Introduction:

The financial world offers a vast array of investment opportunities, from traditional stocks and bonds to complex derivatives such as options. While some ventures promise a steady return, others are fraught with high levels of risk. The line between investing and gambling can sometimes blur, particularly in the realm of options trading. Understanding the fundamental differences between the two can empower investors to make informed decisions and mitigate potential pitfalls.

Image: www.barbara-huson.com

Options Trading: A Calculated Gamble

Options are contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) by a predetermined expiration date. Options trading offers a spectrum of strategies, from conservative income-generating endeavors to speculative, high-risk maneuvers. The potential rewards can be substantial, but so can the losses. Unlike in traditional stock ownership, where investors can potentially lose the entirety of their investment, the most that can be lost in options trading is the premium paid for the contract.

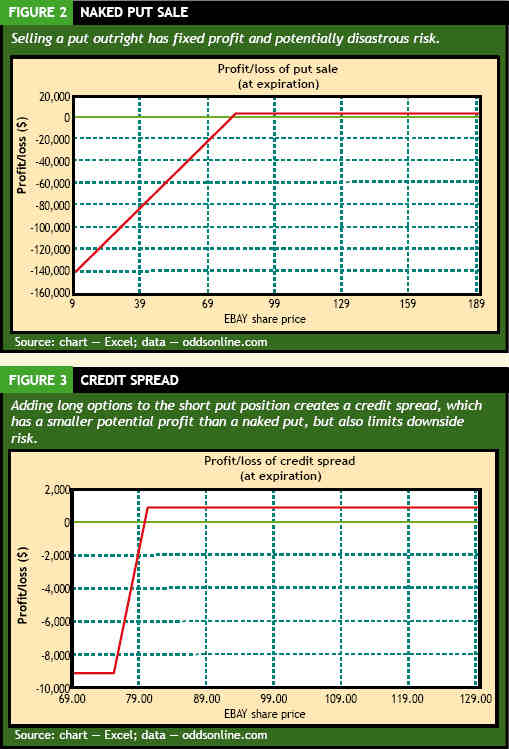

Seasoned options traders meticulously calculate probabilities and risk-reward ratios, leveraging mathematical models and market analysis to enhance their decision-making. However, the uncertain nature of financial markets introduces an element of gambling. Unforeseen events and market volatility can swiftly turn a profitable trade into a loss-making venture.

Gambling: A Game of Chance

Gambling, on the other hand, is defined by its unpredictable outcomes and reliance on luck. While some forms, such as poker or sports betting, involve a degree of skill, the fundamental element is uncertain returns. The odds of winning are predetermined by the game’s rules, and participants wager against those odds, fueled by the hope of a windfall. The allure of gambling lies in its potential for quick and significant financial gains, albeit with a far greater likelihood of losses.

Key Distinctions:

-

Investment vs. Wager: Options trading involves investing capital in a contract with a defined risk profile, whereas gambling entails wagering money on an uncertain event.

-

Risk Mitigation: Options traders employ strategies to manage risk, such as stop-loss orders and hedging, while gamblers primarily rely on luck.

-

Knowledge vs. Fortune: Options trading favors those with financial expertise and analytical skills, while gambling often favors those with a lucky streak.

-

Tax Implications: Options trading profits are taxed as capital gains, while gambling winnings may be subject to different or higher tax rates.

-

Sustainability: Options trading can be a viable long-term wealth-building strategy, whereas gambling is generally unsustainable due to its high-risk, low-probability nature.

Image: warsoption.com

Options Trading Vs Gambling

Image: www.financial-spread-betting.com

Conclusion:

While options trading and gambling may share some superficial similarities, the underlying principles and risk profiles are vastly different. Options trading empowers individuals with a deep understanding of financial markets to harness specific opportunities and manage risk, while gambling relies on chance and the hope of outsmarting the odds. Recognizing these distinctions is crucial for investors seeking to navigate the financial arena with informed choices. By demystifying the complexities of options trading and distinguishing it from gambling, investors can empower themselves to pursue financial goals through calculated strategies rather than impulsive wagers.