Have you ever dreamt of maximizing your return on investment, but felt intimidated by the complexities of traditional stock markets? What if I told you there’s a world of possibilities just waiting to be explored – a world where you can potentially gain a significant edge through strategic financial maneuvers? That world is the realm of options trading, and with the right platform, it’s more accessible than ever before.

Image: www.interactivebrokers.com.hk

Options trading, at its core, is a powerful tool that allows you to control underlying assets like stocks, futures, and more, without necessarily owning them outright. But navigating this dynamic arena can be daunting for even seasoned investors. This is where option trading platforms come in; they’re your trusted allies, providing the tools, resources, and insights you need to confidently explore the world of options.

Deciphering the Language of Options: A Beginner’s Guide

Before diving into the exciting world of platforms, it’s crucial to understand the basics of options trading. Imagine you’re walking into a bustling marketplace where vendors are offering contracts to buy or sell a specific item at a predetermined price and future date. In options trading, those items are financial assets, and the contracts are options. You’re not buying or selling the asset itself, but rather the *right* to do so in the future.

There are two basic types of options: calls and puts. A call option gives you the right, but not the obligation, to buy an underlying asset at a specific price (the strike price) before a set date (the expiration date). Think of it as holding a golden ticket to buy that asset at a discounted rate. On the other hand, a put option gives you the right to sell an underlying asset at a specific price before the expiration date. This allows you to potentially profit from a decline in the asset’s value.

The Power of Options: Harnessing Leverage and Risk Management

Options trading offers exciting opportunities for potential profit, but it’s also inherently risky. That’s why it’s crucial to understand the potential rewards and downsides before embarking on this journey.

One of the most alluring aspects of options trading is leverage. Options contracts allow you to control a significant amount of underlying assets with a relatively small investment. This can amplify both your potential gains and losses, so careful consideration of risk management is paramount.

For example, a $100 investment in a call option on a stock might give you control over 100 shares of that stock, which could be worth significantly more if the stock price rises. On the other hand, if the stock price falls, your option contract could expire worthless, resulting in the loss of your initial investment.

