In the realm of financial trading, where strategies abound and fortunes can be made or lost in an instant, options trading stands as a complex yet potentially lucrative endeavor. Among the myriad options strategies at investors’ disposal, the IQ butterfly strategy has gained prominence as a versatile and adaptable technique. In this comprehensive guide, we will delve into the intricacies of the IQ butterfly strategy, exploring its history, mechanics, applications, and nuances.

Image: optionstradingiq.com

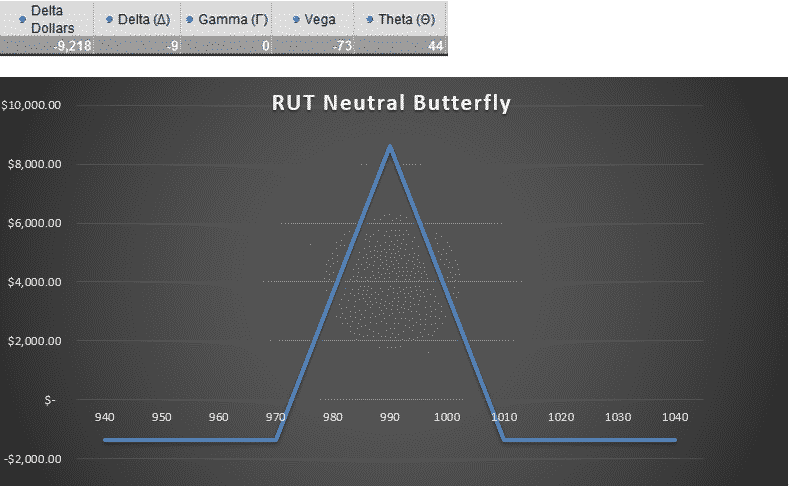

The IQ butterfly strategy derives its name from its unique shape on an options price chart. It is essentially a combination of two bullish call spreads and a vertical spread. The strategy is constructed by buying two call options at a lower strike price, selling two call options at a higher strike price, and selling a put option at an even lower strike price. This intricate combination creates a short position in the middle strike price and a long position in both the lower and upper strike prices.

The IQ butterfly strategy exhibits a moderate to high profit potential, but it also carries a corresponding level of risk. The profit is capped at the difference between the distance between the two call spreads and half of the put spread. As such, the strategy benefits from a range-bound market, where the underlying asset fluctuates within a predictable range. If the underlying asset closes within this predetermined range, the investor can typically capture the spread premium.

The IQ butterfly strategy finds wide application in various market conditions. It is an ideal strategy for investors who anticipate a period of relative stability in the underlying asset. The strategy can also be used to hedge against potential losses in a long stock position. By selling the call options at the higher strike price, investors limit their potential upside while maintaining exposure to moderate gains.

The IQ butterfly strategy has several limitations that investors must consider. The strategy requires vigilant monitoring, as the investor must constantly assess the performance of the underlying asset and make adjustments accordingly. Additionally, the level of risk can be substantial, and investors should only allocate a portion of their portfolio to this strategy.

Executing the IQ butterfly strategy requires a thorough understanding of options trading mechanics. It is essential to select appropriate strike prices and expiration dates for each leg of the strategy. Investors should conduct careful research to determine optimal strike prices based on their risk tolerance and market outlook.

In conclusion, the IQ butterfly strategy is a multifaceted options trading strategy that offers both profit potential and risk. By combining multiple options contracts, investors can achieve a targeted risk-return profile. However, it is imperative to approach this strategy with a keen understanding of options trading and a disciplined risk management approach. As with any financial endeavor, thorough research and careful execution are paramount to maximizing returns while minimizing losses.

Image: thehealthguild.com

Options Trading Iq Butterfly

Image: www.24forex.co.za