As an avid trader, I’ve witnessed the transformative power of option trading firsthand. One strategy that consistently captivates my attention is the covered call, a time-tested approach that offers both income generation and downside protection.

Image: www.dreamgains.com

Understanding the Covered Call

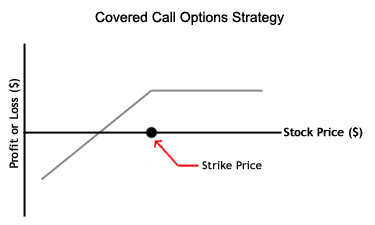

In essence, a covered call involves selling (writing) a call option while simultaneously owning the underlying asset. By granting another party the right (but not the obligation) to purchase your asset at a higher price (known as the strike price), you receive a premium in return. This premium represents the income generated from the transaction.

Crucially, selling a call option obligates you to sell the underlying asset if the price rises above the strike price. This dual position establishes a capped upside potential but also defines a lower floor, protecting against significant losses.

Benefits of Covered Calls

The allure of covered calls lies in their multifaceted advantages:

- Income Generation: The premium received from selling the option represents instant income for the trader.

- Limited Risk: Owning the underlying asset limits the trader’s potential losses to the price paid for it, minus the premium received.

- Downside Protection: If the underlying asset price falls below the strike price, the trader retains ownership, minimizing losses.

li>Flexibility: Traders can customize the strike price and expiration date to align with their risk tolerance and profit objectives.

How to Execute a Covered Call

Executing a covered call involves three key steps:

- Selecting the Underlying Asset: Choose an asset with strong fundamentals and expected price stability, as the call option’s value is directly tied to the asset’s performance.

- Determining the Strike Price: Set the strike price slightly higher than the current asset price. This balances potential income with downside protection.

- Selling the Option: Sell a call option with the chosen strike price and a suitable expiration date. The option’s value will fluctuate based on market conditions and time decay.

Image: allabouttreasury.com

Expert Advice for Maximizing Profits

To enhance your success with covered calls, heed the sage advice from experienced traders:

- Maintain a Margin of Safety: Set the strike price well above the asset’s cost basis to minimize the risk of being forced to sell at a loss.

- Monitor Market Conditions: Stay attuned to news and economic factors that may impact the underlying asset’s price, adjusting your strike price or closing the position if necessary.

- Choose Liquid Options: Select options with high trading volume to ensure efficient execution and minimize bid-ask spreads.

- Consider Rolling Strategies: If the underlying asset price moves substantially, consider rolling the call option to a higher or lower strike price to maintain an appropriate risk-reward ratio.

FAQ

Q: What is the difference between a covered call and a naked call?

A: A naked call involves selling a call option without owning the underlying asset, exposing the trader to unlimited risk. In contrast, a covered call limits the risk to the cost of the underlying asset.

Q: Can I sell more call options than I own of the underlying asset?

A: No, in a covered call, you must own an equal or greater number of shares of the underlying asset as call options sold.

Q: When is the best time to execute a covered call?

A: Covered calls are typically executed when the underlying asset is trading near or above its expected price appreciation. The time to maturity of the call option should align with your investment horizon.

Option Trading Strategies Covered Call

Image: www.pinterest.com

Conclusion

Unleashing the power of covered calls requires knowledge, discipline, and an understanding of market dynamics. By meticulously following the strategies and expert advice outlined above, you can unlock the potential to generate income, manage risk, and enhance your trading prowess.

Are you ready to embrace the world of option trading and explore the transformative benefits of covered calls? Start your journey today and embark on a path of financial empowerment.