Options trading provides traders with versatile tools to navigate the financial markets, offering unique opportunities to profit from both market rises and declines. For beginners venturing into this realm, it’s essential to grasp the basics of options trading, including the intricacies of simple strategies. This comprehensive guide will delve into the world of options trading, illuminating simple strategies that can empower traders with a solid foundation for market success.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)

Image: morrducimenrinnar.netlify.app

Understanding the Dynamics of Options Trading

Options contracts represent agreements between two parties, providing the buyer with the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset. The underlying asset can range from stocks and currencies to commodities like gold or oil. These contracts have predefined prices and expiration dates, allowing traders to tailor their strategies based on their market outlook and risk tolerance.

The interplay between the underlying asset’s price movements and the passage of time fundamentally influences the value of options contracts. When the underlying asset’s price aligns with the direction implied by the trader’s options position, the contract gains value, potentially leading to substantial profits. However, the exponential nature of options trading also magnifies potential losses, highlighting the need for a thorough understanding of risk management principles.

Simplifying Options Trading with Essential Strategies

For beginners navigating the intricacies of options trading, a spectrum of simple strategies offers a strategic approach to capturing market opportunities while managing risk. These foundational strategies can ignite a path toward consistent profitability in the dynamic world of options trading:

1. Covered Calls: A Conservative Strategy for Income Generation

Covered calls, suitable for options traders with a bullish outlook, involve selling (or writing) call options against a stock or other underlying asset that the trader already owns. As the name suggests, the trader is “covering” their short options position with the underlying shares, mitigating potential losses if the asset’s price falls below the strike price. This strategy aims to generate a steady stream of income through premium received from selling the options contracts.

Image: www.projectfinance.com

2. Protective Puts: Hedging Against Market Downturns

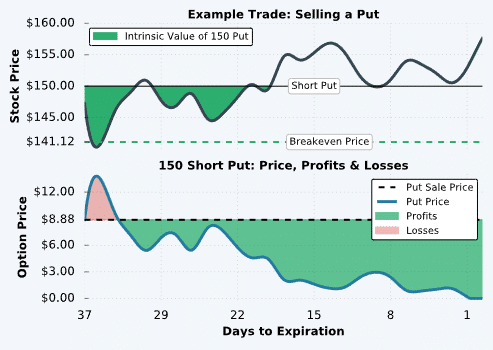

Protective puts, often employed by traders with a neutral or bearish market outlook, entail purchasing put options to safeguard against potential losses on an underlying asset they own. By acquiring a put option, the trader secures the right to sell the asset at a pre-determined strike price, ensuring a cushion against market downturns. This conservative strategy prioritizes capital preservation over speculative gains.

3. Bull Call Spreads: Leveraging Bullish Bias with Spread Trading

Bull call spreads combine the purchase of a call option at a lower strike price with the simultaneous sale of another call option at a higher strike price, both on the same underlying asset. This spread strategy requires a bullish market outlook and aims to capitalize on modest price increases in the underlying asset. The measured risk profile of this strategy aligns with the preferences of risk-averse traders seeking measured gains.

4. Bear Put Spreads: Profiting from Downward Market Momentum

Bear put spreads, suitable for traders anticipating a bearish market trend, involve selling a put option at a higher strike price and simultaneously buying another put option at a lower strike price on the same underlying asset. This spread strategy seeks to benefit from declines in the underlying asset’s price while limiting the trader’s risk exposure, making it a viable choice for cautious traders.

Options Simple Trading Strategies

Image: www.pinterest.fr

Conclusion: Unlocking Options Trading Success

Options trading, while presenting a realm of potential opportunities, demands a discerning approach to strategy selection and risk management. By mastering simple options trading strategies, beginners can lay a solid foundation for their trading endeavors, leveraging these tactics to navigate market fluctuations and pursue consistent profits. As you delve deeper into the world of options trading, consider seeking guidance from reputable resources like financial advisors or educational materials to enhance your decision-making and unlock the full potential of this dynamic financial instrument.