Introduction

I’ll never forget the day my brokerage account alerted me that my options trade had been ‘liquidated.’ My heart sank as I realized that I’d lost a significant portion of my investment due to a little-understood term known as “paper trading.” Wanting to clear the fog that covered paper options trading, I took a deep dive into the world of simulated trading and the rules that govern it.

Image: www.rockwelltrading.com

Paper options trading, also known as simulated trading, is a practice where traders can execute buying or selling of stock options without risking real money. Such trades and transactions are done on platforms that mimic actual markets to make it look as if real money is involved, providing practice to novice traders. However, it is imperative to remember that these trades are not executed in the actual market, and thus no real profits or losses occur.

Paper Trading as a Learning Opportunity

Paper trading has both evangelists and skeptics. Some avow that paper trading is an efficient method to grasp the dynamics of options trading and develop a risk appetite without jeopardizing real capital. Others dismiss it as an unreliable simulation that can develop bad habits and false confidence by creating a false sense of accomplishment.

Pros of Paper Trading:

- Risk-free learning: Traders can hone their skills without risking real money.

- Underlying functioning: Access to the inner workings of a stock options market without significant risk.

- Testing strategies: Strategies can be tested, adjusted, and refined in a realistic setting.

Cons of Paper Trading:

- Lack of consequence: The absence of real monetary repercussions can lead to reckless trading.

- Emotional detachment: Simulated trading may not fully capture the emotional impact and pressure faced when trading with real funds.

- Unrealistic market conditions: Trading platforms may not accurately reflect real-time market conditions.

Image: www.reddit.com

A Path to Success

While paper trading has its limitations, it can be a valuable tool for traders who approach it cautiously. By incorporating both paper and real-world experience, traders can arm themselves with the necessary skills and composure to navigate the often choppy waters of options trading.

The true measure of a trader’s success lies not solely in paper trading proficiency, but in their ability to translate their expertise into real market acumen. As with any endeavor, a combination of theoretical knowledge, simulation, and practical experience provides the most fertile ground for growth and achievement.

Tips from the Trading Trenches

Having braved both paper and real-world trading, I’d like to extend some advice to fellow traders seeking a steady footing in this dynamic realm:

- Commence with a comprehensive understanding: Immerse yourself in the fundamentals of options trading through books, seminars, or online resources. A solid cognitive pedestal will fortify your trading decisions.

- Harness simulated trading to hone your skills: Unleash your trading prowess in paper trading to solidify your understanding of options trading concepts and strategies.

- Dive into the real market gradually: Venture into real-world trading with a portion of your capital that you’re both willing and able to lose. Experience is an invaluable educator.

- Manage your mind: Emotions can be a formidable adversary in trading. Cultivate self-discipline and emotional control to avoid rash decisions.

Frequently Asked Questions (FAQs)

- What is paper trading?

Paper trading simulates options trading without real monetary involvement, enabling traders to practice and learn without financial risk.

- What are the benefits of paper trading?

Paper trading shields traders from financial losses, facilitates the exploration of options trading concepts, and serves as a testing ground for strategies.

- How effective is paper trading?

Paper trading can contribute to options trading comprehension, but genuine proficiency stems from executing trades in real-world markets.

- What are the drawbacks of paper trading?

Paper trading may foster overconfidence due to the absence of real consequences and may not accurately reflect real market conditions.

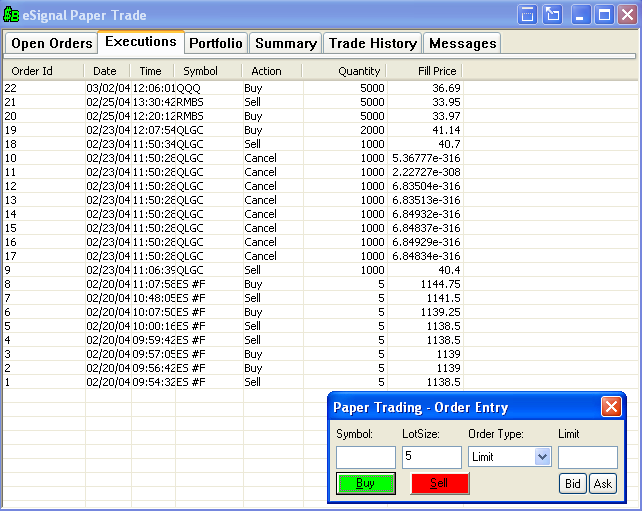

Paper Option Trading Tos

Image: forum.esignal.com

Conclusion

As the saying goes, practice makes perfect. Paper options trading provides traders with a valuable platform to refine their expertise, much like a pianist rehearsing scales before a performance. However, it’s important to avoid the pitfall of spending excessive time in this simulated realm, as the true test of a trader’s mettle lies in handling the psychological and financial pressures of the real market.

So, are you ready to venture into the world of options trading, armed with the knowledge of paper trading TOS? Remember, the markets are ever-evolving, demanding constant adaptation and learning. Embrace the journey with a spirit of curiosity and resilience, and the rewards may be as plentiful as the challenges.