Do you recall the exhilarating moment you got entangled in an intellectual battle of wits, navigating through the treacherous labyrinth of options trading? If so, foster your curiosity as we embark on an adventure into a realm where options trading soars effortlessly across borders. Behold, the captivating world of export option trading.

Image: www.youtube.com

Export Option Trading: A Gateway to Expanding Horizons

In the intertwined fabric of international trade, export option trading fills a distinct niche. Export option trading empowers exporters with an astute mechanism to mitigate currency fluctuations, safeguarding their revenue streams amidst the unpredictable whirls of forex markets.

Imagine this: You’re an intrepid exporter, shipping a cache of goods to a distant land. The shipment’s value hinges critically upon the exchange rate prevailing at the time of payment. A sudden currency fluctuation could diminish your earnings, leaving you aground on the shores of profitability. Enter the beacon of export option trading, a lifeline that shields you from these treacherous currents.

Securing Export Profits Against Unpredictable Currency Movements

Export option trading hinges upon the judicious use of currency options. These instruments empower exporters with the right, but not the obligation, to exchange a specified currency at a predetermined rate on a specified date.

In our illustrative scenario, you could purchase a call option granting you the right (but not the obligation) to sell the foreign currency you will receive at a predetermined exchange rate, even if the market rate plunges. By exercising this option, you effectively lock in a favorable exchange rate, safeguarding your profit margin. Conversely, if the exchange rate surpasses your expectations, you can simply relinquish the option, capitalizing on the more lucrative market rate.

Unraveling the Mechanics of Export Option Trading

Understanding the nuts and bolts of export option trading is key to harnessing its potential. Let’s delve into its intricacies:

-

Underlying Asset: The foreign currency you will receive as payment for your exported goods.

-

Strike Price: The exchange rate specified in the option contract, which you have the right to execute.

-

Expiration Date: The date on which the option expires, after which it becomes void.

-

Premium: The price you pay to acquire the option.

Choose an appropriate strike price and expiration date based on your profit targets, risk tolerance, and market forecasts. The premium you pay reflects the market’s assessment of the likelihood that the option will be exercised profitably.

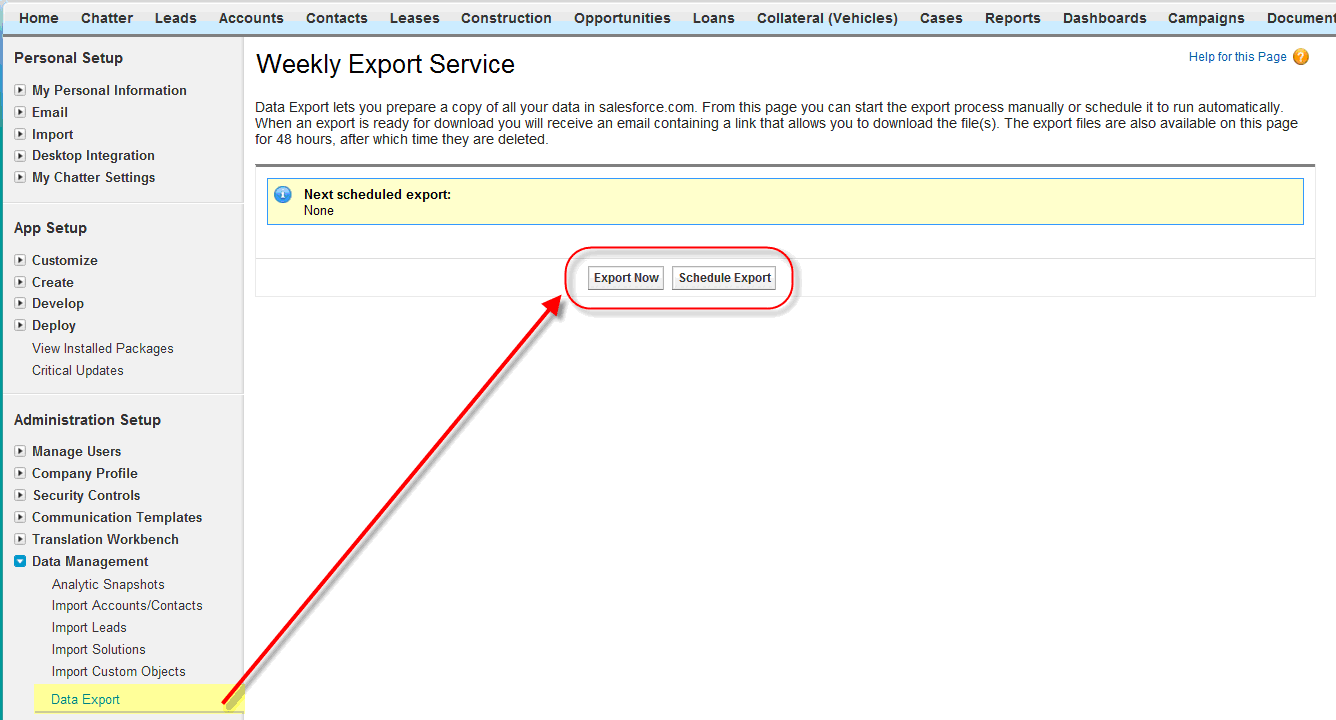

Image: www.shellblack.com

Expert Insights into Export Option Trading

Mastering export option trading demands a blend of knowledge and strategic acumen. Here are some tips from seasoned practitioners:

-

Stay Informed: Keep abreast of economic indicators, currency trends, and geopolitical events that could influence exchange rates.

-

Manage Risk: Calculate your potential profit and loss scenarios carefully, ensuring that you have adequate risk management strategies in place.

-

Evaluate Timing: Determine the optimal time to enter and exit the option market, considering market volatility and your specific hedging objectives.

FAQs on Export Option Trading

Q: Is export option trading suitable for all exporters?

A: Export option trading is a valuable tool for exporters who face significant currency exposure.

Q: How complex is export option trading?

A: Export option trading involves some complexity, but with proper education and risk management, it can be effectively utilized.

Export Option Trading

Conclusion

Export option trading offers a powerful hedge against currency fluctuations, protecting exporter profitability and enabling them to navigate the global marketplace with newfound confidence. By embracing this sophisticated tool, you can mitigate risks, capitalize on opportunities, and expand your export horizons.

Are you an aspiring exporter eager to unlock the transformative power of export option trading? Share your thoughts in the comment section below. Together, let’s explore the uncharted territories of international trade and tame the tempestuous seas of currency fluctuations.