Option trading on the same day, often referred to as day trading, has piqued the interest of both seasoned investors and newcomers alike. This fast-paced trading strategy involves buying and selling options contracts within a single trading day, with the aim of capturing short-term market movements and generating quick profits. In this comprehensive guide, we delve into the intricacies of same-day option trading, exploring its basic concepts, strategies, and potential rewards.

Image: www.adigitalblogger.com

Understanding Same-Day Option Trading

Options contracts grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specific date. In day trading, traders focus on short-term price fluctuations in the underlying asset, attempting to profit from the difference between the purchase and sale prices of the option contract. Unlike traditional option trading, which can involve holding contracts for extended periods, same-day option trading emphasizes quick executions and rapid turnovers. This dynamic trading environment requires traders to possess a deep understanding of the market and a keen eye for identifying profitable opportunities.

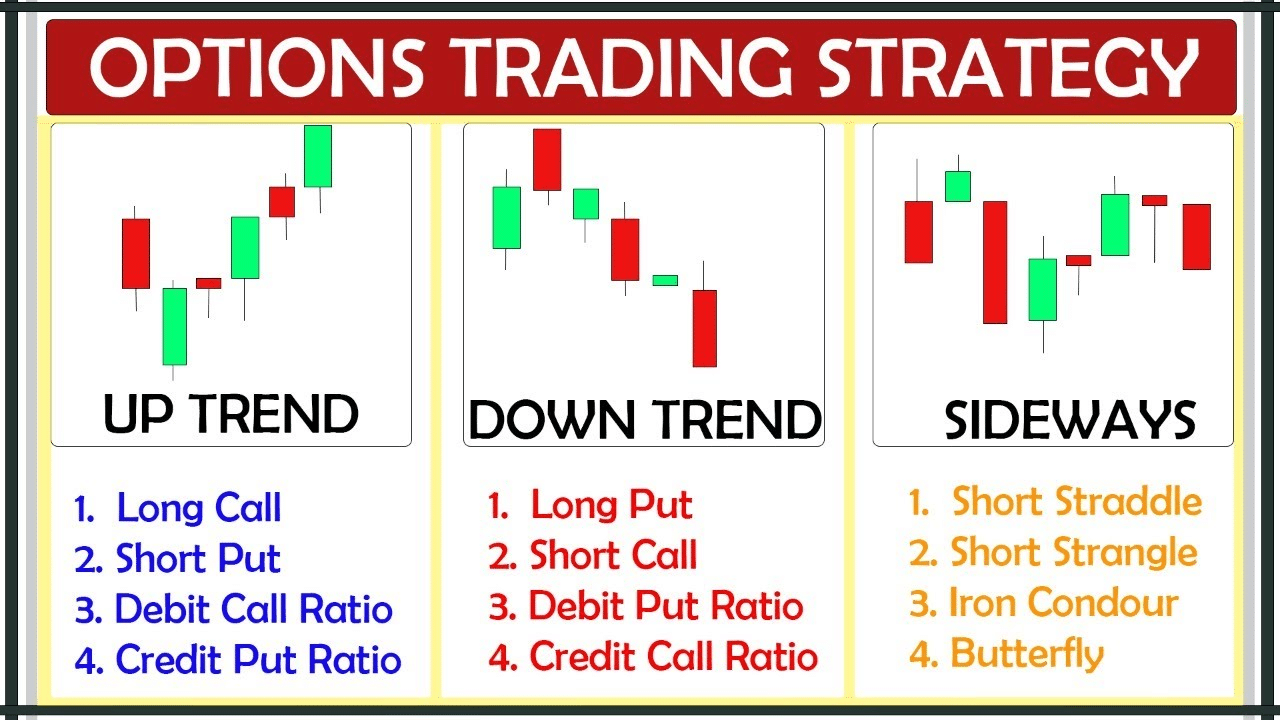

Day Trading Strategies for Options

Same-day option trading comprises a diverse range of strategies tailored to specific market conditions and risk tolerances. Some of the popular strategies include:

-

Scalping: Traders aim to make small, frequent profits by buying and selling options within a short timeframe, capitalizing on minor price fluctuations.

-

Range Trading: Involves identifying a trading range and buying (or selling) options when the underlying asset approaches the lower (or upper) end of the range, anticipating a reversal within the defined boundaries.

-

Momentum Trading: Traders attempt to ride the wave of a trending market by buying (or selling) options in the direction of the prevailing trend.

-

Hedging: Options are utilized to reduce risk in an existing position by offsetting gains or losses in the underlying asset.

-

Contrarian Trading: Traders go against the prevailing market sentiment, betting on a reversal in the asset’s price trend.

Tips for Successful Same-Day Option Trading

Success in same-day option trading demands a combination of knowledge, skill, and discipline. Here are some essential tips to navigate this challenging yet potentially rewarding endeavor:

-

Master Options Basics: Understand key concepts such as strike price, expiration date, premium, and the Greeks to make informed trading decisions.

-

Choose Liquid Options: Opt for options with high trading volume and open interest to ensure quick execution and minimize slippage.

-

Manage Risk Wisely: Employ effective risk management strategies, including stop-loss orders, to limit potential losses.

-

Stay Informed: Continuously monitor market news and economic indicators to stay abreast of potential trading opportunities.

-

Practice Discipline: Adhere to a trading plan and avoid impulsive or emotional trading decisions.

Image: investgrail.com

Option Trading On Same Day

Image: derivfx.com

Conclusion

Same-day option trading presents both challenges and opportunities for traders seeking short-term profits. By embracing a deep understanding of options concepts, implementing effective strategies, and maintaining discipline, traders can enhance their chances of success in this fast-paced trading environment. Remember, thorough research, risk management, and a commitment to continuous learning are essential cornerstones for profitable same-day option trading.