As a seasoned investor, I’ve always been fascinated by the intricate world of options trading. The allure of potential returns amidst calculated risks has drawn me into this dynamic realm. Among the various platforms available, Interactive Brokers stands out as a formidable choice, offering robust tools and exceptional support for traders seeking to navigate the intricacies of options.

Image: yufyfiqec.web.fc2.com

The Multifaceted Ladder: Navigating Option Trading Levels

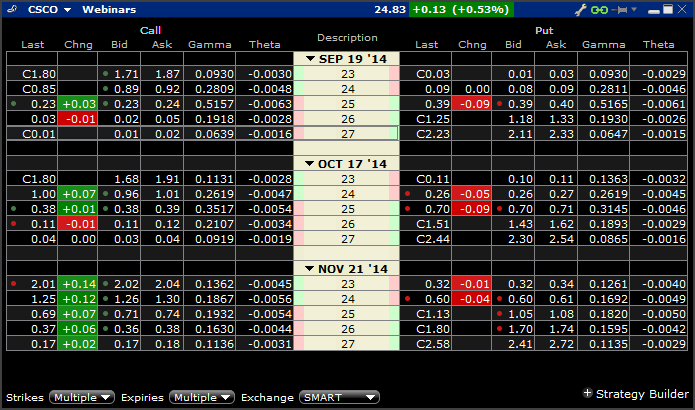

At the heart of options trading lies the concept of levels, a nuanced system that establishes the parameters within which trades are executed. Each level represents a specific price range, and traders must carefully analyze the underlying asset’s historical performance and current market conditions to determine the optimal level for their strategies.

Understanding option trading levels is crucial for both managing risk and optimizing profits. It empowers traders to identify potential opportunities and execute trades with precision, maximizing their chances of success in this ever-evolving financial landscape.

Level 1: The Price of the Underlying Asset

Level 1, the foundational level, represents the current market price of the underlying asset. This price serves as a benchmark against which all other levels are measured. Traders can buy or sell options at this level, depending on their market outlook.

Level 2: The First Level Above and Below the Underlying Price

Moving one level above and below the underlying price, we encounter Levels 2 and 3, respectively. These levels provide a buffer zone, allowing traders to adjust their strategies based on market fluctuations. Options at these levels offer a balance between risk and potential reward.

Image: udilisavu.web.fc2.com

Level 3: The Second Level Above and Below the Underlying Price

Levels 4 and 5, located two levels above and below the underlying price, offer a higher degree of risk and reward. Traders who anticipate significant market movements may consider executing trades at these levels. However, it’s essential to exercise caution, as these trades can amplify both profits and losses.

Level 4: The Third Level Above and Below the Underlying Price

At Levels 6 and 7, traders venture into the realm of speculative trading. These levels are characterized by extreme risk and potential rewards, attracting traders with a higher appetite for volatility.

Navigating these diverse levels requires a thorough understanding of options trading principles, market analysis techniques, and risk management strategies. Traders who embrace a disciplined approach, combined with continuous learning and adaptation, are better equipped to succeed in the challenging yet rewarding world of options trading.

Expert Insights: Unleashing Profitable Trading Strategies

To enhance your options trading journey, we’ve compiled valuable tips and expert advice from seasoned professionals in the field:

- Define Your Goals: Establish clear and realistic trading goals. This will guide your decisions and help you stay focused throughout the trading process.

- Thorough Research: Conduct thorough research on the underlying assets, market trends, and historical data. Knowledge is power in the options trading realm.

- Sharpen Your Analysis: Develop analytical skills to interpret market data and identify trading opportunities. Technical analysis and fundamental analysis are essential tools for successful trading.

- Plan Your Trades: Before executing a trade, meticulously plan your entry and exit points. Consider potential profit targets and risk tolerance.

- Patience is Paramount: Successful options trading demands patience. Avoid impulsive trades and wait for the right opportunities to arise.

- Embrace Risk Management: Implement a robust risk management strategy. Determine your acceptable risk levels and stick to them.

- Stay Updated: Constantly monitor market news and economic indicators. Staying informed allows you to adapt your strategies to changing market conditions.

- Continuous Learning: The options trading landscape is ever-evolving. Embrace continuous learning to enhance your skills and knowledge.

Common FAQs: Unveiling the Mysteries of Option Trading Levels

To provide further clarity, we’ve compiled a comprehensive FAQ section that addresses common questions related to option trading levels:

- Q: What factors influence the choice of option trading levels?

A: Market conditions, underlying asset performance, and trader risk tolerance are key factors influencing the selection of option trading levels. - Q: Can I trade options at any level?

A: No, each underlying asset has specific trading levels established by the exchange or brokerage firm, defining the range within which trades can be executed. - Q: How do I determine the right trading level for my strategy?

A: Analyze the underlying asset’s price history, volatility, and market sentiment to identify the most suitable trading level for your objectives. - Q: What are the risks associated with different trading levels?

A: Levels further from the underlying price typically carry higher risks, as they are more susceptible to price fluctuations. Higher levels also amplify potential profits. - Q: How can I mitigate risks associated with option trading levels?

A: Implement a comprehensive risk management strategy that includes defining stop-loss levels, position sizing, and diversification.

Option Trading Levels Interactive Brokers

Image: lazuxyderonav.web.fc2.com

Conclusion

Navigating the intricate world of option trading levels is a crucial aspect of successful trading. By understanding the different levels, employing expert strategies, and incorporating risk management principles, traders can establish a solid foundation for profitable trading.

If you’re intrigued by the potential of option trading, take the next step toward success by delving into the resources and guidance provided in this article. Embrace the challenge, learn from experts, and let your trading journey commence.