Are you ready to delve into the world of options trading? Navigating this dynamic market requires a savvy understanding of profit and loss calculations. That’s where an options trading profit loss calculator emerges as an invaluable tool. In this article, we unveil the secrets of using this calculator effectively to maximize your trading potential.

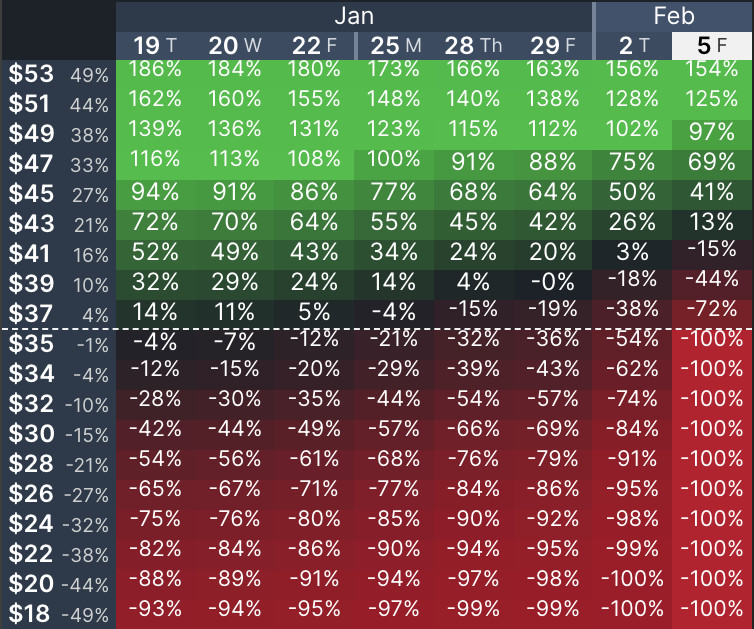

Image: optionstrat.com

Understanding the Essence of Options Trading Profit Loss Calculator

An options trading profit loss calculator is a revolutionary tool that allows you to determine the potential profit or loss associated with an options trade before you execute it. This feature empowers you to make well-informed decisions by simulating different scenarios, factoring in various parameters that influence the outcome of your trade.

The Significance of Options Trading Profit Loss Calculator

Options trading can be a lucrative endeavor, yet navigating the complexities of this market necessitates a solid understanding of the risks and rewards involved. An options trading profit loss calculator grants you the foresight to assess the potential profitability of a trade, allowing you to:

-

Identify the breakeven point, where the trade profits are zero, minimizing the risk of substantial losses.

-

Plan your exit strategies with greater precision, knowing the exact price at which you would like to sell your options to maximize profits or minimize losses.

-

Optimize your trading strategy by testing different scenarios and adjusting your parameters to find the most favorable conditions for profitable trades.

Now, let’s embark on a comprehensive guide to using an options trading profit loss calculator to elevate your trading game:

Navigating the Options Trading Profit Loss Calculator Interface

Most options trading profit loss calculators feature user-friendly interfaces, making them accessible to both seasoned traders and beginners alike.

-

Input the Underlying Asset: Begin by selecting the underlying asset for your options trade, whether it’s a stock, index, commodity, or currency pair.

-

Specify the Option Type: Determine the type of option you plan to trade, such as a call or a put option.

-

Enter the Strike Price: Define the strike price of the option contract, which represents the price at which you have the right, but not the obligation, to buy (for a call option) or sell (for a put option) the underlying asset.

-

Set the Expiration Date: Indicate the expiration date of the option contract, specifying the date on which the option expires and becomes worthless if not exercised.

-

Establish the Premium: Enter the premium you are willing to pay or receive for the options contract. The premium is the price of the option, representing the amount you pay to acquire the right to buy or sell the underlying asset.

-

Calculate: Once you have input all the necessary information, click on the ‘Calculate’ button.

The calculator swiftly generates the potential profit or loss for your options trade, taking into account the current market price of the underlying asset, the option’s strike price, time to expiration, and volatility.

Image: projectopenletter.com

Interpreting the Results of Options Trading Profit Loss Calculator

The options trading profit loss calculator presents the potential profit or loss in a clear and concise manner:

-

Profit: If the calculated value is positive, it indicates the potential profit you can gain from the trade if the market conditions evolve favorably.

-

Loss: A negative value signifies the potential loss you may incur if the market conditions deviate from your expectations.

-

Breakeven Point: The calculator also displays the breakeven point, which is the price at which the option’s value equals the premium paid. At this point, neither profit nor loss is realized.

Fine-tuning Your Options Trading Strategy

The options trading profit loss calculator empowers you to fine-tune your trading strategy by allowing you to experiment with different parameters:

-

Experiment with Strike Prices: Adjust the strike price to observe how it affects the potential profit or loss. Selecting a strike price closer to the current market price generally results in higher premiums but also higher potential profits.

-

Alter the Expiration Date: Modify the expiration date to assess the impact of time decay on the option’s value. Longer-term options typically carry higher premiums but are more susceptible to time decay.

-

Adjust the Premium: Input different premium values to determine the premium you are willing to pay for the potential profit or loss you expect.

By experimenting with these parameters, you can optimize your trading strategy to align with your risk tolerance and profit objectives.

Options Trading Profit Loss Calculator

Image: edegawiwajy.web.fc2.com

Conclusion

If you seek to conquer the world of options trading, the options trading profit loss calculator is your indispensable ally, meticulously calculating the potential profit or loss for your trades. Remember, while the calculator provides valuable insights, it remains a tool to supplement your knowledge and analytical skills.