The options trading market presents a unique challenge, as it is constantly evolving, with dramatic market swings and shifting opportunities. To succeed in this dynamic environment, it is imperative to understand the concept of market timing and how to leverage it to your advantage.

Image: s3.amazonaws.com

Defining Options Trading Market Timing

In essence, options trading market timing refers to the process of analyzing market conditions and identifying periods when options are most likely to appreciate in value. By predicting when volatility is likely to spike or decline, traders can make informed decisions on whether to buy or sell options, with the aim of capitalizing on price movements and minimizing risk.

Historical Fluctuations: A Glimpse into Market Behavior

Throughout history, the options market has experienced periods of heightened volatility, often coinciding with significant events such as geopolitical crises, economic downturns, or major corporate announcements. These volatile times present lucrative opportunities for traders who can deftly navigate the market’s unpredictable movements.

Leveraging Volatility: Strategies for Success

To successfully time the options market, traders employ a variety of strategies. One common approach is to identify periods of high implied volatility, which indicates market expectations of significant price fluctuations in the underlying asset. Buying options during these times can yield substantial profits if the expected volatility materializes.

Alternatively, some traders opt to trade on low implied volatility, betting that the market will remain relatively stable. Selling options in these periods can generate a slow but steady income stream if volatility remains low. It is crucial to note that timing is of the essence when employing this strategy, as missing the turning point can lead to significant losses.

Image: www.skillsuccess.com

Analyzing Technical Indicators: A Technical Perspective

Traders often rely on technical analysis to predict market movements. By studying charts and identifying patterns, they can make informed decisions on when to enter and exit the market. Bollinger Bands, moving averages, and relative strength index (RSI) are among the popular technical indicators used in options trading market timing.

Combining Fundamental and Technical Analysis: A Balanced Approach

While technical analysis provides insights into market behavior, it is equally important to consider fundamental factors that drive stock prices. This includes macroeconomic data, industry trends, earnings reports, and company-specific events. By combining fundamental and technical analysis, traders can gain a more comprehensive understanding of the market and make more informed trading decisions.

Monitoring News and Market Sentiment: Staying Informed

Staying abreast of current events and market sentiment is crucial for successful options market timing. Breaking news, geopolitical events, and macroeconomic data releases can significantly impact market volatility and option prices. By monitoring news and sentiment indicators, traders can anticipate potential triggers and adjust their strategies accordingly.

Risk Management: A Prudent Approach

Options trading involves inherent risk, and it is paramount to implement effective risk management strategies. Clearly defining entry and exit points, setting stop-loss orders, and understanding the potential downside of each trade are essential practices for managing risk and preserving capital.

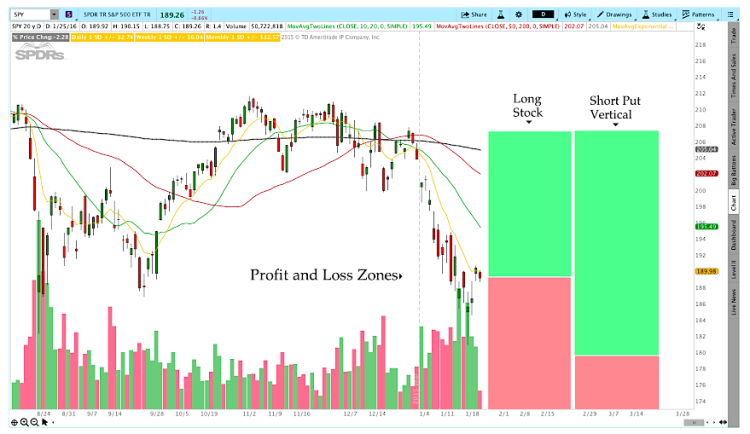

Options Trading Market Times

Image: www.seeitmarket.com

Conclusion: Mastering Market Dynamics

Navigating the options trading market is a challenging yet potentially rewarding endeavor. By understanding market timing, employing proven strategies, and combining technical and fundamental analysis, traders can position themselves to identify opportunities, capitalize on volatility, and minimize risk. Remember, while market timing can enhance trading performance, it is not an exact science, and traders should always approach the market with a measured level of risk tolerance and a commitment to continuous learning.