<!DOCTYPE html>

Image: tme.net

As the world of finance evolves, short options trading has emerged as a potent technique to harness market fluctuations for potential returns. This intricate strategy involves selling options with the expectation that the underlying asset will move in a predictable direction.

I initially encountered short options trading while exploring advanced investment strategies. Intrigued by its potential, I delved deeper, eager to unravel its complexities. Through extensive research, I discovered a treasure trove of knowledge that I now eagerly share with fellow traders.

Unveiling the Essence of Short Options Trading

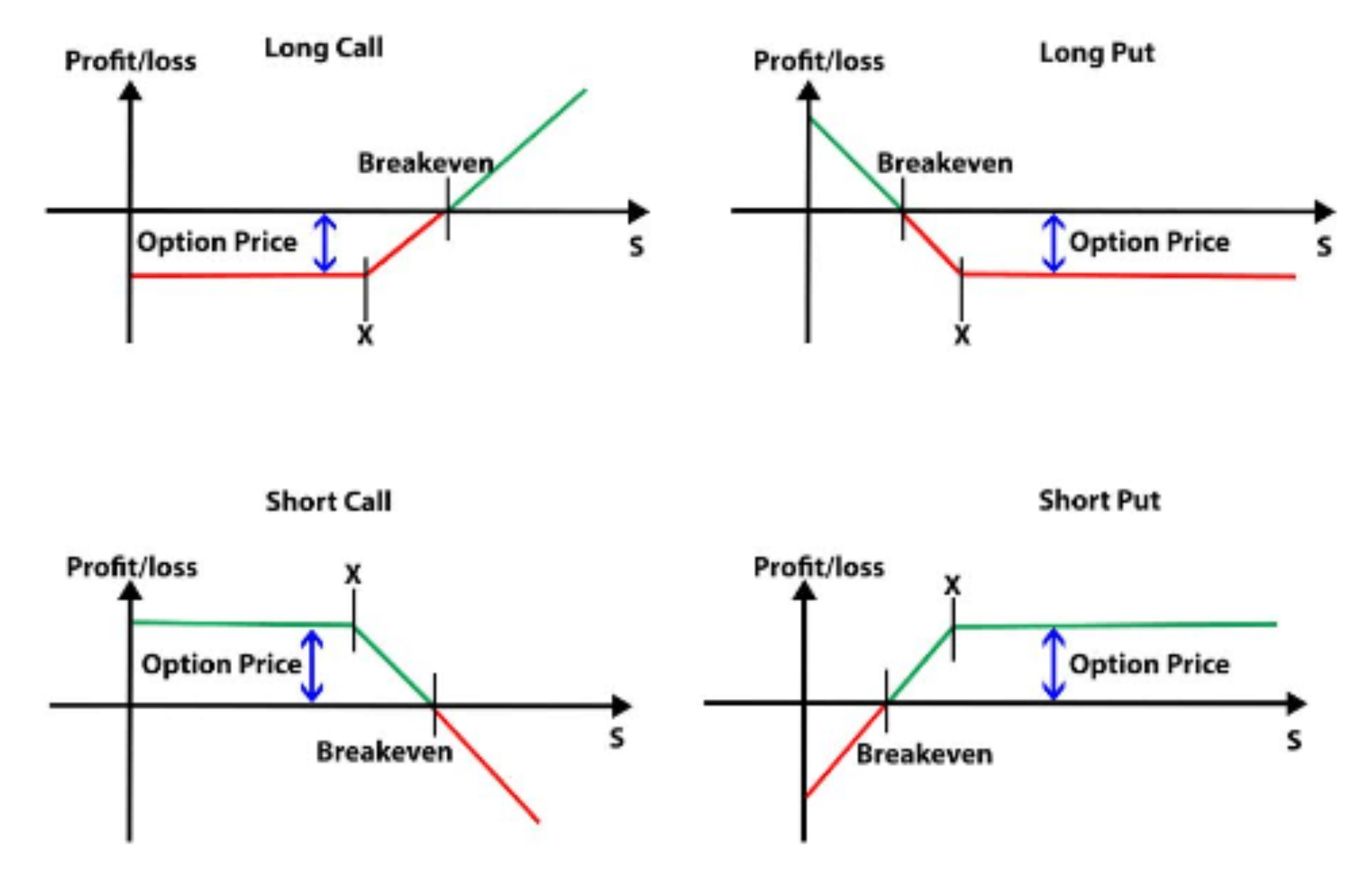

In essence, short options trading involves writing, or selling, an option contract. The writer of the option is obligated to either buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at a predetermined price and date. However, they receive a premium payment from the buyer of the option.

The key distinction from traditional options trading lies in the seller’s position. Instead of purchasing an option, the writer sells it, speculating that the underlying asset will not reach the strike price. If their prediction holds true, they retain the premium payment. However, if the asset price moves against them, they may be obligated to buy or sell the asset at an unfavorable price.

