The Allure of Options: A Swift Path to Financial Freedom?

Options trading, a tantalizing realm within the financial sphere, has captivated the imaginations of countless individuals seeking to expedite their path to financial prosperity. These enigmatic financial instruments, akin to the philosopher’s stone of alchemists, promise transformative returns that eclipse the pedestrian gains of traditional investments. But beneath the veneer of immense rewards lies a labyrinth of complexities and potential risks, making it imperative to navigate these uncharted waters with a compass of knowledge and a steady hand. In this comprehensive guide, we embark on a perilous expedition into the depths of options trading, deciphering its intricacies, unveiling its perils, and revealing the secrets to harnessing its transformative power for unparalleled financial growth.

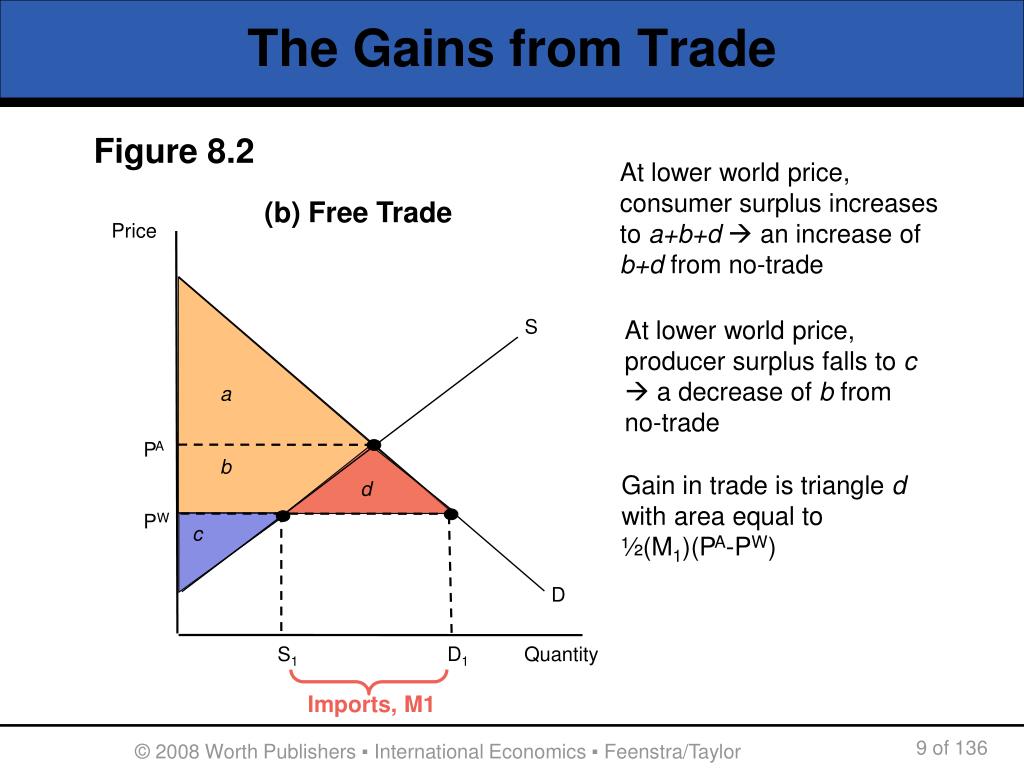

Image: www.slideserve.com

Delving into the Options Paradigm: Concepts and Mechanisms Unveiled

Options, in essence, are derivative contracts that confer upon their holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset, such as a stock or commodity, at a predetermined price, known as the strike price, within a specified period, referred to as the expiration date. This flexibility affords traders a spectrum of strategies, empowering them to tailor their investments to specific market scenarios and risk appetites.

Navigating Options Strategies: From Basic to Advanced Techniques

The options universe encompasses a kaleidoscope of strategies, ranging from the rudimentary to the virtuoso, each tailored to distinct market conditions and objectives. Covered calls, a conservative strategy, encompass selling call options against stocks one owns, enabling the collection of premiums while maintaining ownership of the underlying asset. Conversely, cash-secured puts involve selling put options against cash reserves, potentially generating income or acquiring the underlying asset at a lower price if the market declines.

For those with a higher tolerance for risk, iron condors and straddles beckon, offering opportunities for substantial gains amidst heightened volatility. Iron condors involve the simultaneous sale of out-of-the-money call and put options with different strike prices, while straddles consist of buying both a call and a put option with the same strike price and expiration date, capitalizing on significant price movements in either direction.

Unveiling the Nuances of Greeks: The X-ray of Options Dynamics

Comprehending the intricacies of options trading demands an understanding of the Greeks, a pantheon of metrics that quantify various aspects of an option’s behavior in response to changing market conditions. Delta, the most fundamental Greek, gauges the sensitivity of an option’s price to fluctuations in the underlying asset’s price. Theta, on the other hand, measures the unrelenting decay of an option’s value as it approaches its expiration date.

Gamma and Vega delve into the intricacies of an option’s price sensitivity to changes in its delta and implied volatility, respectively. These Greeks, in conjunction with others such as Rho and Kappa, empower traders to scrutinize options with a surgeon’s precision, enabling them to make informed decisions and mitigate risks.

Image: courses.lumenlearning.com

Risk Management: Surfing the Waves of Market Turbulence

As with any financial endeavor, options trading carries inherent risks that must be navigated with unwavering vigilance. Market volatility, akin to a tempestuous sea, can swiftly erode an investor’s capital, particularly for those wielding options with shorter expiration dates. Moreover, fluctuations in implied volatility, the market’s anticipation of future price swings, can profoundly impact option pricing, potentially leading to substantial losses.

Prudent risk management strategies are paramount to weather these market storms. Implementing stop-loss orders, which automatically exit trades when specified price thresholds are breached, can safeguard capital from catastrophic losses. Additionally, position sizing, the judicious allocation of funds across various trades, ensures that a single adverse market move does not sink the entire portfolio.

Psychology of Options Trading: Taming the Inner Gambler

The psychological toll of options trading cannot be understated. The allure of rapid wealth creation can entice traders to abandon rational decision-making, succumbing to the throes of fear and greed. Discipline, self-control, and a robust understanding of one’s risk tolerance are essential to avoid falling prey to these emotional pitfalls.

Embarking on the Options Adventure: Resources and Education

Venturing into the realm of options trading requires a solid foundation of knowledge and access to reputable educational resources. Online brokerages and platforms abound, offering a wealth of educational materials, webinars, and simulation tools to hone one’s skills. Books, articles, and online forums provide a treasure trove of insights and strategies, guiding traders through the intricacies of this complex domain.

Options Trading For Massive Gains

Image: www.youtube.com

Conclusion: Unveiling the True Power of Options Trading

Options trading, a potent financial instrument, empowers individuals to amplify their returns and potentially generate transformative wealth. However, it is imperative to approach this endeavor with a clear understanding of the inherent risks and the importance of sound risk management principles. Through diligent research and unwavering discipline, traders can harness the immense power of options to achieve their financial aspirations. Remember, fortune favors the prepared, and in the realm of options trading, knowledge is the ultimate currency.