Options trading practice software is a powerful tool that can help beginners gain the knowledge and skills necessary to succeed in this challenging market. With realistic simulations, interactive tutorials, and advanced analysis tools, practice software provides a risk-free environment where traders can test their strategies and hone their skills before venturing into live trading. Understanding how these software platforms work and how to make the most of their features is essential for aspiring traders seeking to leverage this invaluable resource.

Image: moneypip.com

Understanding the Basics of Options Trading Practice Software

At its core, options trading practice software mimics the real-world trading environment, allowing users to buy and sell options contracts without risking real capital. By simulating market fluctuations and providing access to various trading tools, practice platforms enable traders to experience the nuances of options trading without the associated financial risk. These platforms often feature customizable parameters, allowing users to adjust market conditions and experiment with different scenarios.

Harnessing the Benefits of Realistic Simulations

Realistic simulations are the cornerstone of options trading practice software. These simulations recreate the actual trading experience, exposing users to the dynamic market conditions and unpredictable price movements found in live markets. By navigating simulated market environments, traders can observe how their strategies perform in varying conditions, identify their strengths and weaknesses, and make adjustments accordingly. This iterative learning process is crucial for developing the adaptability and resilience necessary for successful options trading.

Interactive Tutorials: Empowering Beginners

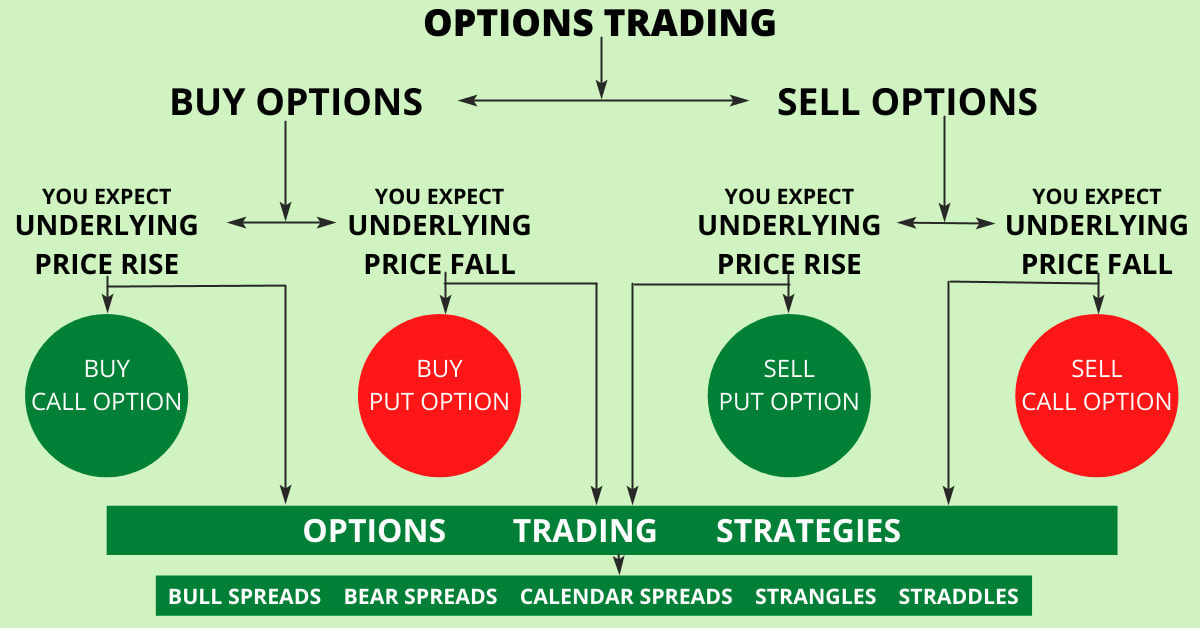

Interactive tutorials are another valuable feature found in many options trading practice software programs. These tutorials provide step-by-step guidance, covering the basics of options trading, such as contract types, pricing, and trading strategies. By working through these tutorials, beginners can build a solid foundation of knowledge, ensuring they have a clear understanding of the options market before making real-world trades.

Image: stewdiostix.blogspot.com

Advanced Analysis Tools: Enhancing Decision-Making

Modern options trading practice software often incorporates sophisticated analysis tools that empower traders with deep insights into market behavior. These tools enable traders to analyze historical price data, identify trends, and evaluate the potential profitability of different strategies. By utilizing advanced analysis tools, traders can make informed decisions backed by data and enhance their trading performance.

Choosing the Right Options Trading Practice Software

With numerous practice software options available, selecting the most suitable platform is paramount. Consider factors such as the platform’s user interface, the level of customization it offers, and the variety of trading tools and simulations it provides. Explore different platforms, read reviews, and seek recommendations from experienced traders to find the software that aligns with your specific learning needs and objectives.

Optimizing Practice Software for Success

To maximize the benefits of options trading practice software, traders should approach their training systematically. Set aside dedicated time for practice, create realistic trading plans, and track your progress carefully. Analyze your trades, identify areas for improvement, and adjust your strategies accordingly. With consistent practice and a methodical learning approach, traders can develop the skills and confidence necessary to excel in the real-world options market.

Options Trading Practice Software

Image: riset.guru

Conclusion

Options trading practice software is an invaluable resource for aspiring traders seeking to navigate the complexities of this unique market. By leveraging realistic simulations, interactive tutorials, and advanced analysis tools, practice platforms empower traders to gain the knowledge and skills necessary for successful trading. By choosing the right software and optimizing its use, traders can enhance their decision-making capabilities, minimize risk, and increase their chances of long-term trading success.