Empowering Traders through Knowledge and Collective Insight

In the fast-paced and dynamic world of finance, option trading stands as a powerful tool for risk management, profit optimization, and precision hedging. However, unlocking the full potential of options requires not only technical proficiency but also a deep understanding of strategies and an astute grasp of market dynamics. The traders community serves as a beacon of knowledge, where traders from all walks of life gather to share insights, exchange ideas, and enhance their trading acumen. By delving into the realm of option trading strategies, traders can empower themselves with a competitive edge, navigate market uncertainties with confidence, and maximize their trading endeavors.

Image: www.projectfinance.com

Unveiling the Essence of Option Trading Strategies

Options, financial instruments that derive their value from an underlying asset, present traders with an array of strategies tailored to diverse risk appetites, investment objectives, and market conditions. These strategies span a spectrum from conservative to aggressive, each designed to capitalize on specific market scenarios and enhance profit potential. Understanding and mastering these strategies is paramount for traders seeking to harness the full capabilities of options.

Diving into Basic Option Strategies

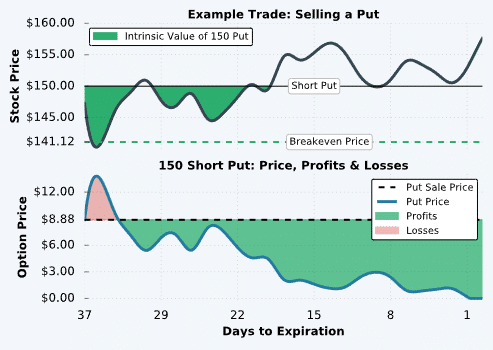

Laying the foundation for option trading, basic strategies encompass familiar concepts such as calls and puts, along with their corresponding long and short positions. Buying a call option conveys to the holder the right, but not the obligation, to buy the underlying asset at a predetermined price (strike price) on or before a set expiration date. Its counterpart, selling a call option, involves granting another party this right in exchange for a premium. Conversely, buying a put option bestows the right to sell the underlying asset, while selling a put option entails assuming the obligation to buy at the strike price. These foundational strategies form the building blocks upon which more intricate strategies are constructed.

Exploring Advanced Option Strategies

Venturing beyond the basics, advanced option strategies introduce greater complexity and potential rewards. Combining multiple options positions in sophisticated ways, these strategies aim to capture market movements more effectively. Spreads, for instance, involve simultaneously buying and selling options with different strike prices and expiration dates to define a specific range of profitability. They offer risk-reward profiles tailored to varying market expectations and volatility levels. Other advanced strategies, such as iron condors and butterflies, involve intricate combinations of options designed to harness market neutrality and capitalize on specific price movements. These strategies demand a higher level of expertise and market analysis, enabling traders to target specific market scenarios with greater precision.

Image: wallpaperaccess.com

Navigating Options Trading Strategies with Success

Embarking on option trading strategies requires not only theoretical knowledge but also practical experience and continuous learning. Traders can refine their skills through paper trading platforms, which simulate real-world market conditions without financial exposure. This allows them to experiment with various strategies, refine their decision-making, and gain invaluable experience before risking capital. Additionally, engaging with the traders community offers a wealth of insights, knowledge sharing, and support. Forums, online discussion groups, and educational resources empower traders to connect with peers, exchange ideas, and stay abreast of the latest developments in option trading strategies.

Option Trading Strategies Traders Community

/TipsforAnsweringSeries7OptionsQuestions1_2-5b9977d443234ce5978494004c287af9.png)

Image: www.fullquick.com

Conclusion

Option trading strategies provide a powerful arsenal for traders seeking to navigate market complexities, optimize returns, and manage risk with precision. Embracing a combination of theoretical understanding, practical experience, and continuous learning empowers traders to harness the full potential of options. The traders community stands as a vibrant hub of knowledge and collaboration, fostering the exchange of insights, support, and the collective pursuit of trading excellence. By immersing themselves in this community and embracing the infinite possibilities of option trading strategies, traders can unlock a world of financial opportunities and elevate their trading endeavors to new heights.