I remember my first foray into option trading. I was fresh out of college, eager to make my fortune, and saw options as a quick path to riches. Little did I know the rollercoaster ride I was about to embark on.

Image: blog.dhan.co

Option trading is a complex and potentially lucrative strategy that allows traders to profit from price fluctuations without owning the underlying asset. It’s like having a financial superpower, but with great power comes great responsibility.

**The Power of Leverage**

Options offer leverage, enabling traders to control a much larger position with a smaller investment. This can multiply profits exponentially, but it also amplifies losses.

For example, a stock option worth $1 may control $100 worth of the underlying stock. This means that a 1% move in the stock price can result in a 10% gain or loss for the option trader.

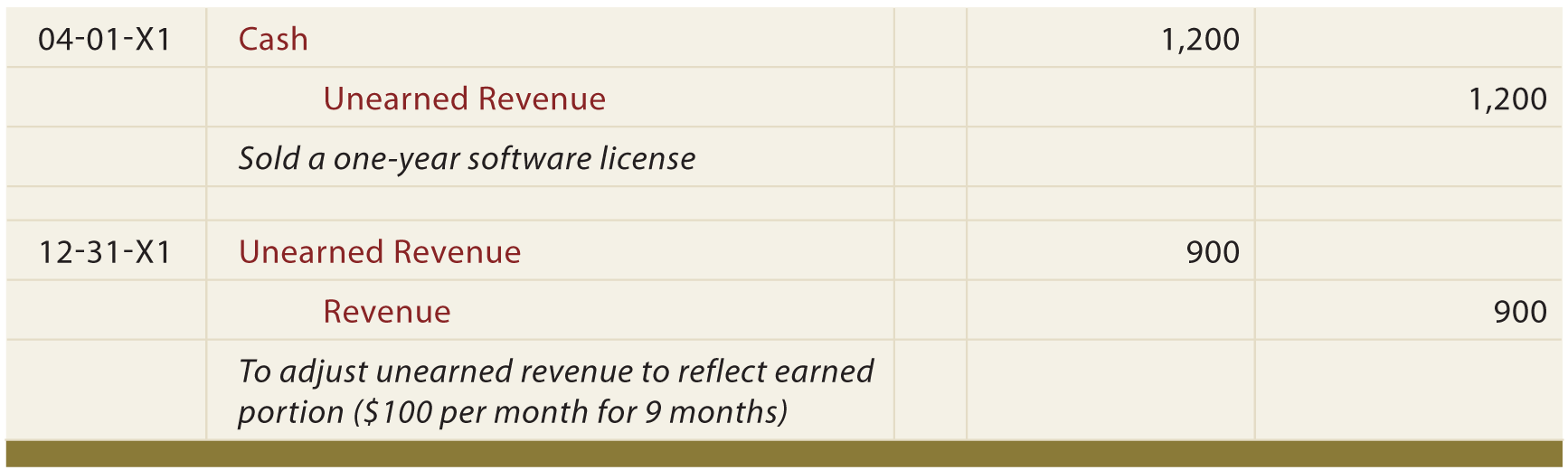

**Defining Unearned Income**

In option trading, unearned income refers to the premium received by the seller of an option contract. The premium is essentially the price paid by the buyer to gain the right to exercise the option but not the obligation.

Unearned income can be substantial, especially if the option is held to expiration. However, it’s important to remember that the option seller also assumes the risk of loss if the trade moves against them.

**Strategies for Generating Unearned Income**

- Selling Covered Calls: Selling call options against a stock you own, limiting potential gains but generating premium income.

- Selling Put Options: Selling put options to receive income, while assuming the obligation to buy the underlying stock at a predetermined price if exercised.

- Iron Condor: A neutral strategy that involves selling both a call and a put option with different strike prices, generating income from the premium spread.

Image: seboxinero.web.fc2.com

**Tips and Expert Advice**

Navigating option trading successfully requires a well-informed approach. Here are some tips and expert advice:

- Understand the Risks: Option trading carries significant financial risk. Before trading, fully understand the potential losses involved.

- Start Small: Don’t jump into option trading with large sums. Start by trading in smaller amounts to gain experience and test your strategies.

- Use Stop-Loss Orders: Set stop-loss orders to limit potential losses if the trade moves against you.

- Seek Professional Guidance: Consider seeking guidance from a qualified financial advisor who specializes in option trading.

**FAQ about Option Trading**

- Q: What is the difference between a call and a put option?

- A: A call option gives the holder the right to buy the underlying asset at a specific price, while a put option gives the holder the right to sell it.

- Q: How much can I make from option trading?

- A: The amount you can make depends on your trading strategy, market conditions, and the amount of risk you take.

- Q: Is option trading a scam?

- A: No, option trading is a legitimate financial instrument that can be used to generate income or hedge risk. However, scams and unethical practices do exist, so it’s important to trade responsibly.

Option Trading Unearned Income

Image: pupuzifecose.web.fc2.com

**Conclusion**

Option trading, when approached with caution and knowledge, can be a powerful tool for generating unearned income and enhancing investment portfolios. However, it’s crucial to understand the risks, start small, and seek professional guidance if necessary.

Are you ready to explore the world of option trading and unlock the potential of unearned income?