In the treacherous waters of financial markets, where volatility lurks like a hidden reef, traders seek solace in the guidance of skilled navigators. Enter the realm of options trading bots, AI-driven companions that automate complex trading strategies with the precision of laser-guided missiles. Python, the versatile programming language of choice for data scientists and programmers alike, has emerged as the formidable captain at the helm of these automated trading vessels.

Image: www.activestate.com

Options trading, a sophisticated investment strategy, involves the buying and selling of options contracts, derivatives that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. Skilled traders meticulously craft these options strategies to hedge against risk, capitalize on market volatility, and generate substantial profits. However, the intricate calculations and lightning-fast execution required in options trading have long posed a formidable challenge, even for seasoned professionals.

This is where Python swoops in like a digital savior, empowering traders with the ability to create sophisticated options trading bots that automate these complex strategies. These algorithms tirelessly monitor market data, analyze trends, and execute trades with the speed and accuracy that human traders can only dream of. By harnessing the computational prowess of Python, traders can now navigate the treacherous seas of options trading with newfound confidence and precision.

Navigating the Labyrinth of Options Trading with Python

Embarking on the journey of options trading with Python requires a deep understanding of both the underlying financial concepts and the programming intricacies of Python. Traders must first familiarize themselves with the basics of options trading, such as different types of options contracts (calls, puts, straddles, strangles), the concept of strike prices and expiration dates, and the nuances of volatility and implied probability.

With a firm grasp of these financial fundamentals, traders can then delve into the realm of Python programming, mastering the essential libraries and syntax required for options trading. This includes working with financial data structures, utilizing technical indicators for trend analysis, and implementing robust trading logic. Numerous online resources, tutorials, and open-source libraries are available to guide traders through this process, providing them with the necessary tools to construct their own Python-powered trading bots.

Unveiling the Secrets of Automated Options Trading Strategies

The true power of options trading bots lies in their ability to automate complex trading strategies, freeing traders from the constraints of manual execution and allowing them to capture market opportunities around the clock. Python provides a robust framework for implementing these strategies, empowering traders to tap into the vast array of financial data and analytical tools available within the Python ecosystem.

One widely adopted options trading strategy executed by Python bots is the covered call strategy. This involves selling covered call options, which grants the buyer the right to buy the underlying asset at a predetermined price, while the seller simultaneously owns the underlying asset. The premium received from selling the call option generates income for the seller, while also limiting their potential profit if the underlying asset rises in value. Python bots can be programmed to monitor the underlying asset’s price movements and automatically adjust the strike price and expiration date of the covered call to maximize returns.

Another popular options trading strategy is the iron condor strategy. Commonly used in neutral market conditions, this strategy involves selling an out-of-the-money call option and an out-of-the-money put option, while simultaneously buying two in-the-money call options and two in-the-money put options. The premium received from selling the out-of-the-money options offsets the cost of purchasing the in-the-money options, creating a defined risk and reward profile. Python bots are adept at implementing this strategy, dynamically adjusting the strike prices and expiration dates of the options to capture market movements and manage risk.

Harnessing the Wisdom of Expert Insights and Practical Tips

Venturing into the world of options trading with Python requires not only technical proficiency but also a deep understanding of trading concepts and market dynamics. Seasoned veterans in the field emphasize the importance of continuous learning, risk management, and emotional discipline.

One invaluable tip echoed by experts is to start small and gradually increase trading volume as you gain experience and confidence. This approach allows traders to minimize risk while honing their trading skills and developing a sound understanding of the markets. It is also crucial to establish a robust risk management framework that defines clear entry and exit points, position sizing, and stop-loss levels. This framework helps traders navigate market volatility and protect their capital.

Beyond technical expertise, successful options trading also requires a high degree of emotional intelligence. Traders must be able to control their emotions, avoid impulsive decisions, and adhere to their trading plan even amidst market fluctuations. This mental resilience is essential for long-term success in the demanding world of options trading.

