Venturing into the world of options trading can be daunting, especially if you’re starting with limited capital. However, with careful planning and a sound understanding of the basics, you can harness the opportunities that options offer even with a modest investment of $100.

Image: www.youtube.com

Options provide a unique way to trade on the potential price movements of underlying assets, such as stocks, indices, or commodities, without the need to purchase the underlying asset itself. This allows you to potentially amplify your potential returns while managing your risk.

The Basics of Options Trading

An option contract represents a binding agreement between two parties: the buyer and the seller. The buyer of the option has the right (but not the obligation) to buy or sell the underlying asset at a specified price (the strike price) on or before a specific date (the expiration date).

There are two main types of options: calls and puts. Calls give the buyer the right to buy the underlying asset, while puts give the buyer the right to sell the underlying asset. Options can have varying expiration dates, ranging from a few days to several months.

Options Pricing and Greeks

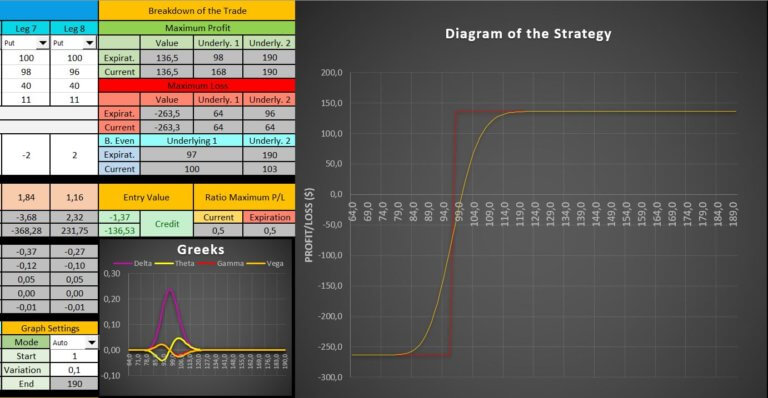

The price of an option contract is influenced by several factors, including the current price of the underlying asset, the strike price, the expiration date, and the level of volatility in the market. The pricing of options can be complex, but it’s important to understand the key Greeks, which are metrics that measure the sensitivity of an option to changes in these factors.

The Greeks include delta, gamma, vega, and theta. Delta measures the rate of change in the option’s price relative to changes in the underlying asset’s price. Gamma measures how quickly delta changes as the underlying asset’s price changes. Vega measures the sensitivity of an option’s price to changes in volatility, and theta measures how quickly an option loses value as time passes.

Tips for Option Trading with $100

Trading options with a limited amount of capital requires a disciplined approach and a focus on managing risk. Here are a few tips to help you maximize your chances of success.

- Start with small positions: Avoid putting all your $100 at risk on a single trade. Start with positions that are a small percentage of your total capital, such as $5 or $10.

- Choose liquid options: Liquidity refers to the ease with which you can buy or sell an option at a fair price. Opt for options that have high trading volume, as they offer tighter bid-ask spreads and are less susceptible to large price swings.

- Manage your risk: Use stop-loss orders to limit potential losses. You can also consider buying options with different strike prices and expiration dates to diversify your risk.

- Understand the Greeks: Gain a basic understanding of the Greeks and how they influence option pricing. This will help you make informed decisions about the options you trade.

- Be patient: Option trading can take time and patience. Don’t expect to become an expert overnight. Take your time to learn the ins and outs of the market and develop a trading strategy that works for you.

Image: www.warsoption.com

FAQ

- Q: Can I become rich with options trading?

A: While options trading offers the potential for high returns, it’s important to remember that it also carries risk. It’s possible to lose your entire investment, so it’s essential to trade with caution and a realistic understanding of your own risk tolerance.

- Q: What is the minimum amount of capital I need for options trading?

A: While some brokers may have higher account minimums, it’s generally possible to start options trading with as little as $100.

- Q: How do I get started with options trading?

A: Start by educating yourself about options and the risks involved. Open an account with a reputable broker, and begin with small positions while you gain experience and confidence.

Option Trading With $100

Image: www.youtube.com

Conclusion

Option trading with $100 can be a viable way to supplement your income or grow your portfolio over time. However, it’s essential to approach this venture with a clear understanding of the risks involved and a sound trading strategy. By following the tips and suggestions outlined in this article, you can increase your chances of success and unlock the potential that options trading offers.

Is option trading with a small amount of capital something you’re interested in? Feel free to reach out if you have any further questions or require guidance in getting started.