Introduction

In today’s dynamic financial markets, savvy organizations are constantly seeking innovative ways to mitigate risk and enhance their investment returns. One such strategy that deserves heightened attention is options trading. Options trading offers a powerful suite of instruments that can empower organizations to tailor their risk-reward profiles, capitalize on market opportunities, and unlock additional sources of value. This article delves into the world of options trading, exploring its mechanics, benefits, and how organizations can harness its potential.

Image: alphabetastock.com

Delving into Options Trading: Key Concepts and Mechanics

Options are versatile financial contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts come in two primary flavors: calls and puts. Call options confer the right to buy, while put options grant the right to sell.

Understanding the core components of an option contract is key. The underlying asset refers to the security or commodity being traded. The strike price represents the price at which the buyer of the option has the right to exercise their option. The expiration date denotes the specified window during which the option can be exercised. Finally, the premium is the price paid by the option buyer to the option seller for this contractual right.

The Allure of Options Trading: A Pandora’s Box of Benefits

Options trading has gained prominence among organizations for a multitude of reasons. Foremost among them is its versatility, providing a myriad of ways to tailor risk and enhance returns. By leveraging options, organizations can hedge against potential losses, speculate on future price movements, generate income from option premiums, or leverage their capital for enhanced returns.

Moreover, options trading can serve as a potent tool for risk management. By employing option strategies, organizations can neutralize potential market downturns or minimize risks associated with unexpected price fluctuations. This risk-hedging capability underscores the versatility of options trading as a strategic component of an organization’s financial toolkit.

Navigating the Options Trading Landscape: Expert Insight and Strategies

Effectively traversing the options trading landscape requires a combination of knowledge and thoughtful strategy. Prudent organizations seek guidance from experienced financial professionals who can provide customized advice tailored to their specific objectives and risk appetite.

Seasoned options traders employ a diverse array of strategies to maximize potential returns while mitigating risks. Covered calls involve selling call options against underlying stocks already owned, generating income from option premiums while maintaining the potential for appreciation. Protective puts, on the other hand, confer the right to sell an underlying asset at a predetermined price, thereby hedging against potential losses.

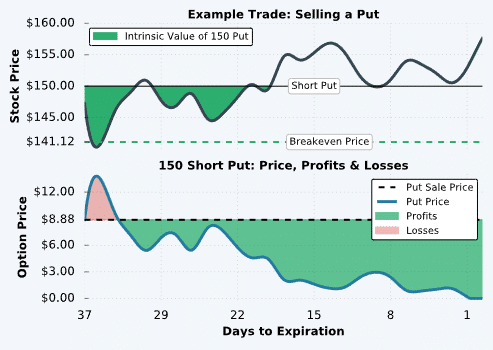

Image: optionalpha.com

Options Trading How Does Your Organization Will Know About It

Image: ar.inspiredpencil.com

Harnessing Options Trading: A Catalyst for Organizational Success

Forward-thinking organizations recognize the transformative potential of options trading. By adeptly deploying options strategies, organizations can unlock hidden value, bolster risk management, and forge a path towards financial prosperity.

Consider the example of an organization with excess cash reserves. Instead of passively earning meager returns from traditional savings accounts, the organization could generate additional income by selling covered