Introduction

Embark on a journey into the dynamic world of options trading, where risk and reward intertwine. Options on Alpaca provide an innovative approach to navigating the financial markets, offering both seasoned traders and curious investors a versatile tool. In this comprehensive guide, we delve into the intricacies of options trading alpaca, unveiling its potent strategies and empowering you with the knowledge to harness its power.

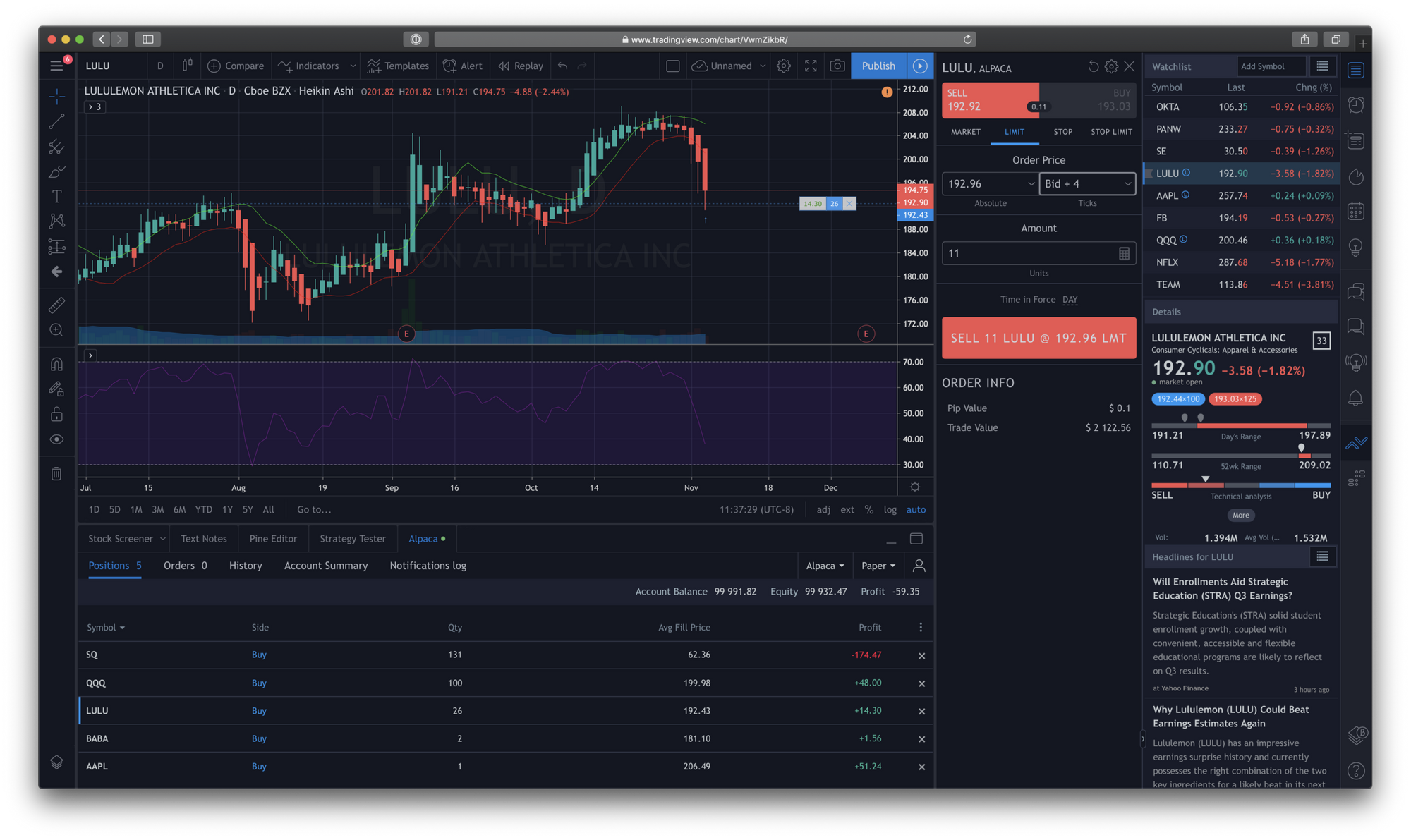

Image: alpaca.markets

What is Options Trading on Alpaca?

Options on Alpaca represent an agreement between two parties, providing the buyer with the right, but not the obligation, to buy or sell a specific underlying asset at a predefined price on or before a specified date. Unlike futures contracts, these instruments bestow greater flexibility, granting traders the option to exercise or not exercise their rights based on market conditions. This empowers them to adapt swiftly to evolving market dynamics, maximizing potential gains while mitigating potential losses.

Basic Concepts of Options Trading

Understanding the fundamental building blocks of options trading proves essential for successful navigation. Call options confer the right to buy an underlying asset, while put options grant the right to sell. The strike price represents the agreed-upon price at which the asset can be bought or sold. Expiration date sets the deadline by which the option must be exercised or expire worthless. Premiums, the fees paid to acquire options, fluctuate based on market conditions and the specific characteristics of the contract.

Bullish and Bearish Options Strategies

Options empower traders to execute strategies tailored to varying market outlooks. Bullish strategies, employed when anticipating price increases, include buying call options or selling put options. Conversely, bearish strategies, executed in anticipation of price declines, involve selling call options or buying put options. By matching appropriate strategies to market conditions, traders enhance their chances of profiting regardless of market direction.

Image: www.youtube.com

Managing Risk in Options Trading

Options on Alpaca offer flexible risk management techniques. Traders can employ stop-loss orders to safeguard their capital by automatically exiting positions if prices move against them. Position hedging using options provides a layer of protection, reducing potential losses while preserving profit potential. By judiciously managing risk, traders mitigate the inherent volatility of options trading, enhancing their chances of long-term success.

Advanced Options Strategies for Seasoned Traders

Alpaca’s options platform caters to experienced traders seeking sophisticated strategies. Spreads, combinations of multiple options contracts, allow for tailored risk-reward profiles. Iron condors, butterflies, and calendars, amongst others, enable advanced traders to customize their exposure to market fluctuations. While these strategies offer the potential for higher returns, they also demand a comprehensive understanding of options dynamics.

Options Trading Alpaca

Image: alpaca.markets

Conclusion

Options trading on Alpaca empowers investors and traders with a potent tool to navigate financial markets. By grasping the fundamental concepts, intricacies of risk management, and a range of strategies, you embark on a transformative journey toward financial success. Remember to approach options trading with prudence and a comprehensive understanding of the market dynamics, enabling you to harness the power of this versatile instrument.