Embrace the World of Option Trading with HDFC Securities

Harnessing the power of option trading has emerged as a captivating investment strategy, enabling traders to capitalize on market opportunities and manage risk. HDFC Securities, a prominent financial institution, offers a comprehensive suite of option trading services, empowering investors with sophisticated tools and expert guidance.

Image: www.myxxgirl.com

HDFC Securities’ option trading platform seamlessly integrates real-time market data, in-depth analysis tools, and personalized advisory services, empowering traders to make informed decisions amidst market complexities.

Understanding Option Trading: A Gateway to Enhanced Returns

Option trading revolves around contracts that grant traders the right, but not the obligation, to buy (call options) or sell (put options) underlying assets at a specified price (strike price) within a predefined time frame. This flexibility empowers traders to speculate on price movements and hedge against potential losses.

Option trading offers several advantages, including the potential for substantial returns, limited downside risk through premium payments, and diversification benefits to mitigate portfolio volatility. Thorough understanding of option pricing models, strategies, and risk management techniques is crucial for successful option trading.

The Mechanics of Option Pricing

Option prices are determined by intricate calculations that consider factors such as the underlying asset’s price, strike price, time to expiration, volatility, interest rates, and dividend yields. These variables dynamically interact, influencing the value of option contracts.

Understanding the nuances of option pricing enables traders to formulate strategic decisions, assess potential profits and losses, and effectively manage risk.

Developing Effective Option Trading Strategies

Successful option trading hinges on the implementation of well-defined strategies that align with individual risk tolerance and investment goals. Popular strategies include covered calls, protective puts, and spreads, each catering to varying market conditions and objectives.

Carefully evaluating market trends, selecting appropriate strategies, and monitoring positions diligently are essential elements of successful option trading.

Image: www.youtube.com

Latest Trends and Innovations in Option Trading

The world of option trading is constantly evolving, driven by technological advancements and evolving market dynamics. Artificial intelligence and machine learning algorithms are revolutionizing trade execution, risk assessment, and strategy optimization.

Furthermore, the emergence of exchange-traded funds (ETFs) that track option indices has democratized access to option strategies, enabling broader participation in this dynamic market.

Expert Tips for Success in Option Trading

To enhance their prospects for success, option traders can benefit from embracing the following expert advice:

- Acquire a Thorough Understanding: Develop a deep comprehension of option pricing models, strategies, and risk management principles.

- Start with Small Positions: Gradually increase position size as knowledge and experience accumulate, minimizing potential losses.

- Manage Risk Effectively: Utilize stop-loss orders, margin management, and position sizing techniques to mitigate risk exposure.

- Monitor Market Trends: Stay up-to-date with economic indicators, company news, and geopolitical events to make informed trading decisions.

- Seek Professional Guidance: Consult with experienced financial advisors or brokers to gain insights and personalized recommendations.

Frequently Asked Questions (FAQs) About Option Trading

Q: What is the difference between call and put options?

A: Call options grant the right to buy, while put options confer the right to sell the underlying asset at the specified strike price.

Q: What determines option pricing?

A: Option prices are influenced by factors such as underlying asset price, strike price, time to expiration, volatility, interest rates, and dividend yields.

Q: Can I lose money in option trading?

A: Yes, option trading involves risk. Losses can exceed the premium paid if the option expires worthless or moves against the trader’s expectations.

Conclusion: Embrace the Opportunities of Option Trading

Option trading with HDFC Securities presents a compelling opportunity for investors to enhance their financial potential. By leveraging the platform’s sophisticated tools, expert guidance, and commitment to customer success, traders can navigate market complexities and capitalize on the advantages of option trading.

Whether you are a seasoned trader or a novice seeking to explore new investment avenues, HDFC Securities’ option trading services provide the foundation for success. Grab this opportunity to unlock the power of option trading and embark on a journey toward financial empowerment.

