In a realm where financial opportunities abound, options trading emerges as a captivating arena for investors seeking high-octane returns. My initial foray into this market was a whirlwind of emotions, a rollercoaster of exhilaration and heart-pounding trepidation. But as I delved deeper, I discovered a profound world of risk and reward, where careful strategy and timely execution held the keys to unlocking significant gains.

Image: www.youtube.com

In this comprehensive guide, we embark on an exploration of the options trading market, unraveling its complexities and empowering you with the knowledge to navigate its turbulent waters.

Options Trading: A Risky Yet Rewarding Endeavor

Options, financial instruments derived from underlying assets such as stocks, commodities, or currencies, confer upon investors the right, albeit not the obligation, to buy (call options) or sell (put options) those assets at a predetermined price on or before a specified date. This flexibility grants traders immense potential for profit but also exposes them to varying degrees of risk.

The options market, a global phenomenon, has witnessed a surge in popularity in recent years, fueled by increased volatility in financial markets, the proliferation of online trading platforms, and the growing appetite among investors for alternative investment strategies.

Evolution of the Options Trading Market

The genesis of options trading can be traced back to the 18th century, when traders in Amsterdam sought to mitigate risks associated with agricultural commodities. Over the centuries, options evolved from rudimentary contracts into standardized instruments traded on regulated exchanges.

The advent of technology revolutionized the options market, enabling electronic trading, real-time price dissemination, and sophisticated risk management tools. Today, the market boasts a staggering array of options contracts, catering to the diverse needs of individual investors, institutional traders, and hedge funds.

Current Trends and Developments

The options trading market is constantly evolving, influenced by economic conditions, regulatory changes, and technological advancements. Some of the latest trends and developments include:

- Increased Volatility: heightened market uncertainty has fueled demand for volatility-hedging strategies, leading to a surge in options trading.

- Growth in Retail Participation: the accessibility of online trading platforms has democratized options trading, attracting a growing number of retail investors.

- Expansion of Options Contracts: exchanges are continually introducing new options contracts on a wide range of underlying assets, providing investors with greater flexibility and diversification opportunities.

Image: ideausher.com

Tips and Expert Advice for Options Traders

Venturing into the options trading market requires a judicious approach. Seasoned traders offer the following tips and expert advice:

- Understand the Risks: grasp the potential risks associated with options trading, including the possibility of losing your entire investment.

- Develop a Trading Strategy: formulate a comprehensive trading strategy that aligns with your risk tolerance and financial goals.

- Research and Due Diligence: thoroughly analyze the underlying asset, market conditions, and options pricing before executing a trade.

- Utilize Stop Loss Orders: implement stop loss orders to automatically exit positions and minimize losses in adverse market conditions.

- Seek Professional Guidance: consider consulting with a financial advisor or experienced options trader to refine your strategy and navigate market complexities.

Frequently Asked Questions on Options Trading

Q1: What is the difference between a call and a put option?

A1: A call option grants the buyer the right to buy an underlying asset at a fixed price, while a put option confers the right to sell.

Q2: How do I determine the Greeks of an option?

A2: Option Greeks, such as delta, gamma, and theta, measure the sensitivity of an option’s price to changes in underlying asset price, time, and other factors.

Q3: What are the tax implications of options trading?

A3: Options trading is subject to taxation, and the tax treatment depends on factors such as the type of option, holding period, and trader’s investment status.

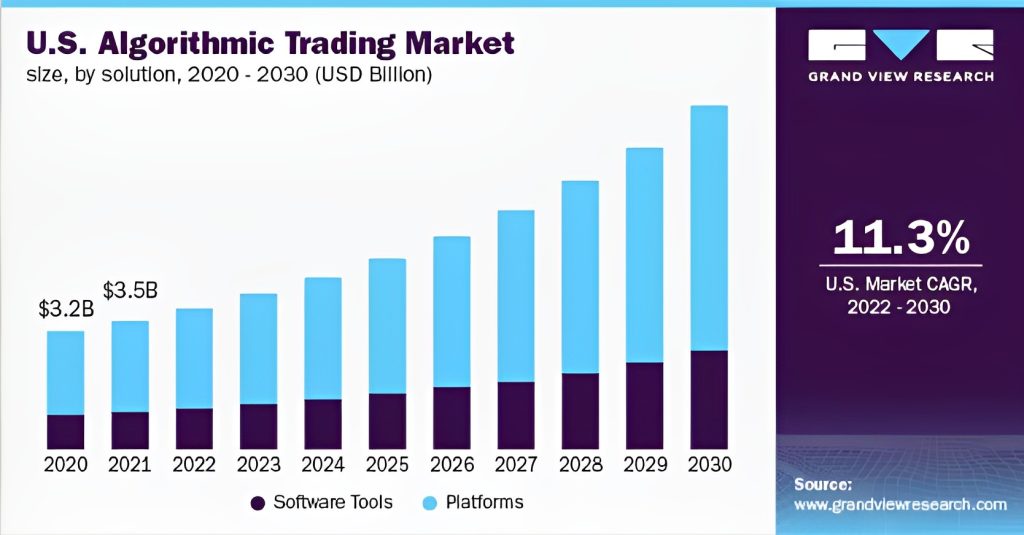

Options Trading Market Size

Image: www.protradingschool.com

Conclusion

The options trading market presents a compelling opportunity for investors to amplify their returns, but it demands a keen understanding of the risks involved and the judicious application of trading strategies. By embracing the principles outlined in this guide, you can arm yourself with the knowledge and confidence to navigate this dynamic market and unlock its full potential.

Are you eager to delve further into the world of options trading? Share your questions and insights in the comments section below.