In the ever-evolving landscape of stock market trading, understanding options trading has become increasingly critical for investors seeking to maximize their potential returns and mitigate risks. One of the most effective tools in options trading is charting, which provides traders with valuable insights into price movements and market sentiment.

Image: texewekiro.web.fc2.com

Charting the Path to Success: An Introduction to Options Trading Charting

Options trading charts are graphical representations of past price data, allowing traders to analyze historical trends, identify patterns, and predict future market movements. By studying these charts, traders can make informed decisions about buying or selling options contracts, increasing their chances of profiting from market fluctuations.

The Heart of the Matter: Core Concepts of Options Trading

To fully understand options trading charts, it is essential to grasp the core concepts of options. Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a set expiration date. The two main types of options are call options, which grant the right to buy, and put options, which grant the right to sell.

Mastering the Art of Charting: Essential Techniques and Indicators

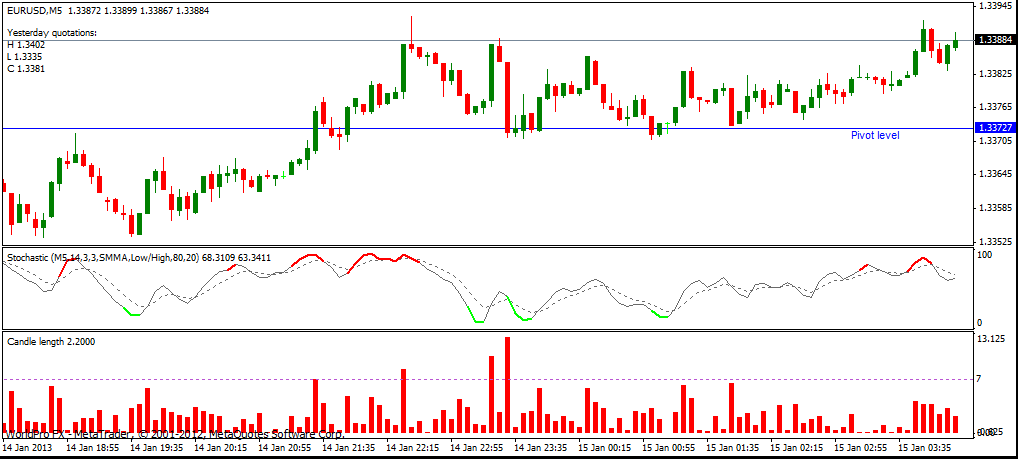

The art of options trading charting involves employing various techniques and indicators to uncover valuable information from price data. Some of the most common charting techniques include:

- Trend Analysis: Identifying the overall direction of the market through the study of price movements.

- Support and Resistance Levels: Key price points at which a stock encounters difficulty moving higher or lower.

- Moving Averages: Indicators that smooth out price fluctuations and provide insights into the market’s general trend.

- Technical Indicators: Mathematical formulas used to analyze price patterns and predict future market behavior, such as the Relative Strength Index (RSI) and Bollinger Bands®.

Image: ansonalex.com

Charting with Confidence: Leveraging Historical Data to Your Advantage

Historical data plays a pivotal role in options trading charting. By analyzing past price movements, traders can identify patterns and trends that may indicate future market behavior. However, it is crucial to remember that charting does not provide absolute predictions but rather offers insights that can enhance decision-making.

The Path to Profit: Applications of Options Trading Charting in Real-World Trading

Options trading charting finds practical applications in various real-world trading scenarios:

- Trend Following: Identifying and capitalizing on market trends by entering and exiting positions according to chart patterns.

- Support and Resistance Trading: Buying or selling options at key support or resistance levels to exploit predictable market movements.

- Volatility Trading: Trading options during periods of high market volatility to capitalize on fluctuating prices.

- Hedge Strategies: Using options to protect existing positions from potential losses.

Continuing the Journey: Embracing the Latest Trends and Developments

The field of options trading charting is constantly evolving, with new techniques and indicators emerging. Staying up-to-date with the latest trends and developments is essential for traders to remain competitive:

- Artificial Intelligence and Machine Learning: Leveraging advanced algorithms to analyze vast amounts of data and identify trading opportunities.

- Volatility Skew: Studying the relationship between implied volatility and different strike prices to gain insights into market sentiment.

- Order Flow Analysis: Monitoring the flow of orders to understand the intentions of large traders.

Options Trading Charting

Image: www.binaryoptionsu.com

Conclusion: Charting the Course to Success in Options Trading

Options trading charting is an essential skill for anyone serious about succeeding in the stock market. By understanding core options concepts, mastering charting techniques, and leveraging historical data, traders can improve their decision-making and increase their chances of profitability. With continuous learning and adaptation to the latest trends, traders can navigate the ever-changing market landscape with confidence and chart a path to financial success.