In the intricate world of finance, where market volatility often resembles a rollercoaster ride, options trading has emerged as a powerful instrument. As an experienced trader, I have witnessed firsthand the potential of options to mitigate risks and exploit market opportunities. Among the various options strategies, buying a put option stands out as a compelling technique for profiting from market declines.

Image: www.binarytradingforbeginners.com

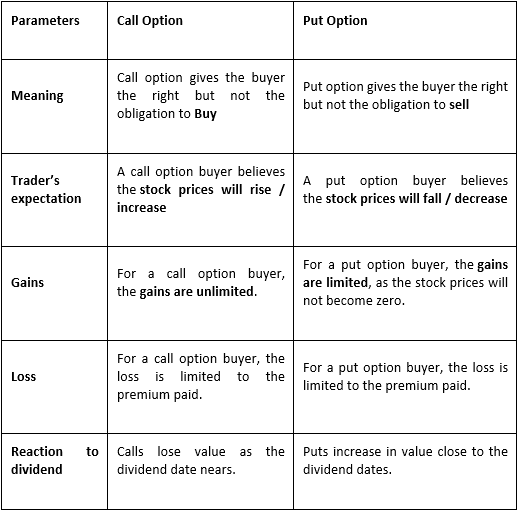

Options, unlike stocks or bonds, represent contracts that grant the buyer (holder) the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Put options specifically provide the buyer with the right to sell an underlying asset at the strike price (agreed-upon price) before expiration.

Risks and Benefits of Buying a Put Option

The appeal of buying a put option lies in its potential to generate returns in falling markets. When the underlying asset’s price declines, the value of the put option increases. This allows investors to hedge against market downturns or profit from pessimistic market forecasts.

However, it’s crucial to understand the inherent risks associated with options trading. Premiums, which represent the initial cost of purchasing the option, can erode profits if the market remains stagnant or moves in the opposite direction. Time decay also factors into the equation, as put options lose value as their expiration date approaches.

Factors to Consider When Buying a Put Option

To maximize the potential of buying a put option, it’s essential to consider several key factors:

- The underlying asset: Assess the historical volatility and performance of the underlying asset to gauge market sentiment and potential price movements.

- Strike price: Determine the strike price that aligns with your market outlook and risk tolerance. OTM (out-of-the-money) options offer higher returns but also carry increased risk.

- Expiration date: Choose an expiration date that provides sufficient time for the desired price movement to materialize while considering the impact of time decay.

- Volatility: Volatility levels can significantly influence put option pricing. Higher volatility typically results in higher premia.

- Market conditions: Analyze current market conditions and consider macroeconomic factors, sentiment indicators, and technical analysis to form an informed market outlook.

Expert Tips and Advice for Success

Based on my experience in options trading, I recommend these tips for enhancing your chances of success when buying a put option:

- Proper planning: Define your trading strategy, objectives, and risk tolerance upfront to guide your decision-making.

- Stay informed: Keep up with market news, updates, and financial analysis to stay abreast of market trends and potential opportunities.

- Manage your risk: Determine the maximum amount you’re willing to lose and adjust your position size accordingly. Consider stop-loss orders to limit potential losses.

- Exercise patience: Options trading often requires patience and discipline. Don’t expect instant returns and allow sufficient time for market fluctuations to materialize.

- Consider professional guidance: If necessary, seek professional guidance from an experienced financial advisor or broker to enhance your understanding of options trading and make informed decisions.

Image: bse2nse.com

FAQs on Buying a Put Option

Q: Can buying a put option guarantee profits?

A: No, there is no guarantee of profits with any investment, including options trading. However, careful planning and risk management can increase the probability of successful outcomes.

Q: What happens if the underlying asset’s price goes up after I buy a put option?

A: The value of your put option will decrease as its intrinsic value erodes. You may consider selling the option to minimize losses or hold onto it if you anticipate a market reversal.

Q: When should I consider selling a bought put option?

A: Exit strategies vary depending on your trading objectives. Sell the put option when you’ve achieved your profit target, if the underlying asset’s price has risen significantly, or if the market outlook has shifted.

Options Trading Buy A Put Option

Image: tradebrains.in

Conclusion

Buying a put option can be a powerful strategy for profiting from market declines or hedging against market risks. By understanding the concept, considering key factors, following expert advice, and managing your risk, you can increase your chances of success in options trading.

Are you interested in exploring the world of options trading further? Share your thoughts and questions in the comments section, and I’ll be happy to engage with you.