Options trading, a complex yet lucrative realm within the financial markets, offers investors the potential for substantial payouts. Understanding the nuances of options trading is crucial to unlock these rewards and navigate its complexities successfully.

Image: optionalpha.com

Essentially, options are financial contracts that provide the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts derive their value from the underlying assets, such as stocks, indices, or commodities. Options trading allows investors to capitalize on price fluctuations, hedge their portfolios, and generate income.

Call Options: The Right to Buy

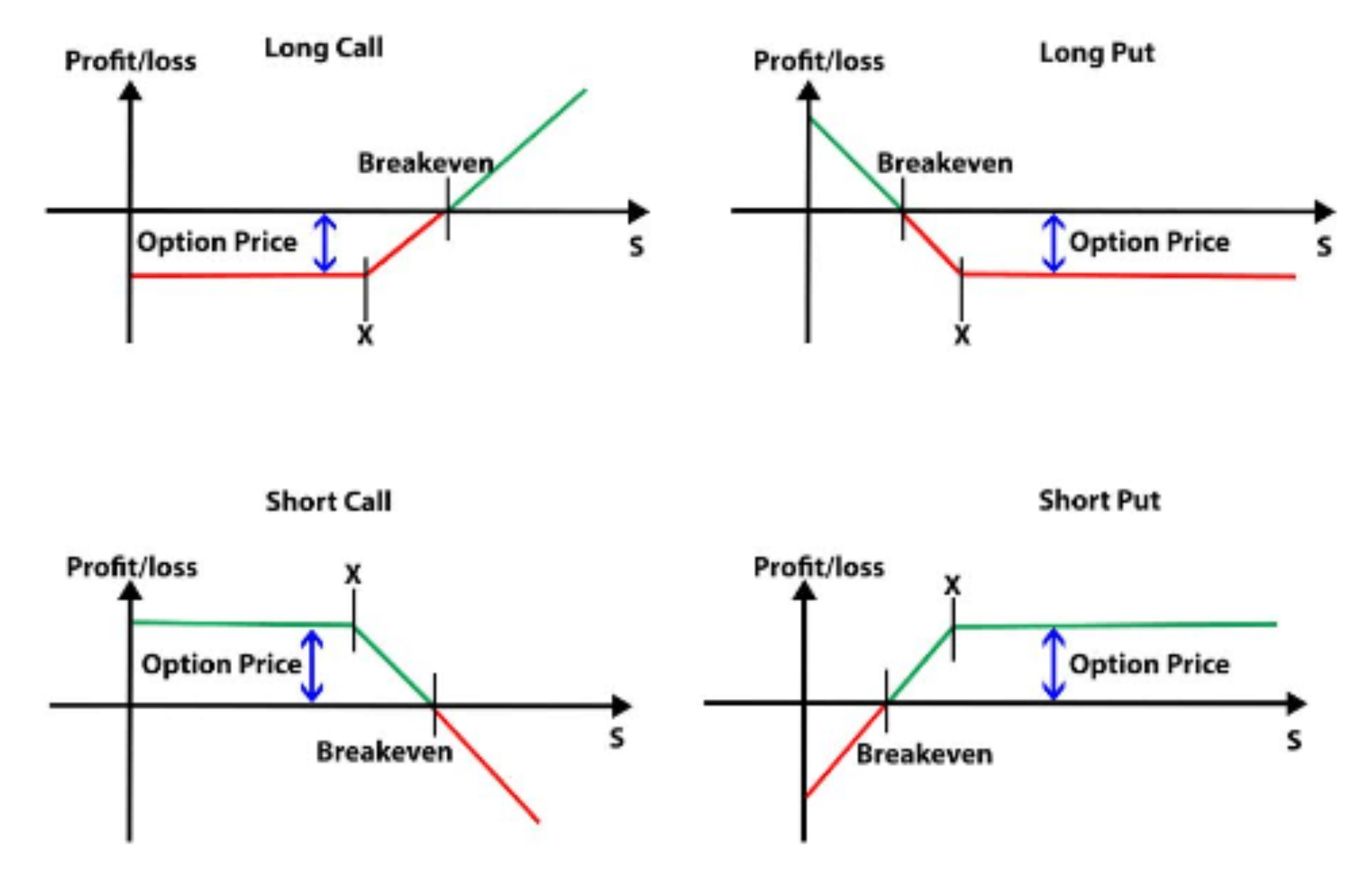

A call option grants the holder the right to purchase an underlying asset at the predetermined strike price before the contract’s expiration date. When the market price exceeds the strike price, the call option gains value, allowing the holder to exercise their right to buy the asset at a favorable price and potentially profit from the price difference.

Put Options: The Right to Sell

Put options, on the other hand, confer the right to sell the underlying asset at the strike price. Investors purchase put options when they anticipate a decline in the asset’s value. If the market price falls below the strike price, the put option gains value, enabling the holder to sell their asset at a higher price than the prevailing market value.

Payout Structures: Diversifying Return Options

Options trading offers a range of payout structures, allowing investors to tailor their strategies based on their risk tolerance and market outlook. The most common payout structures include:

-

In-the-Money: Options with a strike price that is below the current market price (call options) or above the market price (put options) are referred to as “in-the-money.” These options have immediate intrinsic value and can be exercised for a profit immediately.

-

At-the-Money: Options with a strike price that aligns with the current market price are considered “at-the-money.” They have no intrinsic value and derive their worth from the time value remaining until expiration.

-

Out-of-the-Money: Options with a strike price significantly different from the underlying asset’s market price are considered “out-of-the-money.” They have little to no intrinsic value and rely heavily on a significant price fluctuation to become profitable.

Image: tme.net

Factors Influencing Payout: Navigating Market Dynamics

Numerous factors interplay to determine the payout of an options contract. Understanding these variables helps investors refine their trading strategies:

-

Underlying Asset Price: The fundamental price of the underlying asset directly influences the value of options. Positive price movements for call options and negative price movements for put options enhance their profitability.

-

Time to Expiration: The time remaining until an option’s expiration date affects its time value. Options with more time to expiration generally have higher time value and thus greater potential for profit.

-

Volatility: Volatility, a measure of price fluctuations, significantly influences options trading. Higher volatility leads to increased option premiums, expanding potential returns but also risks.

Maximizing Profits: Strategies for Success

To maximize their profits through options trading, investors employ various strategies:

-

Covered Calls: Selling call options against an existing position in the underlying asset to generate income while limiting downside risk.

-

Cash-Secured Puts: Selling put options supported by sufficient cash reserves to purchase the underlying asset at the strike price upon assignment.

-

Iron Condors: A neutral strategy that involves selling both a call and a put option at higher and lower strike prices, respectively, while simultaneously buying a call and a put option at even higher and lower strike prices to create a trade with limited potential profit but enhanced return probability.

Options Trading Payout

Image: profitnama.com

Conclusion

Options trading offers investors a versatile tool to generate income, enhance portfolio returns, and mitigate risks. By comprehending the dynamics of options contracts, including their types, payout structures, and influencing factors, investors can harness the power of derivatives for financial success. However, it’s imperative to approach options trading with a well-informed strategy, managing risk through careful consideration of variables like underlying asset price, time to expiration, and market volatility. By embracing a disciplined trading approach that aligns with individual goals, investors can unlock the full potential of options trading.