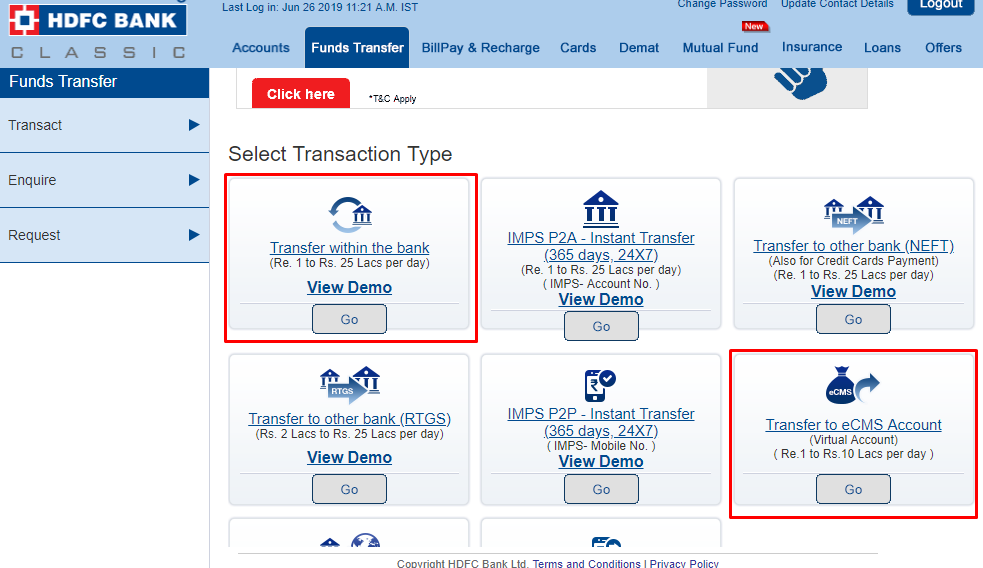

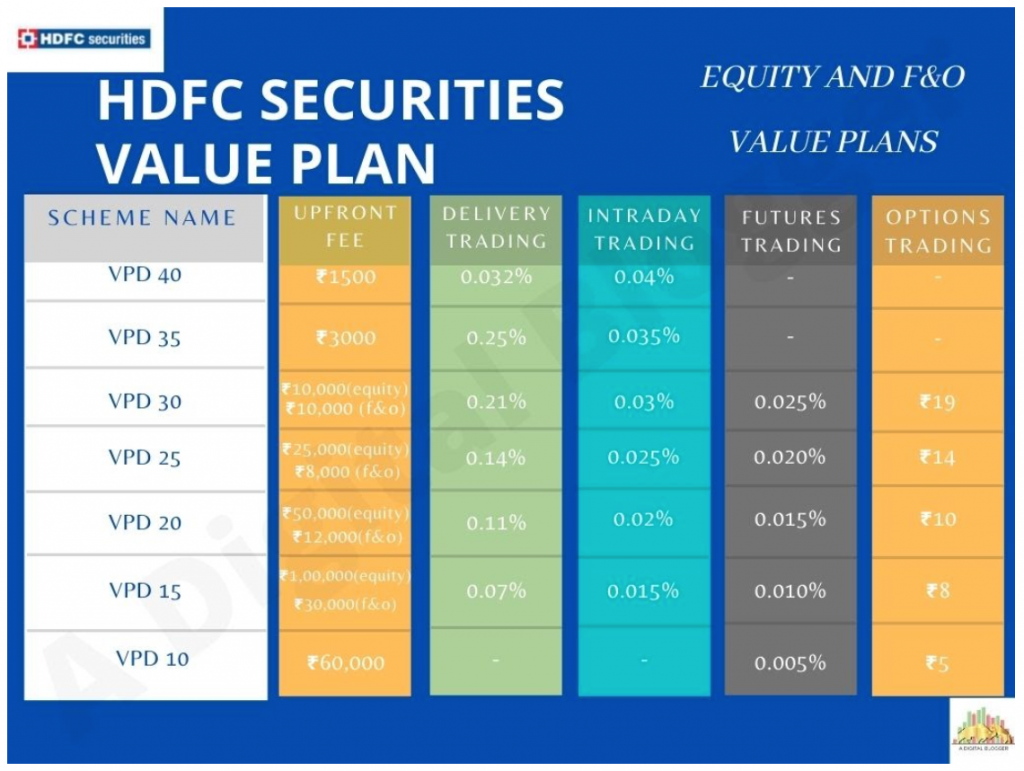

Option Trading In Hdfc Securities

Image: www.adigitalblogger.com

Call to Action: Are You Ready to Join the Option Trading Revolution?

If the prospect of harnessing the transformative power of option trading excites you, we invite you to join HDFC Securities’ vibrant community of successful traders. Our team of experts is ready to guide you every step of the way, empowering you to reach your financial goals through the strategic application of option trading.