Introduction

Navigating the complex world of options trading requires a comprehensive understanding of market dynamics and a meticulous tracking system to monitor your progress. An online option trading journal offers an invaluable tool for traders of all experience levels, providing a centralized repository for recording trades, analyzing performance, and identifying areas for improvement. This article delves into the world of online option trading journals, exploring their benefits, features, and how to leverage them to maximize your trading potential.

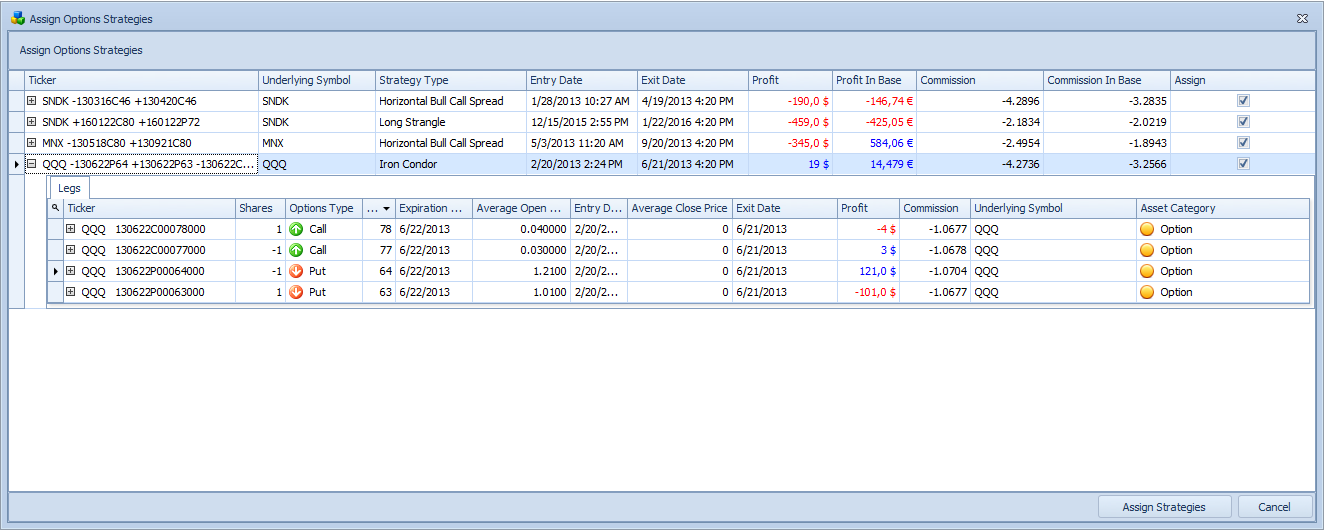

Image: www.traderslog.com

Benefits of an Online Option Trading Journal

Keeping a thorough trading journal yields numerous advantages for options traders:

