**Introduction**

In the ever-evolving landscape of financial markets, options trading stands out as a powerful strategy that empowers individuals to harness the potential of leverage and hedging. While once considered a complex domain reserved for institutional investors, the advent of MOOCs (Massive Open Online Courses) has democratized access to this lucrative realm. In this comprehensive guide, we delve into the world of MOOC options trading, providing a nuanced exploration of its concepts, applications, and strategies. Join us as we unlock the enigma of MOOC options trading, empowering you to navigate the markets with confidence.

Image: ignatiawebs.blogspot.com

**Understanding MOOC Options Trading**

Options trading involves the buying and selling of options contracts, which confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. By harnessing the leverage offered by options, traders can amplify their potential returns relative to their capital outlay. MOOCs, with their open and accessible nature, have played a pivotal role in democratizing options trading knowledge. These courses provide rigorous instruction from leading experts, empowering individuals from all walks of life to delve into this sophisticated arena.

**Benefits of MOOC Options Trading**

-

Increased Profit Potential: Options trading offers opportunities for significant profit potential due to the inherent leverage and flexibility it provides.

-

Risk Management: Options can serve as a hedging tool, enabling traders to manage risk and protect their portfolios against market volatility.

-

Enhanced Flexibility: Options trading allows traders to tailor strategies to their individual risk tolerance and investment goals.

**Challenges of MOOC Options Trading**

-

Complexity: Options trading can be a complex subject to grasp, requiring a thorough understanding of underlying concepts and strategies.

-

Volatility Risk: The value of options contracts can be highly volatile, influenced by various factors that may be challenging to predict.

-

Margin Requirements: Options trading typically requires traders to maintain a margin account, which can limit trading capacity.

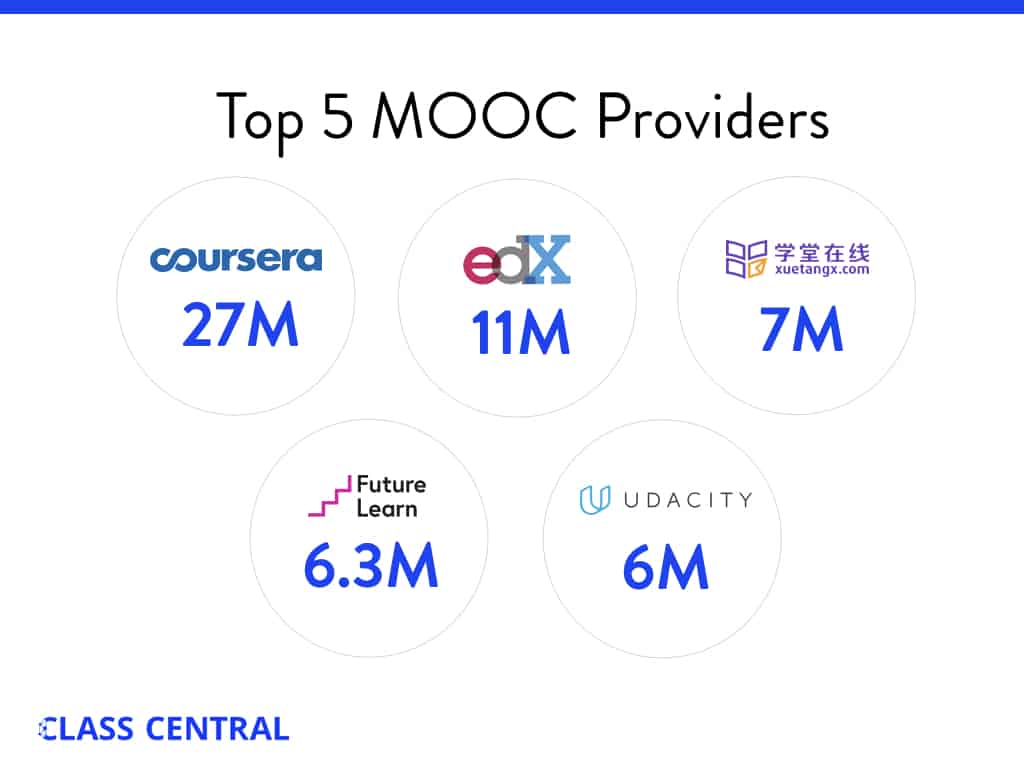

Image: www.classcentral.com

**Choosing a MOOC Options Trading Course**

Navigating the plethora of MOOC options trading courses can be daunting. Consider the following factors when selecting a course:

-

Course Provider: Seek courses offered by reputable platforms known for their educational rigor and industry expertise.

-

Course Outline: Ensure the course covers fundamental concepts, trading strategies, and risk management techniques relevant to options trading.

-

Instructor Qualifications: Choose courses taught by experienced traders or industry professionals who can impart their insights and practical knowledge.

-

Reviews and Ratings: Read reviews from previous students to gauge the quality and efficacy of the course.

**Expert Insights and Actionable Tips**

-

Start Small: Begin with small trades to gain familiarity with the mechanics of options trading while minimizing risk exposure.

-

Practice Risk Management: Implement robust risk management strategies to safeguard your capital, including stop-loss orders and position sizing.

-

Seek Professional Guidance: Consider consulting with a financial advisor or experienced trader for personalized guidance and tailored strategies.

Mooc Options Trading

Image: www.slideshare.net

**Conclusion**

MOOC options trading presents an empowering opportunity for individuals seeking to harness the potential of financial markets. By leveraging the accessibility and expertise offered by MOOCs, aspiring traders can gain the knowledge and skills necessary to navigate the complexities of options trading. This comprehensive guide has illuminated the fundamental concepts, strategies, and challenges associated with MOOC options trading, empowering you to embark on your trading journey with confidence. Remember, the pursuit of financial mastery requires continuous learning, strategic execution, and a prudent approach to risk management.