In the high-stakes world of finance, where fortunes can be made and lost in a heartbeat, option volatility trading has emerged as a popular strategy for savvy traders seeking to navigate the treacherous waters of market fluctuations. While it offers the tantalizing potential for substantial profits, it also carries with it inherent risks that must be carefully considered before taking the plunge.

Image: optionstradingiq.com

To unlock the secrets of option volatility trading and mitigate potential pitfalls, we will delve into the intricacies of this enigmatic strategy, exploring its history, defining its nuances, and unraveling the latest trends shaping its evolution. Along the way, we will arm you with expert advice and practical tips to help you make informed decisions and emerge as a formidable player in this dynamic market.

Embracing the Risk-Reward Dynamic of Option Volatility Trading

At its core, option volatility trading involves speculating on the future volatility of an underlying asset, such as a stock, currency, or commodity. By purchasing options that give the holder the right but not the obligation to buy (call option) or sell (put option) the underlying asset at a predetermined price and date, traders posit on the direction and magnitude of price fluctuations within a specified timeframe.

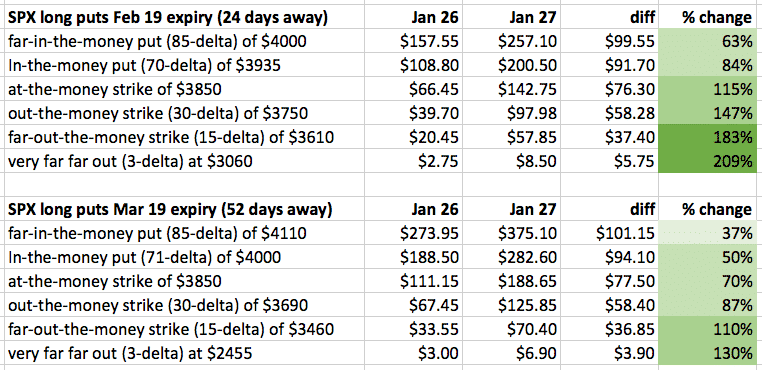

The allure of option volatility trading lies in the potential for exponential returns, especially in markets characterized by high volatility. When market volatility aligns with the trader’s predictions, option premiums soar, offering significant profits. However, the flip side of this potential reward is the ever-present risk of losses should volatility deviate from expectations, potentially eroding initial investments.

Decoding Option Volatility: A Comprehensive Overview

To fully comprehend the complexities of option volatility trading, it is paramount to delve into its underlying concepts and nuances.

- Implied Volatility: This crucial metric gauges market expectations for future volatility of an underlying asset, providing insights into the perceived risk associated with it.

- Historical Volatility: While implied volatility attempts to forecast future uncertainty, historical volatility quantifies the actual volatility observed over a past period, offering a glimpse into the asset’s past behavior.

- Volatility Skew: This metric measures the difference in implied volatility between call and put options with the same expiration date and strike price, providing insights into market sentiment and potential biases.

Understanding these concepts will equip you with a robust foundation for navigating the ever-changing landscape of option volatility trading.

Expert Tips for Navigating Option Volatility Trading Strategies

In the fiercely competitive world of option volatility trading, the ability to leverage expert advice can make all the difference between success and failure.

Image: www.tradingfuel.com

Mastering Risk Management

- Diversify your Portfolio: By investing in a range of underlying assets, you can mitigate the impact of adverse price fluctuations in any single asset.

- Use Stop-Loss Orders: These orders automatically exit positions when losses reach a predetermined level, safeguarding your capital from excessive drawdowns.

Capitalizing on Market Movements

- Monitor Market News and Events: Keep abreast of geopolitical events, economic data releases, and corporate announcements that may impact volatility.

- Employ Technical Analysis: Analyze historical price patterns, identify support and resistance levels, and leverage technical indicators to inform your trading decisions.

Navigating FAQs: Unraveling Option Volatility Trading

- What is the most common type of option volatility trading strategy? Long straddle strategies are popular among volatility traders, involving purchasing both a call and a put option with the same expiration date and strike price.

- How can I measure option volatility? Implied volatility and historical volatility are commonly used to gauge option volatility.

- Are there any risks associated with option volatility trading? Yes, option volatility trading carries inherent risks such as unpredictable market fluctuations, limited profit potential, and the potential for substantial losses.

Option Volatility Trading Strategies And Risk

Image: books.apple.com

Conclusion: Embracing Option Volatility Trading with Informed Decisions

Option volatility trading presents a tantalizing opportunity for profit in the financial markets, yet it requires a clear understanding of its inherent risks and mastery of advanced trading strategies. By embracing a risk-conscious approach, leveraging expert advice, and continuously honing your trading skills, you can harness the power of option volatility to unlock its true potential.

Are you ready to embark on the thrilling journey of option volatility trading? If so, equip yourself with the knowledge, strategies, and risk management tools discussed in this article, and join the ranks of savvy traders who navigate the complexities of the market with confidence and expertise.