Embarking on the Options Odyssey

In the ever-evolving realm of financial markets, options trading stands as a captivating gateway to maximizing investment potential. With the allure of ample rewards and the thrill of risk-taking, options offer traders a unique tool to harness market volatility and pave their path to financial success.Yet, mastering the art of options trading requires a blend of knowledge, strategy, and intuition. This comprehensive guide will delve into the intricacies of options trading, arming you with a profound understanding of its foundational concepts, strategies, and expert insights. Prepare to embark on an options odyssey, where the stock market transforms into an arena of calculated precision.

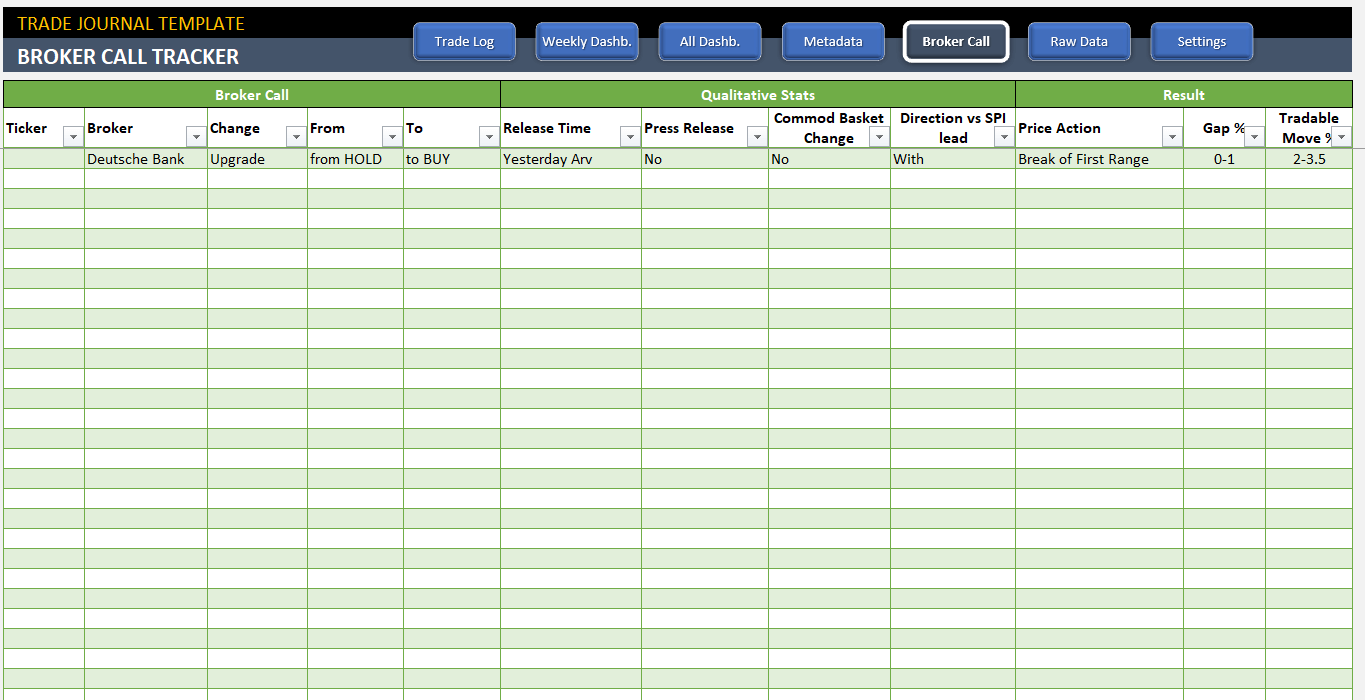

Image: db-excel.com

Unveiling the Essence of Options Trading

An option, simply put, is a financial contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. This contractual flexibility unlocks a plethora of opportunities for traders to capitalize on market fluctuations and implement sophisticated investment strategies.

