Welcome, fellow traders! In the realm of options trading, understanding volatility and its impact on pricing is crucial for successful decision-making. Volatility, the extent to which an asset’s price fluctuates, is a key factor that influences option premiums and ultimately determines our trading strategies.

Image: villarootbarrier.com

Implied Volatility: A Crystal Ball into Future Market Moves

Implied volatility (IV) is an estimate of future volatility derived from the market price of an option contract. It forecasts the expected price movement of the underlying asset and serves as a valuable guide for pricing options.

- High IV: When IV is high, the market anticipates large price fluctuations, implying that options will be expensive.

- Low IV: Conversely, low IV suggests stable market conditions, resulting in lower option premiums.

Traders must carefully assess the implied volatility to develop informed pricing strategies that maximize their potential returns.

Option Pricing Considerations: Navigating the Market

Option pricing involves a delicate balance of several key factors:

- Intrinsic Value: The inherent value of an option based on its current price difference from the underlying asset.

- Time Value: The premium paid for the option’s longevity, expiring worthless if not exercised before its expiration date.

- Implied Volatility: The market’s estimation of future price volatility.

By considering these components and understanding the relationship between volatility and option premiums, traders can make informed decisions about pricing options and capitalize on market dynamics.

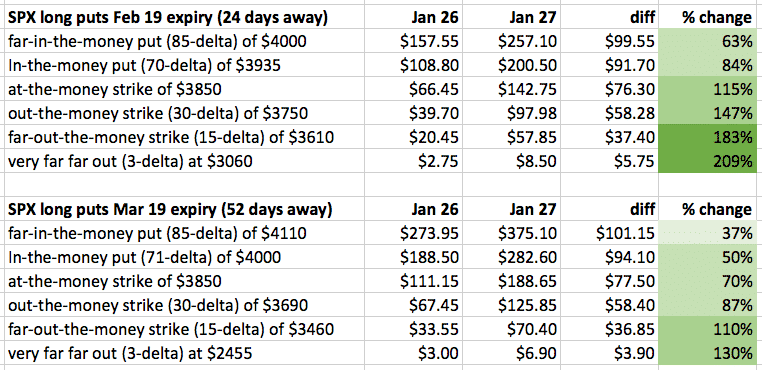

Trading Strategies for Volatile Markets

Volatility, both high and low, presents unique opportunities for traders. While high volatility can lead to rapid price changes, low volatility can offer a stable foundation for short-term strategies.

- Selling Options during High IV: When volatility is high, options are more expensive. Sell options to capitalize on the premium and benefit from decreasing volatility.

- Buying Options during Low IV: When volatility is low, options are cheaper. Buy options in anticipation of future volatility and gain as prices fluctuate.

Adopting the right strategies for the prevailing market volatility is essential for effective trading.

Image: optionstradingiq.com

Expert Tips for Successful Option Trading

Seasoned traders offer these invaluable tips for navigating the complexities of option trading:

- Know Your Options: Understand the different types of options and their specific characteristics.

- Manage Your Risk: Limit your trading to what you can afford to lose and employ proper risk management techniques.

- Study the Greeks: Use Greek letters to analyze option sensitivity to various factors, such as market volatility and time to expiration.

- Practice Discipline: Have a clear trading plan and stick to it, avoiding impulsive decisions.

- Stay Updated: Continuously monitor market news and economic indicators that may influence option prices.

Incorporating these tips into your trading strategy can enhance your ability to maximize profits and minimize losses.

FAQs on Option Volatility

- Q: What is the impact of volatility on option premiums?

- A: High volatility leads to higher premiums, while low volatility results in lower premiums.

- Q: How can I predict future volatility?

- A: Implied volatility provides an estimate of future price fluctuations, but it is not a perfect predictor.

- Q: What are some strategies for trading in volatile markets?

- A: Selling options during high volatility and buying options during low volatility are common strategies employed by traders.

Option Volatility And Pricing Strategies Trading

Image: www.slideshare.net

Call to Action: Empowering your Trading Journey

Embarking on the path of option volatility trading requires education, practice, and a deep understanding of the factors that drive option pricing. By embracing the insights outlined in this article and seeking continuous learning, you can develop a comprehensive approach to option trading and enhance your chances of success.

Tell us, dear reader, are you excited to delve deeper into the world of option volatility and sharpen your trading prowess? Your feedback and questions will help us improve our content, ensuring that it meets your trading needs.