Introduction

Delving into the realm of financial markets can be an exhilarating yet intricate experience. One aspect that sparks curiosity and caution among traders is the concept of day trading options using a cash account. To unravel this terrain, it’s crucial to understand the intricacies and regulations governing this practice, as set forth by the Securities and Exchange Commission (SEC). This comprehensive guide will delve into the SEC rules surrounding day trading options with a cash account, empowering you with the knowledge to trade with confidence and prudence.

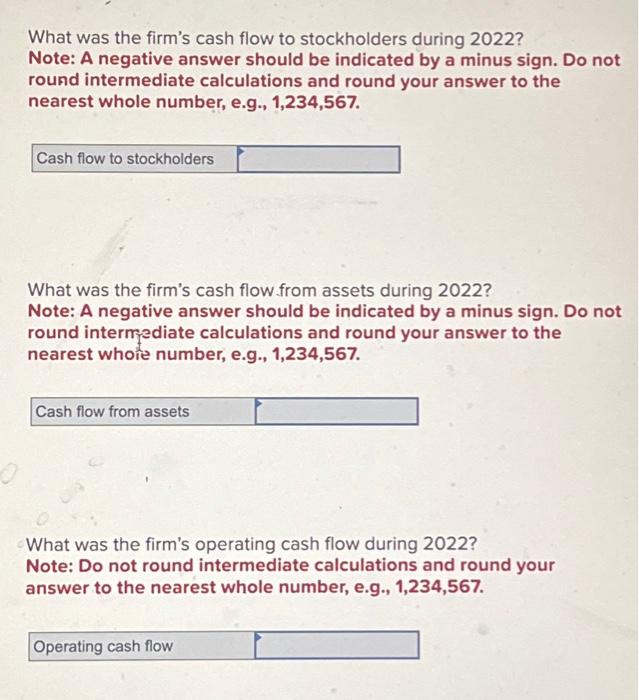

Image: www.chegg.com

Understanding Day Trading and Cash Accounts

Day trading involves the buying and selling of financial instruments, such as stocks or options, within the same trading day, typically aiming to capitalize on short-term price movements. In contrast, a cash account refers to a brokerage account where trades are settled using available funds, without the use of margin or borrowed funds. When day trading options with a cash account, the funds used for the purchase of an option contract must be immediately available in the account. Additionally, settlement of the option contract occurs on the next business day, known as T+1.

SEC Rule 420: Pattern Day Trading (PDT)

The SEC’s Rule 420, also known as the Pattern Day Trader (PDT) rule, aims to curb excessive day trading practices that may pose risks to both the trader and the market. The PDT rule applies to cash accounts that engage in four or more day trades of securities within a rolling five-business-day period. A day trade is defined as buying and selling the same security on the same trading day.

PDT Rule Implications

Traders who meet the PDT criteria are subject to a 90-day restriction on day trading activities. During this period, they can only trade once per five business days and must maintain a minimum account balance of $25,000. Failure to comply with the PDT rule may result in account restrictions or even trading account closure.

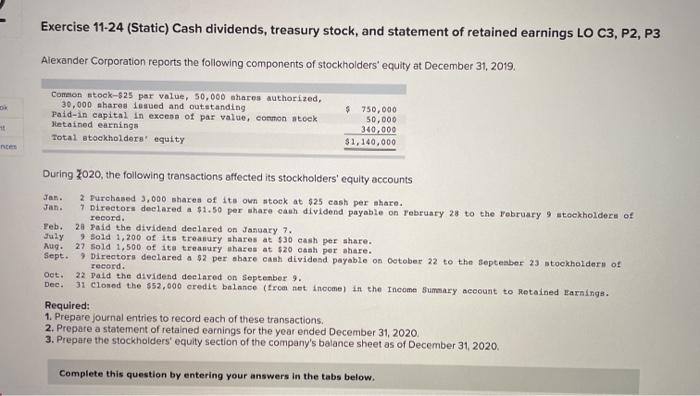

Image: www.chegg.com

Exemptions to the PDT Rule

The PDT rule does not apply to certain categories of traders, including:

- Traders with a net worth exceeding $1 million, excluding their primary residence

- Traders who are registered as a broker-dealer or other financial professional

- Traders who hold a proprietary account with a firm that is a member of a designated contract market

Risks of Day Trading Options with a Cash Account

While day trading options with a cash account can provide opportunities for profit, it also carries inherent risks. These include:

- The potential for substantial losses due to market volatility

- Limited availability of funds for subsequent trades due to the T+1 settlement period

- The inability to hold positions overnight, which can expose traders to significant overnight risk

- The possibility of being designated as a PDT and facing trading restrictions

Strategies for Responsible Day Trading

To mitigate the risks associated with day trading options with a cash account, consider adopting the following strategies:

- Develop a sound trading plan that aligns with your risk tolerance and financial goals.

- Conduct thorough research and due diligence on the underlying securities before executing trades.

- Use stop-loss orders to limit potential losses.

- Maintain a diversified portfolio to spread risk.

- Monitor market trends and news events that may impact your trades.

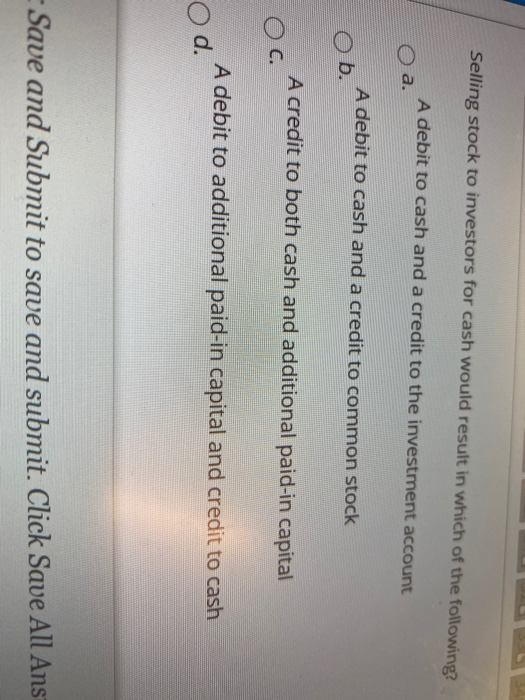

Sec Rules On Day Trading Options With A Cash Account

Image: www.chegg.com

Conclusion

Navigating the SEC rules surrounding day trading options with a cash account requires a clear understanding of the PDT rule and its implications. By adhering to these regulations, traders can participate in this potentially rewarding activity while mitigating risks. Remember, responsible day trading involves careful planning, risk management, and a disciplined approach. By embracing these principles, you can enhance your chances of success in the dynamic and challenging world of day trading options.