Unlock the Secrets of QQQ Options Trading

Image: www.quickscreentrading.com

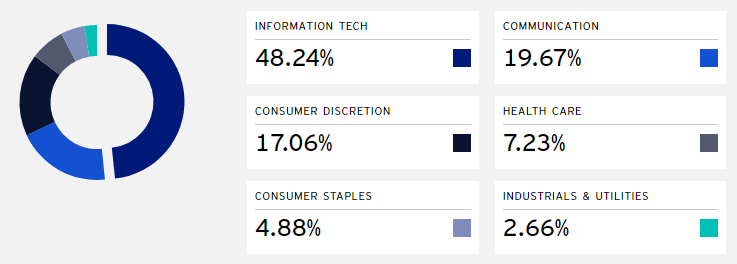

Options trading has gained immense popularity among investors seeking to enhance their returns. Among the various options available, the Invesco QQQ Trust (QQQ) stands out as a highly liquid and widely traded index fund that provides investors with exposure to the top 100 non-financial companies listed on the Nasdaq Composite Index. Understanding the cost of a single QQQ contract is crucial for informed decision-making in options trading.

Understanding Options Contracts

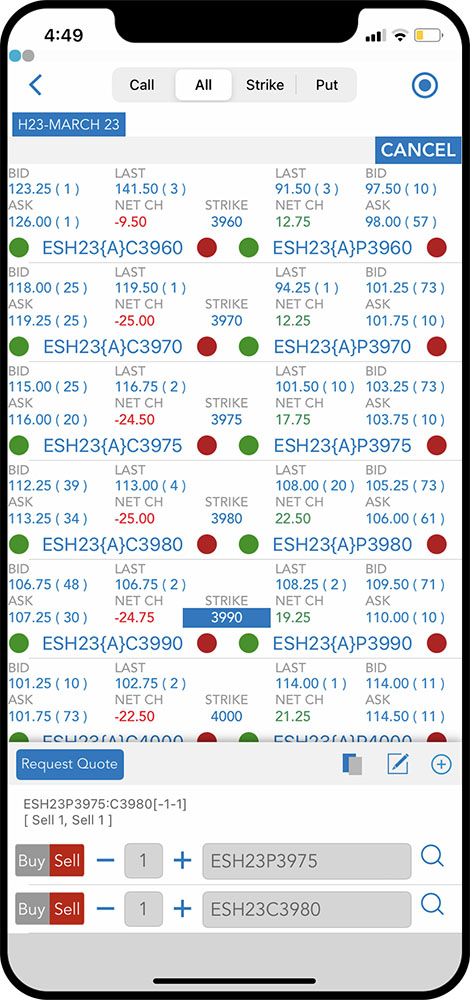

An options contract, in essence, grants the holder the right but not the obligation to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility offers traders a range of strategies to profit from potential market movements.

QQQ Options Contract Cost

The cost of a QQQ options contract is determined by several factors, including the current price of the QQQ ETF, the strike price of the contract, the time remaining until the expiration date, and the implied volatility of the underlying asset. These factors interact dynamically, influencing the premium paid by the options buyer.

Calculating the Premium

The premium is the price an options buyer pays for the right to exercise the contract. It represents the market’s assessment of the probability that the contract will be profitable. The Black-Scholes model, a widely accepted formula, is often used to calculate the theoretical premium, taking into account the aforementioned factors.

Example

Suppose the current price of the QQQ ETF is $300, and you are considering purchasing a one-month call option with a strike price of $305. The implied volatility for QQQ options is currently 15%. Using the Black-Scholes model, the theoretical premium for this contract would be around $8.50 per share.

This means that to purchase a 100-share contract (standard contract size), you would need to pay a premium of 100 * $8.50 = $850.

Types of QQQ Contracts

EQQQ offers various contract types to cater to different trading strategies:

- Call Options: Grant the right to buy QQQ shares.

- Put Options: Grant the right to sell QQQ shares.

- European Options: Exercisable only on their expiration date.

- American Options: Exercisable at any time before their expiration date.

Strategies and Risks

Traders can employ a range of strategies with QQQ options, such as buying or selling calls or puts for bullish or bearish positions, respectively. However, it’s crucial to note that options trading involves substantial risk and is not suitable for all investors.

Conclusion

Understanding the cost of a QQQ options contract is fundamental for successful options trading. By grasping the factors that influence premium pricing, investors can make informed decisions, manage risk, and harness the potential of this exciting asset class. Remember to conduct thorough research, consider your investment objectives, and consult with a financial professional if needed. The world of options trading is waiting to unveil its secrets to you.

Image: www.thebluecollarinvestor.com

Options Trading Qqq 1 Contract Cost

Image: tradingstrategyguides.com