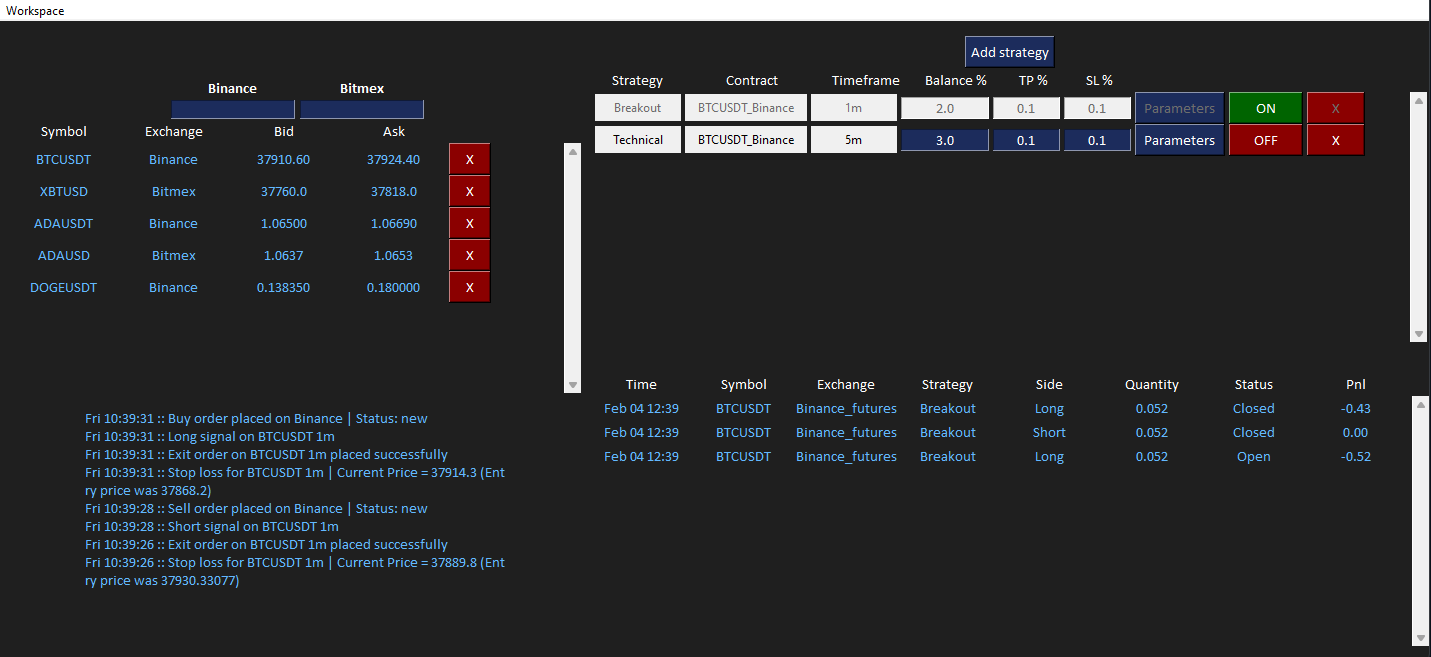

Image: wetradehq.com

Options Trading Bot Python

Image: pythonawesome.com

Embracing the Future of Options Trading with Python

The advent of Python-powered options trading bots marks a transformative era in the financial markets. These algorithms empower traders with unprecedented levels of automation, precision, and analytical capabilities. As technology continues to evolve, we can expect even more sophisticated and efficient trading bots to emerge, further revolutionizing the way options trading is conducted.

For those seeking to harness the power of Python for options trading, numerous resources are available to guide them on this journey. Online courses, workshops, and communities of experienced traders provide valuable insights, mentorship, and access to cutting-edge trading strategies. By embracing the transformative power of Python and continuously refining their skills, traders can navigate the ever-changing seas of financial markets with confidence and precision.

So hoist the sails of your Python-powered trading bot, set a course for success, and embark on the exhilarating odyssey of automated options trading. The vast ocean of financial opportunity awaits those who dare to explore its depths with the aid of this formidable technological companion.