Options trading has emerged as a potent tool for investors seeking to navigate the complexities of the financial markets. To harness its full potential, traders need an intuitive interface that empowers them with the necessary information, tools, and functionality. In this article, we will delve into the mechanics of an options trading interface, unravel its components, and provide insights to enhance your trading experience.

Image: www.researchgate.net

Navigating the Interface: Essential Components

The options trading interface is structured to streamline the trading process, presenting vital information and execution capabilities at a glance. Key components include:

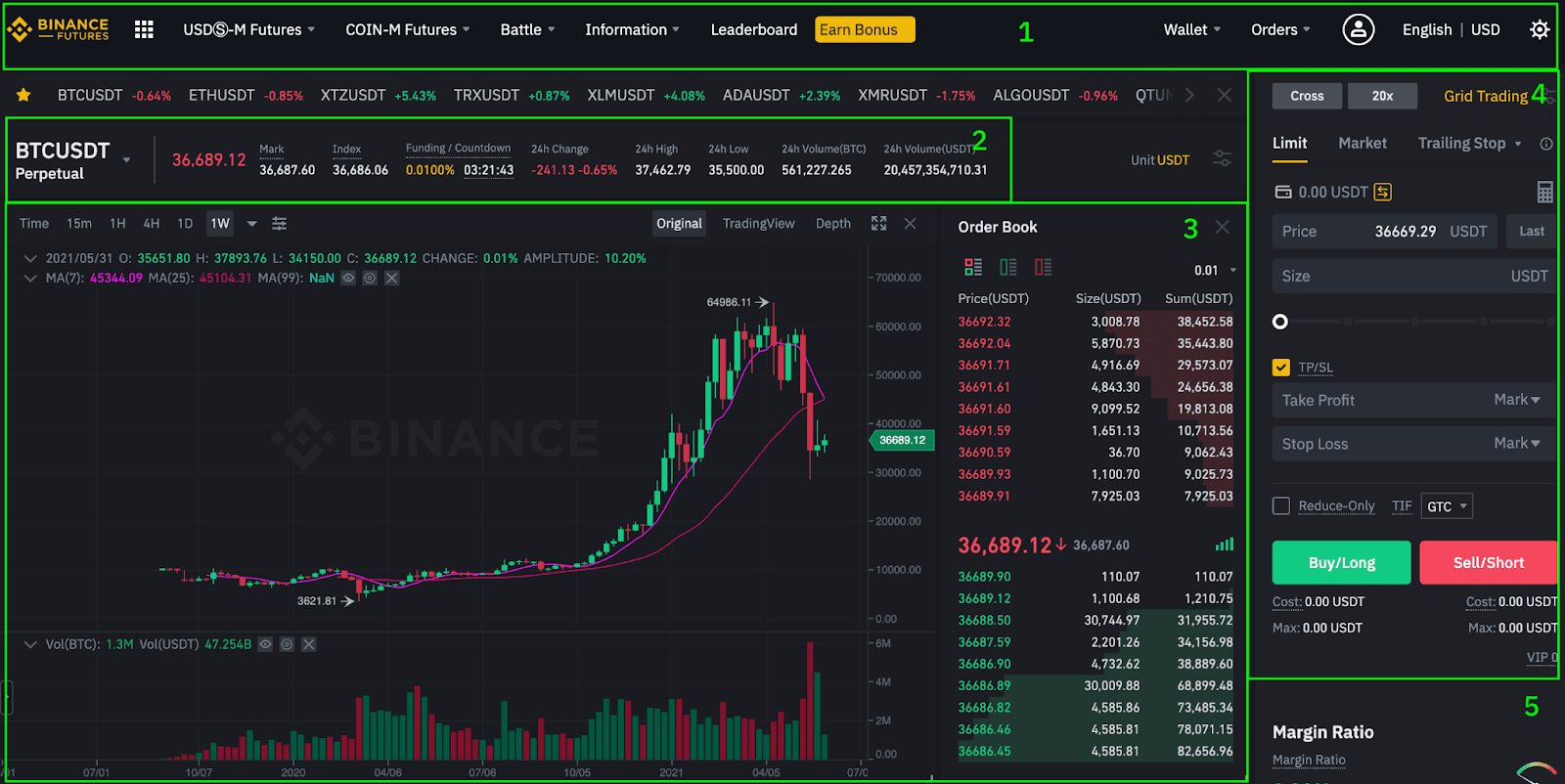

1. Market Depth Panel:

- Provides real-time bid and ask prices for various strike prices and expirations, offering insights into market sentiment and liquidity.

2. Option Chain Display:

- Displays available options contracts for a specific underlying asset, including the underlying price, strike price, expiration date, and current market value.

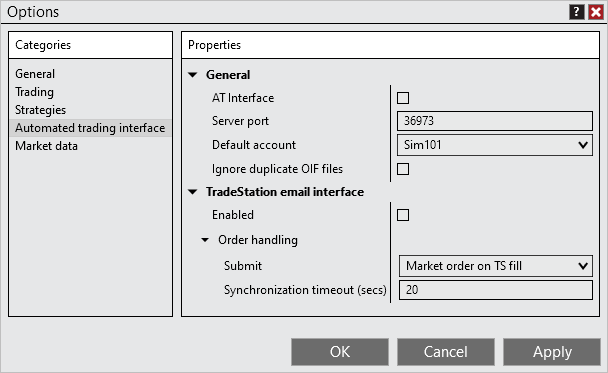

3. Order Entry Panel:

- Enables traders to place and manage orders, specifying order type, quantity, limit price, and other parameters.

4. Options Trading Tools:

- Includes analytical tools such as implied volatility charts, Greeks calculators, and scenario analyses, empowering traders with data-driven insights.

Understanding the Trading Process: Step-by-Step Guide

Navigating the options trading interface requires a clear understanding of the underlying mechanics. Here’s a step-by-step guide to executing an options trade:

1. Select an Underlying Asset:

Start by choosing the underlying asset for which you wish to trade options, such as stocks, indices, or commodities.

2. Identify Option Contract:

Within the option chain display, select the contract that aligns with your trading strategy, considering factors such as strike price, expiration date, and volatility.

3. Place an Order:

In the order entry panel, specify the order type (e.g., market, limit, stop), quantity, and any other relevant parameters.

4. Submit the Order:

Review the order details thoroughly, ensuring accuracy, and submit the order to the exchange for execution.

5. Monitor the Trade:

Once submitted, monitor the status of the order and any subsequent trading activity through the interface’s order management system.

Leveraging Tools and Analytics: Enhancing Trading Decisions

Modern options trading interfaces offer a suite of analytical tools to empower traders with data-driven insights. These tools include:

-

Implied Volatility Charts: Plot historical and projected volatility levels, providing insights into market expectations for future price movements.

-

Greeks Calculators: Calculate the Greeks of an option (Delta, Gamma, Theta, Vega, Rho), which measure its sensitivity to various market variables.

-

Scenario Analyses: Allow traders to simulate different market conditions and analyze potential trade outcomes based on various inputs.

Image: ninjatrader.com

Image: ninjatrader.comOptions Trading Interface Explained

Image: www.binance.com

Conclusion

Mastering the intricacies of an options trading interface is paramount for success in the financial markets. By breaking down the components, understanding the trading process, and effectively utilizing analytical tools, traders can unlock the full potential of this powerful trading platform. Stay updated with the latest enhancements and developments in options trading interfaces to remain competitive and make informed trading decisions.