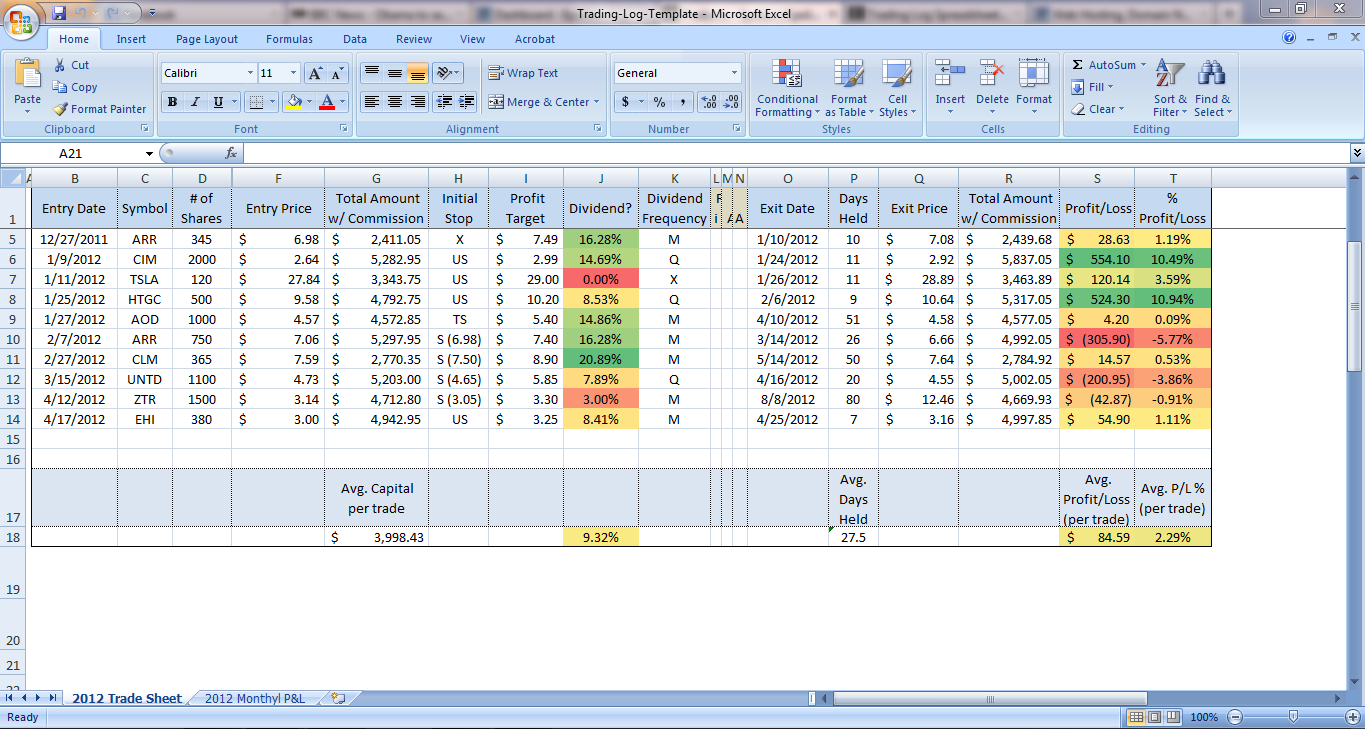

- Detailed Trade Tracking: Capture key data points for each trade, including entry and exit prices, expiration dates, strike prices, and profit or loss.

- Performance Analysis: Review past trades to evaluate your decision-making process, gauge risk management strategies, and identify patterns in your trading behavior.

- Emotional Management: By journaling your trades, you can track your emotional reactions during market fluctuations, helping you develop emotional discipline and avoid knee-jerk reactions.

- Tax Documentation: Maintain accurate records for tax reporting, ensuring compliance and simplifying the process of calculating gains and losses.

- Continuous Improvement: Ongoing review of your trading journal provides valuable insights into areas for improvement, allowing you to refine your strategies and enhance your profitability.

Features of an Online Option Trading Journal

Online option trading journals offer a range of features to facilitate comprehensive trade monitoring:

- Trade Entry: Quickly log trade details such as the underlying stock, option type, strategy, and entry price.

- Trade Management: Track position adjustments, including adjustments to the strike price or expiration date, as well as profit/loss calculations.

- Charting: Integrate charts within your journal to visually analyze market trends and identify trading opportunities.

- Statistics: Generate custom reports that provide insights into your overall performance, including win rate, profit factor, and risk/reward ratio.

- Cloud Storage: Securely store your trading data online, ensuring accessibility from any device, anytime.

How to Leverage an Online Option Trading Journal

Harness the power of an online option trading journal by incorporating it into your trading routine:

- Pre-Trade Planning: Before placing trades, jot down your strategy and objectives in your journal, ensuring clarity in your decision-making process.

- Post-Trade Analysis: After executing trades, take some time to reflect on the rationale behind your actions, the outcome, and any lessons learned.

- Regular Review: Periodic assessments of your trading journal will help you identify patterns, pinpoint areas for improvement, and refine your trading approach.

- Seek Feedback: Share your journal entries with a mentor or experienced trader to gain valuable feedback and enhance your trading journey.

Image: www.tradingdiarypro.com

Option Trading Journal Online

Image: db-excel.com

Conclusion

In the realm of option trading, an online trading journal is not merely a tool; it’s a powerful ally that empowers traders with the insights and control to elevate their trading performance. By meticulously recording trades, analyzing historical data, and continuously seeking improvement, traders can unlock their full potential and navigate the challenges of the options market with confidence. So, embrace the benefits of an online option trading journal today and embark on a path to enhanced trading success.