The world of options trading is a captivating realm where calculated risks can yield exponential returns. Among the many factors that influence option pricing, gamma occupies a position of paramount importance, often referred to as the “Holy Grail” by seasoned traders. In this comprehensive guide, we will delve deeply into the enigmatic world of gamma, illuminating its profound significance and unveiling practical strategies to harness its power for unparalleled trading success.

Image: www.youtube.com

Understanding the Elusive Gamma

Gamma, in essence, measures the sensitivity of an option’s delta to changes in price. It quantifies the rate at which an option’s delta changes relative to shifts in the underlying asset’s price. When gamma is positive, the option’s delta increases as the underlying asset’s price moves in the direction of the option’s payoff. Conversely, if gamma is negative, the option’s delta decreases as the underlying’s price moves favorably.

The Gamma Advantage

The ability to manipulate gamma strategically empowers traders with an array of potent advantages. Firstly, a positive gamma position amplifies delta gains, enabling traders to capitalize on rapid price fluctuations and maximize profits. Secondly, a well-timed gamma play can drastically reduce the risk associated with unfavorable price movements, adding an element of protection to trading strategies.

Strategies for Harnessing Gamma’s Potential

Mastering the art of gamma trading revolves around employing strategies that elevate your returns while mitigating risks. Some of the most effective approaches include:

-

Selling Strangles or Straddles: Create a bullish or bearish position by selling a combination of call and put options at different strike prices. This strategy captures positive gamma in the event of substantial price movements.

-

Gamma Scalping: Involves buying and selling options with opposing deltas close to the underlying asset’s price. Successful implementation requires precise timing and a deep understanding of gamma dynamics.

-

Leveraged Gamma Plays: Employ margin trading or advanced options strategies to increase gamma exposure and magnify returns. However, this approach should only be considered by experienced traders with a high risk tolerance.

Expert Insights from Industry Titans

According to renowned options trading guru Jack Schwager, “Gamma is the most powerful weapon in the options trader’s arsenal.” By embracing gamma’s intricacies and incorporating it into your trading strategy, you unlock the potential for extraordinary profits.

As renowned trader Mark Douglas once stated, “Trading is not a get-rich-quick scheme. It is a challenging endeavor that requires a deep understanding of the underlying mechanics.” Diligently studying gamma and its impact on option pricing is paramount for navigating the treacherous waters of options trading successfully.

Conclusion: Embrace Gamma, Excel in Trading

Unveiling the secrets of gamma is akin to deciphering a hidden code that unlocks boundless opportunities for options traders. By wielding this newfound knowledge and implementing the strategies outlined above, you can elevate your trading endeavors to unprecedented heights, reaping the rewards of sound decision-making and astute market navigation. Remember, the path to financial success lies in the unwavering pursuit of knowledge and the relentless mastery of market dynamics.

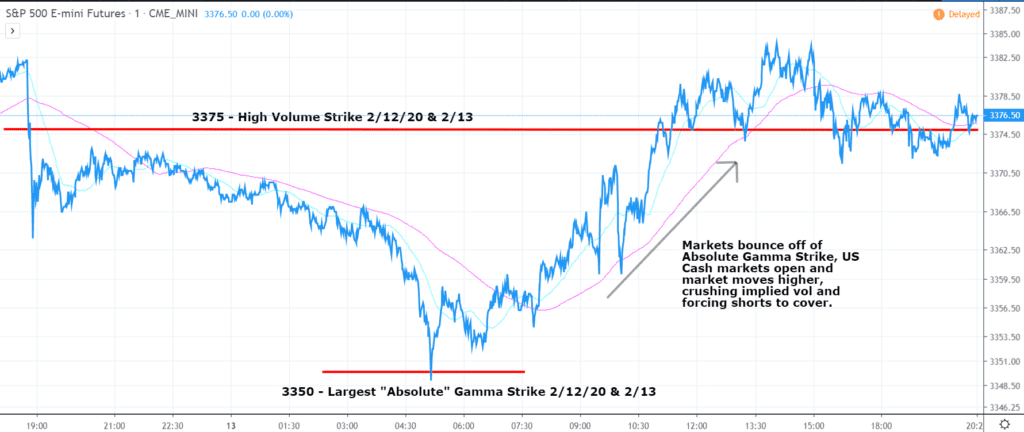

Image: spotgamma.com

How To Use Gamma In Options Trading