Navigating the Market’s Ebb and Flow: A Voyager’s Tale

In the vast expanse of the financial markets, where opportunities abound and risks lurk, option trading unveils a path to potential gains. Among the many strategies employed by savvy investors, the option trading strangle stands out as a versatile tool for navigating market volatility and capitalizing on both upward and downward price movements. Embark on this enlightening journey to unravel the intricacies of an option trading strangle, empowering yourself with the knowledge to harness its potential and elevate your investment endeavors.

Image: www.projectfinance.com

Delving into the Anatomy of an Option Trading Strangle

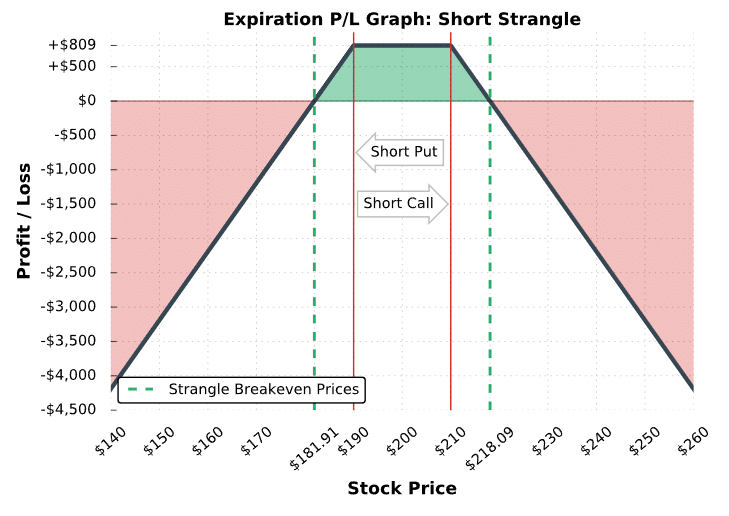

An option trading strangle hinges on the simultaneous purchase of both a call option and a put option on the same underlying asset, bearing different strike prices yet identical expiration dates. This strategic positioning grants the option owner the right, but not the obligation, to buy or sell the underlying asset at the predetermined strike prices before the contract’s expiration. The call option, carrying a higher strike price than the current market value, confers the right to buy, while the put option, bearing a lower strike price, conveys the right to sell.

The allure of an option trading strangle lies in its adaptability to varying market scenarios. When markets surge, the call option gains value, potentially offsetting any losses incurred by the put option. Conversely, during market downturns, the put option shines, potentially mitigating losses from the call option. It’s akin to a financial tightrope walk, where the investor seeks equilibrium amidst market turbulence.

Mastering the Dynamics of Option Trading Strangles: An Alchemist’s Guide

To master the art of option trading strangles, understanding the interplay of key factors is paramount. Strike prices, premiums, and expiration dates dance in harmonious balance, dictating the potential outcomes. Selecting strike prices that align with anticipated market movements is a crucial step. Premiums, representing the price of the options, must be carefully considered, as they directly impact profitability. Expiration dates, acting as the temporal boundaries of the options, impose a sense of urgency on decision-making.

Beyond these foundational elements, grasping the nuances of volatility, liquidity, and margin requirements is essential. Volatility, embodying the market’s temperament, influences option prices and can amplify both profits and losses. Liquidity, reflecting the ease of executing trades, ensures seamless entry and exit from positions. Margin requirements, serving as collateral for leveraged positions, must be carefully managed to avoid unwanted consequences.

Expert Perspectives and Practical Insights: Unlocking the Wisdom of Masters

In the realm of option trading strangles, the insights of seasoned practitioners illuminate the path to success. Renowned investors like Warren Buffett emphasize the importance of thorough research and understanding risks before venturing into this dynamic arena. Technical analysts, such as Peter Brandt, underscore the significance of price action and chart patterns in identifying potential trading opportunities. By tapping into the wisdom of these masters, aspiring option traders can shorten their learning curve and make more informed decisions.

Practical tips from experienced traders can also prove invaluable. Setting realistic profit targets and managing risk through stop-loss orders are prudent measures that help navigate the unpredictable market landscape. Continuous monitoring of positions and a willingness to adapt to changing market conditions are hallmarks of successful option traders. Armed with these expert insights and practical strategies, you’ll be well-equipped to navigate the intricacies of option trading strangles.

Image: www.xtremetrading.net

Option Trading Strangle

Image: blog.dhan.co

Embracing the Power of Option Trading Strangles: A Journey of Empowerment

Through this comprehensive exploration of option trading strangles, you’ve gained the knowledge and confidence to harness its potential. Remember, the journey to financial empowerment is a continuous ascent, marked by learning, adaptation, and judicious decision-making. Embrace the market’s ebb and flow, and let your understanding of option trading strangles propel you toward your financial goals.