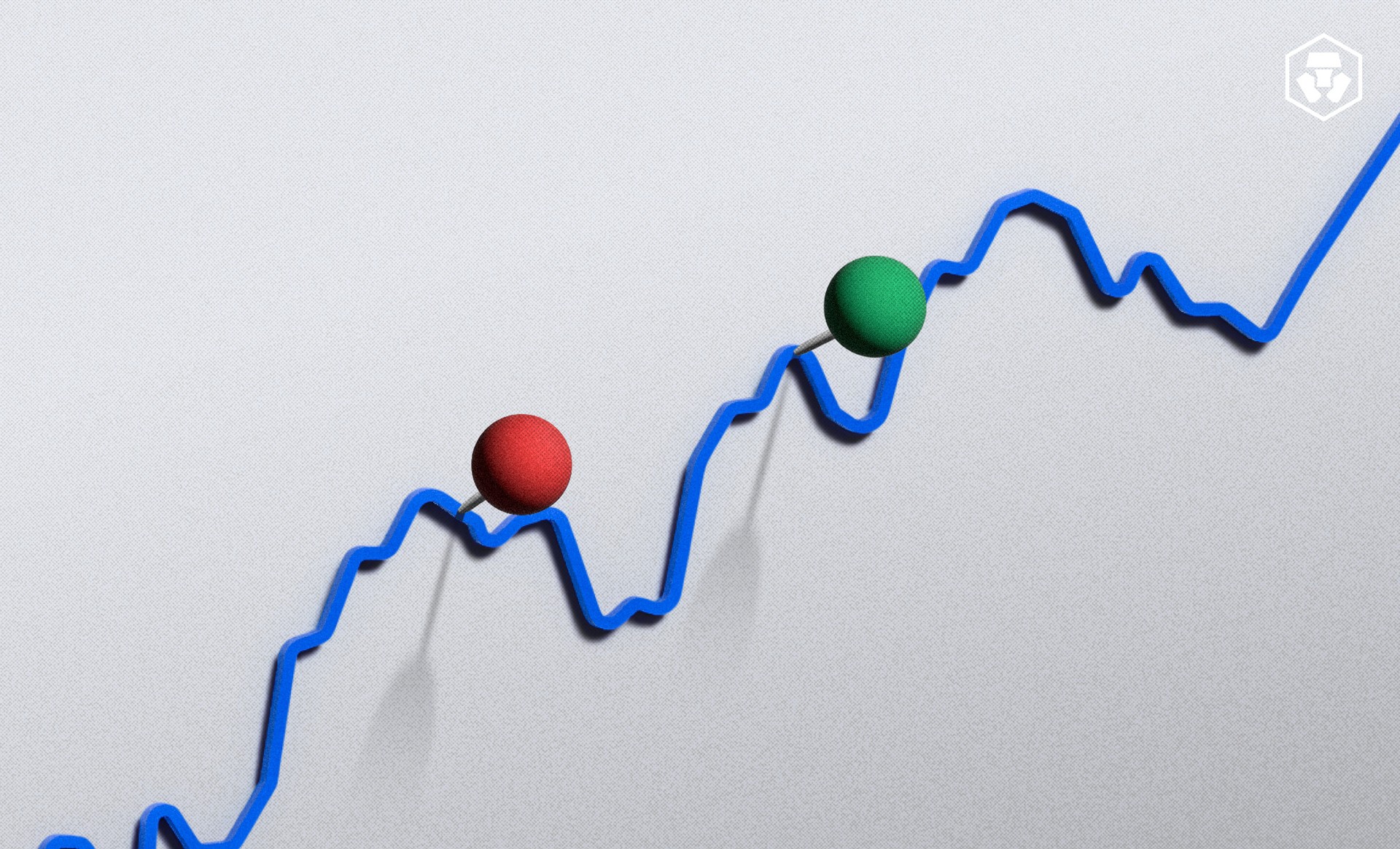

For savvy traders seeking to navigate the often unpredictable stock market with precision, understanding the art of day trading is essential. Day trading involves leveraging options strategies to capture short-term market movements, potentially yielding substantial rewards. Among these strategies, hedging with options stands out as a powerful tool for managing risk and maximizing profit potential. In this comprehensive guide, we will delve into the world of short-term trade ideas for day trading options to hedge, empowering you with actionable insights from the experts.

Understanding the Basics of Day Trading Options

Day trading with options revolves around leveraging the financial instruments known as options. Options represent contracts that grant the holder the right to buy (call option) or sell (put option) an underlying asset, typically a stock or index, at a predetermined price (strike price) within a specific period (expiration date). Traders purchase these contracts based on their market outlook, aiming to capitalize on price fluctuations.

Hedging, a cornerstone of risk management in day trading, involves employing a strategy designed to safeguard against potential losses. When used with options, hedging mitigates the volatility inherent in the market by balancing the trader’s exposure to different underlying assets or the same asset at varying strike prices.

Unveiling Short-Term Trade Ideas

-

Delta Neutral Trading: This strategy focuses on creating a portfolio with corresponding amounts of call and put options with the same underlying asset and strike price. It perpetuates delta neutrality, limiting price changes from influencing the portfolio’s overall value, enabling traders to benefit from time decay and potentially generate income from the premiums.

-

Pairs Trading: Pairs trading involves simultaneously buying and selling similar stocks with a historical relationship or price correlation. The aim is to exploit price discrepancies between the paired stocks, mitigating specific risk exposures. By correctly anticipating and leveraging the convergence or divergence of the pair, traders can strive to secure profit regardless of market direction.

-

Butterfly Spreads: As a multi-leg option strategy, butterfly spreads incorporate one call, one put, and two additional options (typically calls or puts) with varying strike prices. This intricately structured strategy pursues profiting from anticipated limited price movements while hedging against extreme market fluctuations. Butterfly spreads cater to those seeking defined risk and reward parameters.

Expert Insights and Actionable Tips

“Risk management is the paramount principle in day trading with options to hedge. Always exercise prudence in position sizing and thoroughly comprehend the inherent risks before executing any trade,” counsels seasoned day trader, Mark Douglas.

“Stay informed about market trends, economic news, and company-specific announcements. Knowledge is the linchpin of successful day trading,” emphasizes financial analyst, Karen Jones.

“Discipline and emotional restraint are vital in day trading. Avoid impulsive decision-making and stick to your trading strategy. Discipline is the key to consistent profitability,” advises professional trader, John Carter.

Conclusion

The intricate world of day trading options to hedge presents a compelling opportunity for traders to enhance their market acumen, potentially reap substantial returns, and effectively manage risk. By grasping the strategies outlined in this article, aspiring traders can equip themselves with a firm foundation for successful short-term trade execution. Remember to approach day trading with due diligence, continuously seek knowledge and refinement, and exercise discipline throughout your trading journey. May the markets favor your informed decisions!

Image: www.bank2home.com

Short Term Trade Ideas Day Trading Options To Hedge

Image: crypto.com