Introduction

The world of options trading is teeming with unfamiliar terms, known as “Greeks.” These enigmatic measures quantify the intricate relationship between options prices and various factors, often leaving traders perplexed. In this comprehensive guide, we’ll unravel the mysteries of this trading enigma, empowering you to navigate the options market with confidence.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_the_Greeks_to_Understand_Options_Aug_2020-01-5905879905614e4e979e60e572c8e3a4.jpg)

Image: www.investopedia.com

Defining the Options Geeks

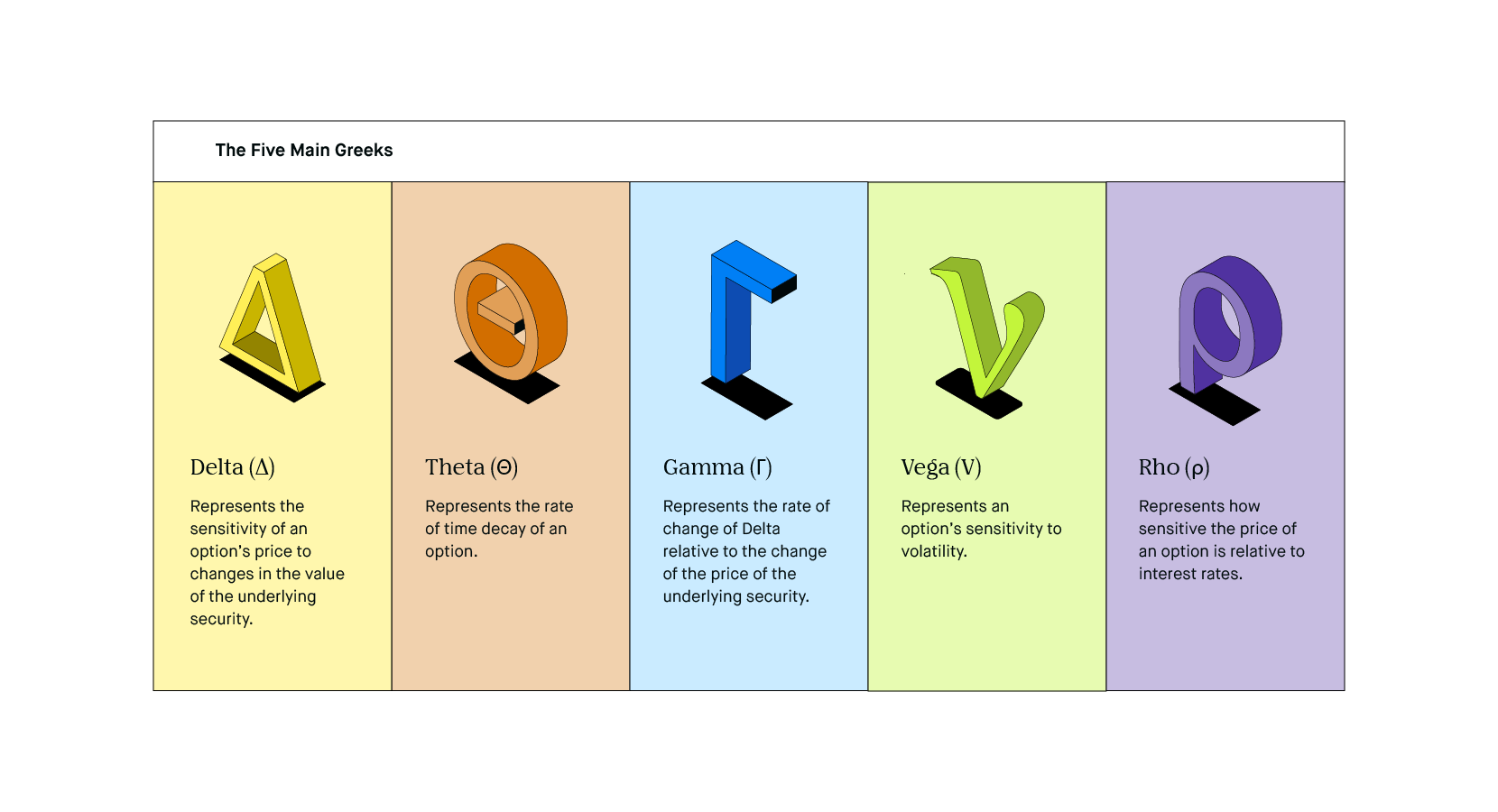

Greeks are mathematical metrics that gauge the sensitivity of an option’s price to changes in underlying variables. They provide traders with valuable insights into the potential risks and rewards associated with each contract. The most prominent Greeks include:

- Delta: Measures the change in option price for a given change in the underlying asset’s price.

- Gamma: Quantifies the change in Delta for a given change in the underlying asset’s price.

- Vega: Measures the change in option price for a change in volatility.

- Theta: Indicates the decay in option value as time passes.

- Rho: Measures the change in option price for a given change in interest rates.

Navigating the Greeks: A Step-by-Step Guide

Understanding the Greeks is crucial for prudent options trading. Here’s a step-by-step guide to incorporating them into your trading strategy:

1. Identify the Underlying Asset: Determine which underlying asset your option is linked to (e.g., stocks, bonds, currencies).

2. Study the Greeks: Familiarize yourself with the concept, calculation, and interpretation of the relevant Greeks for your trading purpose.

3. Monitor Volatility: Closely observe the market volatility and incorporate Vega into your analysis to assess its potential impact on option prices.

4. Manage Time Decay: Keep an eye on Theta, especially for short-term options, to minimize losses due to time value erosion.

5. Track Interest Rates: Monitor changes in interest rates and use Rho to assess potential impacts on option prices, particularly in the case of long-term options.

Expert Tips and Advice

To enhance your options trading acumen, consider incorporating these expert tips into your strategy:

- Trade with Small Positions: Start with modest positions to minimize potential losses while gaining experience in options trading.

- Use Limit Orders: Employ limit orders to execute trades within predefined price ranges, controlling risk and preventing slippage.

- Monitor the Greeks Regularly: Keep a close watch on the Greeks to proactively adjust your trading strategy in response to market changes.

- Seek Professional Guidance: Consult with experienced options traders or financial advisors to benefit from their expertise and guidance.

Image: learn.robinhood.com

Frequently Asked Questions (FAQs)

Q: Can I trade options without understanding the Greeks?

A: While not necessary, a thorough understanding of the Greeks significantly enhances decision-making and risk management in options trading.

Q: Which Greeks are most important for short-term options?

A: Delta, Gamma, and Vega are particularly relevant for assessing price sensitivity in short-term options.

Options Greeks Trading System

Image: tradeoptionswithme.com

Conclusion

Embracing the concepts of the options Greeks empowers you to unlock the intricacies of derivatives trading. By incorporating these metrics into your strategy, you gain unprecedented insight into option price behaviors and make more informed trading decisions.

Ask yourself, dear reader, are you ready to dive into the realm of options trading with newfound knowledge and confidence? The world of derivatives awaits your exploration!