Introduction

In the realm of financial markets, options trading can be a daunting concept for both experienced investors and beginners alike. Options contracts offer a unique way to speculate on the future price movements of underlying assets, but the associated risks can be substantial. Enter paper trading options accounts: a revolutionary tool that allows traders to gain hands-on experience in options trading without risking a single dollar.

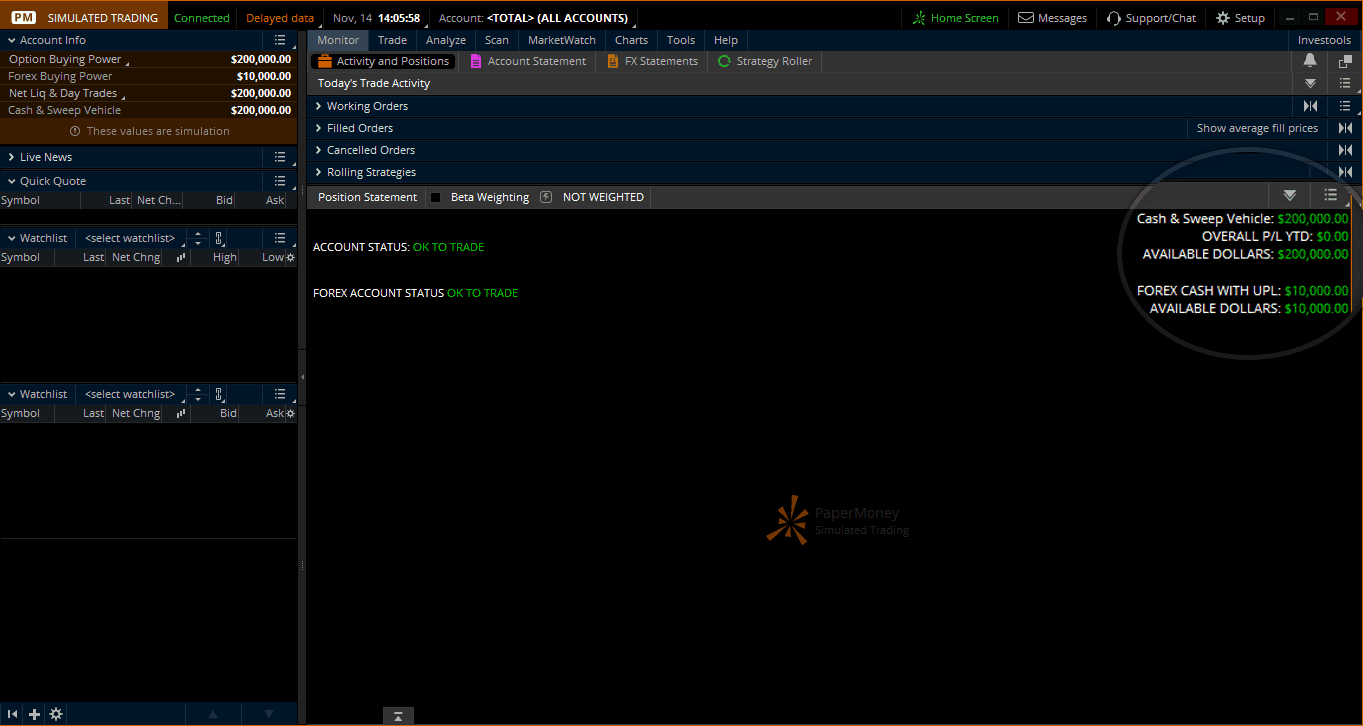

Image: brokerchooser.com

What is a Paper Trading Options Account?

A paper trading options account is a virtual trading platform that simulates real-world options trading conditions. It allows traders to buy and sell hypothetical options contracts using simulated funds, providing them with an invaluable learning ground before they venture into live trading. Paper trading accounts mimic the dynamics of live markets, allowing traders to track market movements, place orders, and witness their execution in real-time.

Benefits of Using a Paper Trading Options Account

The benefits of using a paper trading options account are numerous:

Risk-Free Practice: The biggest advantage of a paper trading account is the ability to practice options trading without the financial risks associated with live trading. Traders can make mistakes, test strategies, and refine their trading skills without the fear of losing real money.

Improved Decision-Making: Paper trading options accounts allow traders to backtest different trading strategies under various market conditions. By analyzing the outcomes of their simulated trades, they can gain valuable insights into the effectiveness of their strategies, identify potential weaknesses, and refine their decision-making process.

Building Confidence: Paper trading accounts provide a safe environment for traders to build confidence in their abilities. By experiencing the ebb and flow of options trading without the pressure of financial risks, traders can develop the necessary discipline and emotional resilience to succeed in real-time trading.

Cost-Effective Education: Paper trading accounts offer a cost-effective way to educate oneself about options trading. Unlike live trading, paper trading does not involve any account opening fees, commissions, or other trading costs, making it an accessible option for aspiring traders of all financial backgrounds.

How to Get Started with Paper Trading Options Accounts

Opening a paper trading options account is a straightforward process. Numerous online brokers offer paper trading options accounts designed for different trading styles and skill levels. Here’s a step-by-step guide to get started:

- Choose a Broker: Research different brokers that offer paper trading options accounts. Consider factors such as platform functionality, trading tools, and customer support.

- Open an Account: Register for a paper trading options account on the chosen platform. The registration process typically requires basic information such as your name, contact details, and investment goals.

- Fund Your Account: Paper trading accounts provide virtual funds that mimic real money. Determine the appropriate virtual account balance based on your trading objectives.

- Start Trading: Explore the trading platform and familiarize yourself with the tools and features. Begin placing virtual orders and monitoring the performance of your hypothetical trades.

Image: wealthyeducation.com

Paper Trading Options Account

Image: www.youtube.com

Tips for Effective Paper Trading

To maximize the benefits of paper trading options accounts, follow these tips:

Set Realistic Goals: Approach paper trading with realistic expectations. Understand that simulated trading does not guarantee success in live trading, but it serves as a valuable stepping stone.

Use Limit Orders: Always use limit orders when placing virtual trades to specify a desired price for execution. This prevents unintended slippage and ensures better control over your simulated orders.

Keep a Trading Journal: Record your trading activities, including the underlying assets, option types, strikes, and expiration dates. This helps in analyzing your performance and identifying areas for improvement.

Study Market Trends: Use the paper trading account to follow market trends and news events that may affect the underlying assets of your options trades.