Navigating the Options Trading Landscape: Choosing the Right Platform

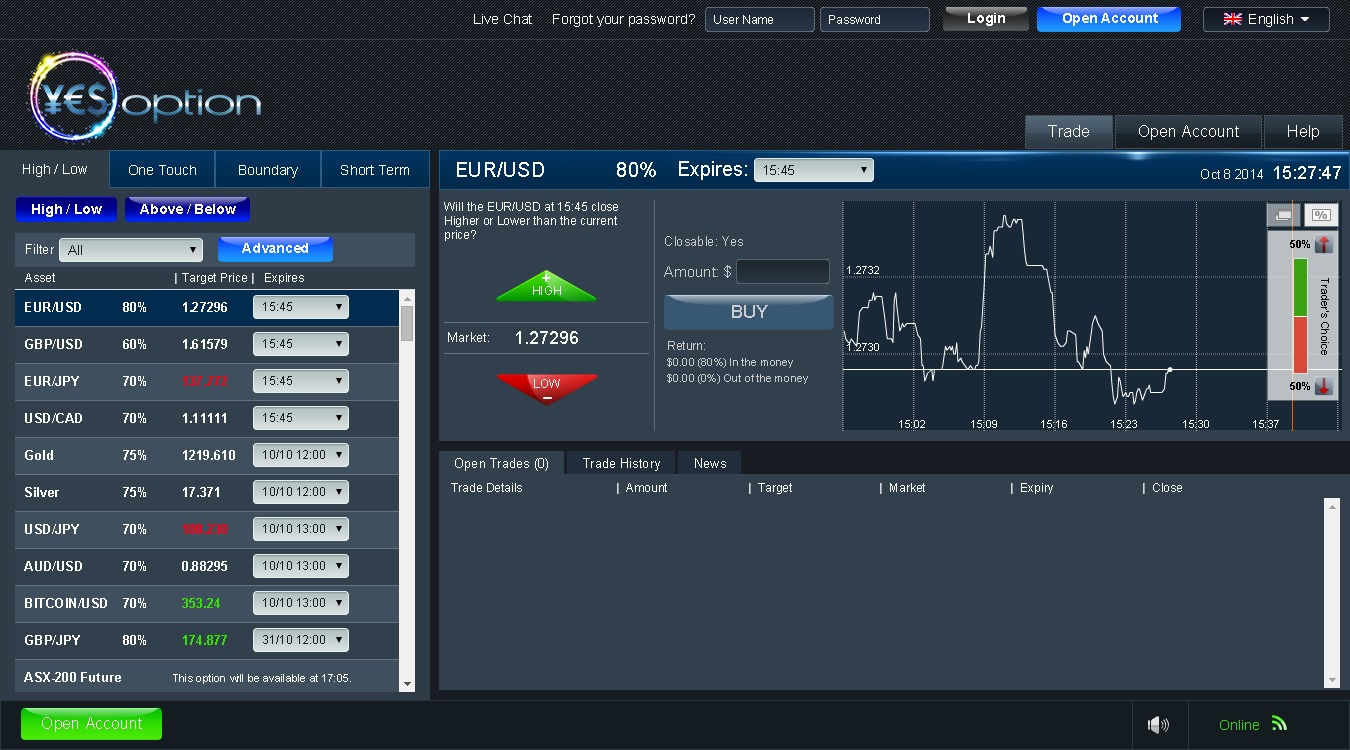

The journey into options trading starts with selecting the right platform – your gateway to this dynamic world. But with so many different platforms available, where do you begin? Consider your personal goals, trading style, and overall experience level when making your decision.

For beginners, a beginner-friendly platform with robust educational resources and intuitive interfaces is paramount. Look for platforms that provide comprehensive tutorials, interactive simulators, and access to in-depth research reports.

More seasoned traders might prioritize platforms with advanced features such as real-time data feeds, customizable charting tools, and sophisticated order types. Advanced platforms often allow for algo trading and offer access to a wider array of options contracts.

Image: s3.amazonaws.com

Evaluating Platforms: Key Considerations for Every Trader

Regardless of your experience level, there are several key factors to consider when choosing an options trading platform. Here’s a checklist to guide your decision:

1. User Interface and Experience:

- Is the platform intuitive and easy to navigate?

- Does it offer personalized dashboards, customizable watchlists, and visual alerts?

2. Educational Resources:

- Does the platform provide comprehensive learning materials, including tutorials, webinars, and research reports?

- Do they offer interactive simulations that help you practice?

3. Trading Tools and Features:

- Does the platform offer real-time market data, advanced charting tools, and multiple order types?

- Are there options for algo trading (automated trading)?

4. Fees and Commissions:

- What are the platform’s transaction fees, subscription charges, and other associated costs?

- Do they offer different fee structures for various trading styles?

5. Customer Support and Security:

- Does the platform offer responsive customer support through phone, email, or live chat?

- Are their security measures robust, including encryption and multi-factor authentication?

Top Platforms for Every Trader: A Comparative Overview

Now that you know what to look for in an options trading platform, let’s explore some industry leaders that cater to various needs and preferences. This is not an exhaustive list, and the best platform for you will ultimately depend on your individual trading style and goals.

1. Thinkorswim (TD Ameritrade):

- **Strengths:** Comprehensive platform with advanced charting, trading tools, and a powerful paper trading simulator.

- **Best for:** Seasoned traders seeking sophisticated tools and in-depth analytics.

2. Interactive Brokers:

- **Strengths:** Global reach, competitive pricing, and a wide range of assets including options, futures, and forex.

- **Best for:** Experienced traders who demand access to a vast array of markets.

3. E*TRADE:

- **Strengths:** User-friendly interface, educational resources, and a diverse selection of options contracts.

- **Best for:** Beginners seeking a straightforward platform with comprehensive learning materials.

4. Fidelity:

- **Strengths:** Competitive pricing, robust research, and a dedicated options platform with strong education materials.

- **Best for:** Traders who value research and want to learn more about options trading.

5. Robinhood:

- **Strengths:** Zero-commission trading, intuitive mobile app, and a focus on simplicity.

- **Best for:** Mobile-first traders who prefer a streamlined trading experience.

Expert Insights: Navigating the Options Market Successfully

Options trading is not for the faint of heart. While the potential rewards are significant, the risks are equally substantial. Here are key insights from experienced option traders to guide your successful journey:

- **Start with a solid understanding of options fundamentals:** Before engaging in real-money trading, master the core concepts of options, their different types, and how they work.

- **Practice with a paper trading account:** Most reputable options trading platforms offer paper trading accounts that allow you to simulate real-world trades without risking your own capital.

- **Develop a trading plan:** Clearly define your investment goals, risk tolerance, and a strategy for managing your trades.

- **Never risk more than you can afford to lose:** Stick to your carefully calculated risk parameters and avoid emotional decisions.

Option Trading Platforms

The Future of Options Trading: Embracing Technology and Innovation

The world of options trading is constantly evolving, driven by technological advancements and the growing demand for accessible investing solutions. Expect to see continued innovation in the areas of artificial intelligence, robo-advisory platforms, and personalized trading experiences.

As you embark on your options trading journey, remember that knowledge is power. Embrace the wealth of educational resources available, practice your skills, and leverage the cutting-edge tools provided by these platforms. The world of options trading, once considered a niche domain, is now more accessible than ever, ready to empower you to reach your financial goals.