At the heart of options trading lies the concept of leverage. With a minimal initial investment, traders can control a significantly larger position in the underlying asset. This leverage, however, comes with inherent risk, demanding meticulous risk management and a thorough understanding of market dynamics.

Delving into the Anatomy of an Option

Every option contract is characterized by its unique set of parameters:

- Type: Call options grant the right to buy an asset, while put options provide the right to sell.

- Underlying asset: The underlying asset can range from common stocks to indices or even commodities.

- Strike price: This predetermined price represents the price at which the trader can exercise the option.

- Expiration date: The contract expires on this specified date, marking the end of its validity.

- Premium: This is the price paid to acquire the option contract. It embodies the market’s assessment of the likelihood of the option being exercised profitably.

Deciphering the intricate interplay of these parameters is fundamental to making informed options trading decisions.

Unveiling the Strategies of a Master Trader

The options trading landscape is teeming with a myriad of strategies, each tailored to distinct risk appetites and market conditions. Among the most prevalent strategies are:

- Covered call: This strategy involves selling a call option against a stock you own, generating income from the premium while limiting potential upside.

- Cash-secured put: Similar to covered calls, this entails selling a put option while holding cash reserves, offering protection against downside risk.

- Bull call spread: Created by buying a higher strike price call option and selling a lower strike price call option, this strategy profits from a moderate rise in the underlying.

- Bear put spread: Conversely, this strategy involves selling a higher strike price put option and buying a lower strike price put option, benefiting from a decline in the underlying’s value.

Image: www.audible.ca

Tapping into Expert Wisdom: Navigating the Options Arena

Seasoned experts and industry thought leaders provide invaluable insights into the complexities of options trading.

- Nassim Taleb, author of “Fooled by Randomness”: “Options are not gambling. They are a way to manage risk and uncertainty. If you understand options, you can use them to reduce risk and increase your return.”

- Warren Buffett, legendary investor: “If you don’t understand options, don’t use them. But if you do, they can be a very powerful tool.”

These expert perspectives underscore the profound influence that knowledge and prudent decision-making can exert upon options trading outcomes.

Putting Theory into Practice: Applying Options Trading Strategies

The transformative nature of options trading crystallizes when put into practice. Consider the following real-world scenarios:

- A cautious investor seeking income: By utilizing covered call strategies, the investor generates a steady stream of income while hedging against potential losses.

- A bull anticipating a stock rise: The investor employs a bull call spread to capitalize on a rise in the stock price, leveraging potential gains while containing risks.

- A prudent trader preparing for market volatility: Utilizing bear put spreads, the trader mitigates losses in anticipation of a downturn in the underlying’s value.

Unlocking the Doors to Confidence in Options Trading

Mastery of options trading demands a holistic approach, intertwining knowledge, calculated decision-making, and informed risk management. By adhering to the following principles, you can elevate your options trading prowess:

- Education: Devour materials on options trading, gleaning insights from books, courses, and articles.

- Research: Analyze underlying assets thoroughly, assessing their historical performance, market sentiment, and industry trends.

- Practice: Hone your skills through simulated trading, gaining invaluable experience in a risk-free environment.

- Risk management: Understand the risks inherent in options trading, employing strategies to mitigate losses and safeguard your capital.

- Discipline: Adhere to a disciplined approach, avoiding impulsive trading decisions and sticking to predetermined trading plans.

Options Trading Stock Market

Image: www.simitome.co

Conclusion: Options Trading – A Calculus of Calculated Moves

Navigating the stock market through options trading is akin to playing a strategic chess game, where every move holds the potential for significant gains or losses. Mastering this financial instrument requires a deliberate fusion of knowledge, strategy, and informed decision-making.

By embarking on this options odyssey, meticulously studying the intricacies of this trading tool, and cultivating a disciplined approach, you can transform the stock market into a tapestry of calculated moves, where risk and reward dance harmoniously.