The stock market, with its inherent volatility and relentless cycles of boom and bust, presents both challenges and opportunities for savvy investors. Among the versatile tools at their disposal, options trading stands out as a sophisticated strategy that enables investors to navigate market fluctuations, amplify potential returns, and hedge against risks. Central to successful option trading is identifying suitable stocks that offer the desired characteristics. This comprehensive guide will delve into the intricacies of option trading, provide a handpicked list of potential stock candidates, and empower you with the knowledge to make informed decisions.

Image: finance.yahoo.com

Understanding Option Trading: A Strategic Odyssey

Options, financial instruments derived from underlying assets such as stocks, offer a unique approach to investing. They provide the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility allows investors to execute various strategies tailored to their risk tolerance and market outlook.

Options trading offers several advantages. It can enhance returns through leveraging, generate income through option premiums, and mitigate losses by hedging existing stock positions. However, it’s crucial to acknowledge that options trading also carries inherent risks that require careful consideration and risk management.

Identifying Stocks for Option Trading: A Criteria-Based Approach

Selecting the right stocks for option trading is paramount to achieving desired outcomes. Consider these key criteria:

• High Liquidity: High trading volume ensures bid-ask spreads are tight, minimizing transaction costs.

• Price Volatility: Stocks with moderate to high volatility offer greater potential for option premiums.

• Market Capitalization: Large-cap and mid-cap stocks tend to exhibit less volatility, making them more suitable for conservative strategies.

• Company Fundamentals: Strong financial performance, a robust balance sheet, and a positive earnings outlook indicate a company’s long-term prospects.

• News and Events: Upcoming events such as earnings reports, product launches, and regulatory changes can influence stock prices and option premiums.

Option Trading Stock List: A Curated Selection

Based on the aforementioned criteria, here’s a carefully curated list of potential stock candidates suitable for option trading strategies:

• Apple (AAPL)

• Microsoft (MSFT)

• Amazon (AMZN)

• Tesla (TSLA)

• NVIDIA (NVDA)

• Berkshire Hathaway (BRK.A)

• Johnson & Johnson (JNJ)

• Coca-Cola (KO)

• Alphabet (GOOG)

• Meta Platforms (META)

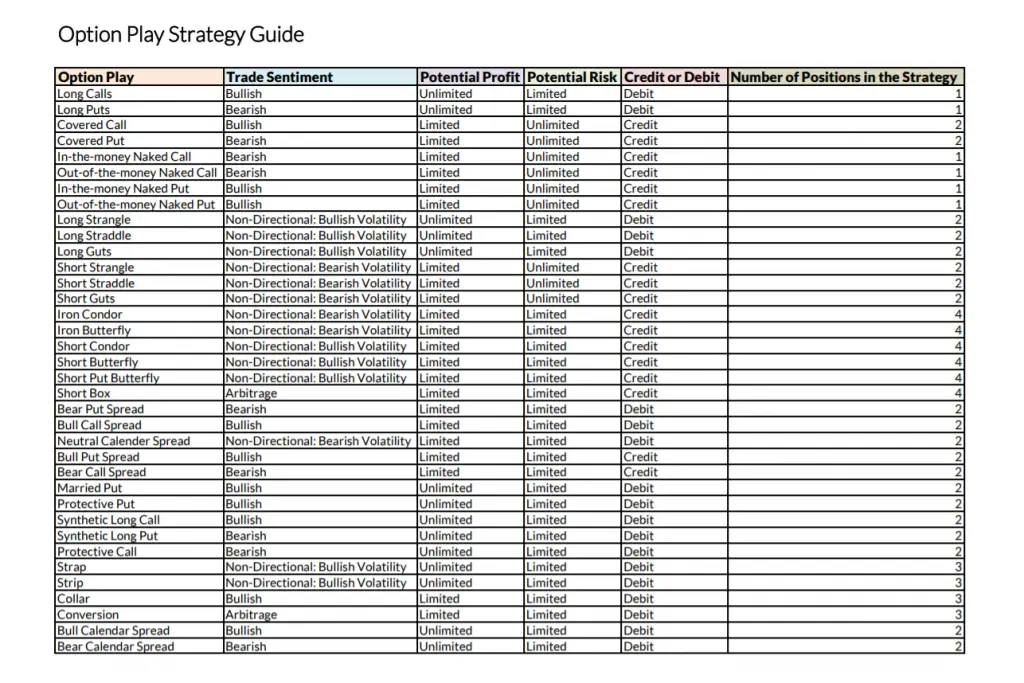

Image: db-excel.com

Option Trading Stock List

Image: www.zekerfiscaal.nl

Navigating Options Trading with Confidence

Mastering option trading requires a comprehensive understanding of its nuances and a disciplined approach to managing risks. Here are some essential tips to guide your journey:

• Educate Yourself: Acquire a thorough understanding of option terminology, contract specifications, and trading strategies.

• Start Small: Limit your initial investments until you gain experience and comfort with option trading.

• Manage Risk: Exercise caution, set appropriate stop-loss levels, and avoid overleveraging.

• Consider Volatility: Implied Volatility (IV) is a key factor influencing option premiums. Monitor IV closely and adjust strategies accordingly.

• Monitor the Market: Stay informed about market news, economic indicators, and company-specific events that may impact option prices.

Embarking on the path of option trading empowers you with greater flexibility, potential returns, and risk management capabilities. Remember, knowledge is your most valuable asset. Continue to learn, adapt, and refine your strategies to navigate the ever-changing market landscape with confidence.