Six Strategies for Mastering Short Options Trading

To effectively navigate the complexities of short options trading, consider adopting these six expert-crafted strategies:

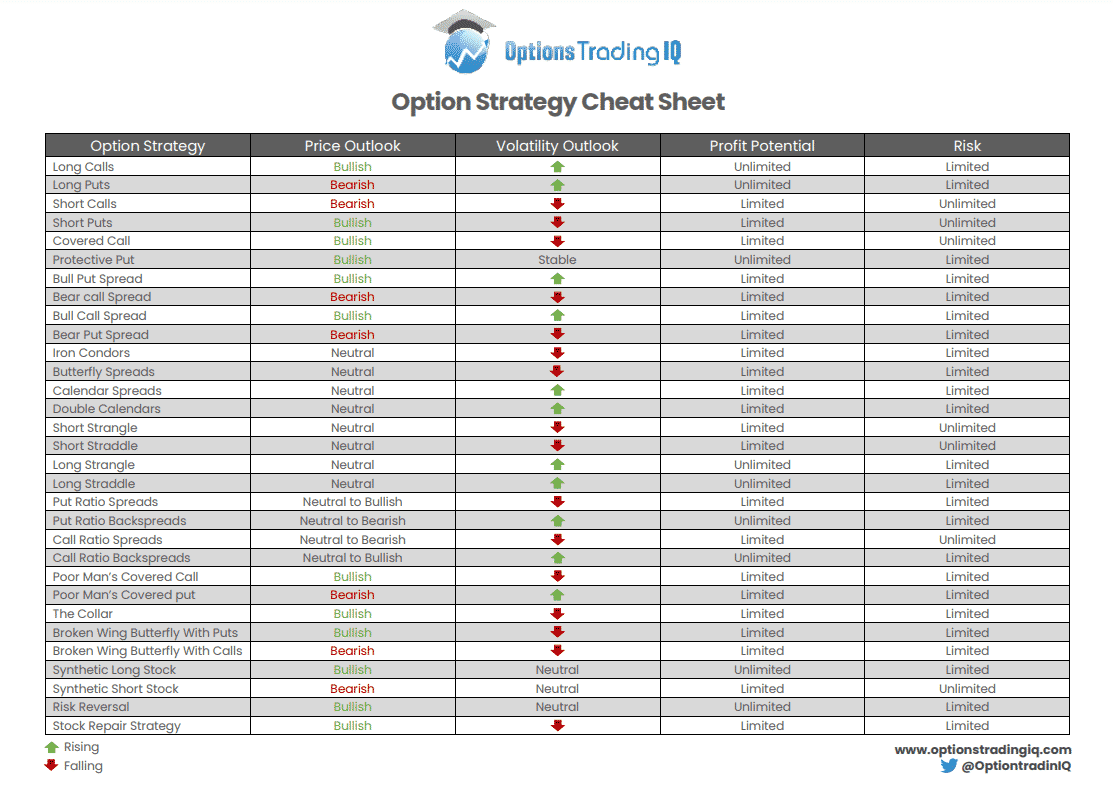

- Cash-Secured Put: This strategy involves selling a put option while simultaneously owning the underlying asset. The premium received serves as additional income if the asset remains above the strike price.

- Naked Put: A more aggressive approach, this strategy entails selling a put option without owning the underlying asset. Potential profits are higher, but so are the risks if the asset price falls.

- Call Credit Spread: This strategy involves selling a higher-priced call option while simultaneously buying a lower-priced call option with the same expiration date. Profits are generated if the asset price remains within a specific range.

- Put Credit Spread: Similar to the call credit spread, this strategy involves selling a lower-priced put option while buying a higher-priced put option. Profits are generated if the asset price remains above a range.

- Iron Condor: This complex strategy involves selling both a put credit spread and a call credit spread with different strike prices. It profits from a narrow range of asset price movements.

- Strangle: A variation of the iron condor, this strategy involves selling both a put and a call option with the same strike price. Profits are generated from extreme price movements in either direction.

These strategies, while not exhaustive, provide a solid foundation for traders seeking success in short options trading. However, it’s crucial to note that these strategies come with inherent risks and require a thorough understanding of options trading dynamics.

FAQs: Unraveling Short Options Trading

- What are the risks involved in short options trading?

- When is the best time to employ short options trading strategies?

- Is short options trading right for all investors?

- Where can I learn more about short options trading?

- What resources are available to support short options traders?

Image: www.pinterest.com

Short Options Trading Strategies

Image: optionstradingiq.com

Call to Action: Unleash Your Options Potential

Embark on your short options trading journey today, armed with the knowledge and strategies outlined in this comprehensive guide. Whether you are a seasoned trader or a novice seeking new opportunities, the world of short options trading beckons with the potential for substantial rewards.

Dive deeper into this captivating topic by exploring the resources mentioned above. Join online communities, engage with experienced traders, and equip yourself with the know-how to navigate the ever-changing markets. Are you ready to unlock the full potential of short options trading? Start your journey now!