Unlock the Potential of Options Trading on Robinhood

Image: belucydyret.web.fc2.com

In the bustling realm of investing, options trading has emerged as a powerful tool for enhancing financial returns. With its flexible strategies, options offer traders a multitude of ways to profit from market movements, regardless of the direction. Among the leading platforms for options trading stands Robinhood, a renowned brokerage known for its intuitive interface and zero-commission fees.

This comprehensive guide will delve into the intricacies of options trading on Robinhood, empowering traders of all levels to unlock the potential of this versatile instrument. From foundational concepts to advanced strategies, we will navigate the complexities of options trading, unveiling its nuances and empowering you to make informed decisions.

A Primer on Options Trading

Options contracts, also known as derivatives, confer upon their holders the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price (strike price). This duality provides traders with a degree of flexibility not found in traditional stock trading, allowing them to profit from both rising and falling markets.

Robinhood: A Gateway to Options Trading

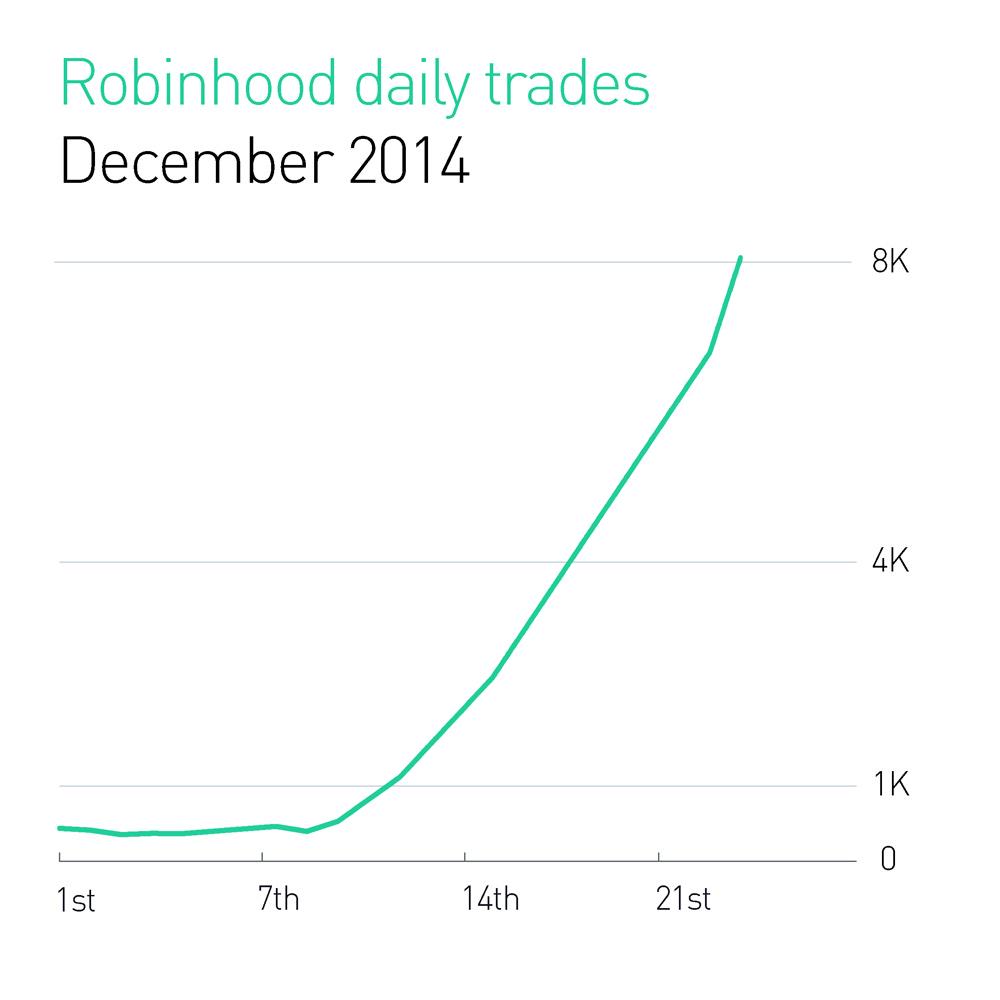

Robinhood has revolutionized the accessibility of options trading, making it easier than ever for individuals to engage in this sophisticated market. Its user-friendly platform, coupled with the absence of trading commissions, has attracted a vast influx of both novice and experienced traders. Robinhood’s intuitive interface, educational resources, and analytical tools empower traders with the confidence to navigate the complexities of options trading.

Navigating the Nuances of Options Trading

While the concept of options may seem straightforward, the intricacies involved in trading these instruments require a thorough understanding. Key concepts to grasp include the types of options (calls and puts), the dynamics of time decay, the impact of volatility, and the significance of underlying asset price movements.

Realizing Profits from Options Trading

Options trading presents a multitude of strategies for realizing profits. Whether trading for income or capital appreciation, traders can tailor their approach based on their risk appetite and market outlook. Common strategies include buying calls or puts, selling covered calls, and executing multi-leg spreads.

Insights from Experts in the Field

To enhance your understanding and harness the wisdom of experienced traders, we have curated insights from renowned experts in the options trading arena. These luminaries offer valuable perspectives, time-tested strategies, and practical tips for maximizing your returns.

Actionable Tips for Successful Options Trading

Successful options trading hinges upon a combination of knowledge, discipline, and risk management. By applying these actionable tips, you can increase your probability of success in this dynamic market:

- Conduct thorough research on the underlying asset and market conditions before making trades.

- Understand the risks associated with each strategy and allocate funds accordingly.

- Monitor your positions closely and adjust as needed to manage risk and maximize returns.

- Employ stop-loss orders to limit potential losses on your trades.

Conclusion: Empowering Traders through Options Trading on Robinhood

Options trading on Robinhood empowers traders with a potent tool for enhancing their financial returns. By comprehending the nuances of this market, leveraging expert insights, and implementing proven strategies, you unlock the potential to profit from both rising and falling markets. Embrace the opportunities that options trading offers, but remember to exercise prudence and mitigate risks through diligent risk management practices. As you embark on this journey, let the words of Mark Twain serve as a guiding principle: “Courage is resistance to fear, mastery of fear, not absence of fear.”

Image: www.youtube.com

Options Trading Robinhood Youtube

Image: www.wiyre.com