Embark on the World of Bitcoin Options Trading with BITO

The realm of investing has witnessed a groundbreaking advancement with the introduction of BITO (Bitcoin Options Market Vector) options trading. This innovative instrument opens up a world of opportunities for investors seeking to navigate the volatile market dynamics of Bitcoin. Whether you’re a seasoned trader or taking your first steps into the world of options, this comprehensive guide will equip you with the knowledge and strategies necessary to excel in BITO options trading.

Image: www.fxstreet.com

Understanding BITO Options: A Gateway to Bitcoin Exposure

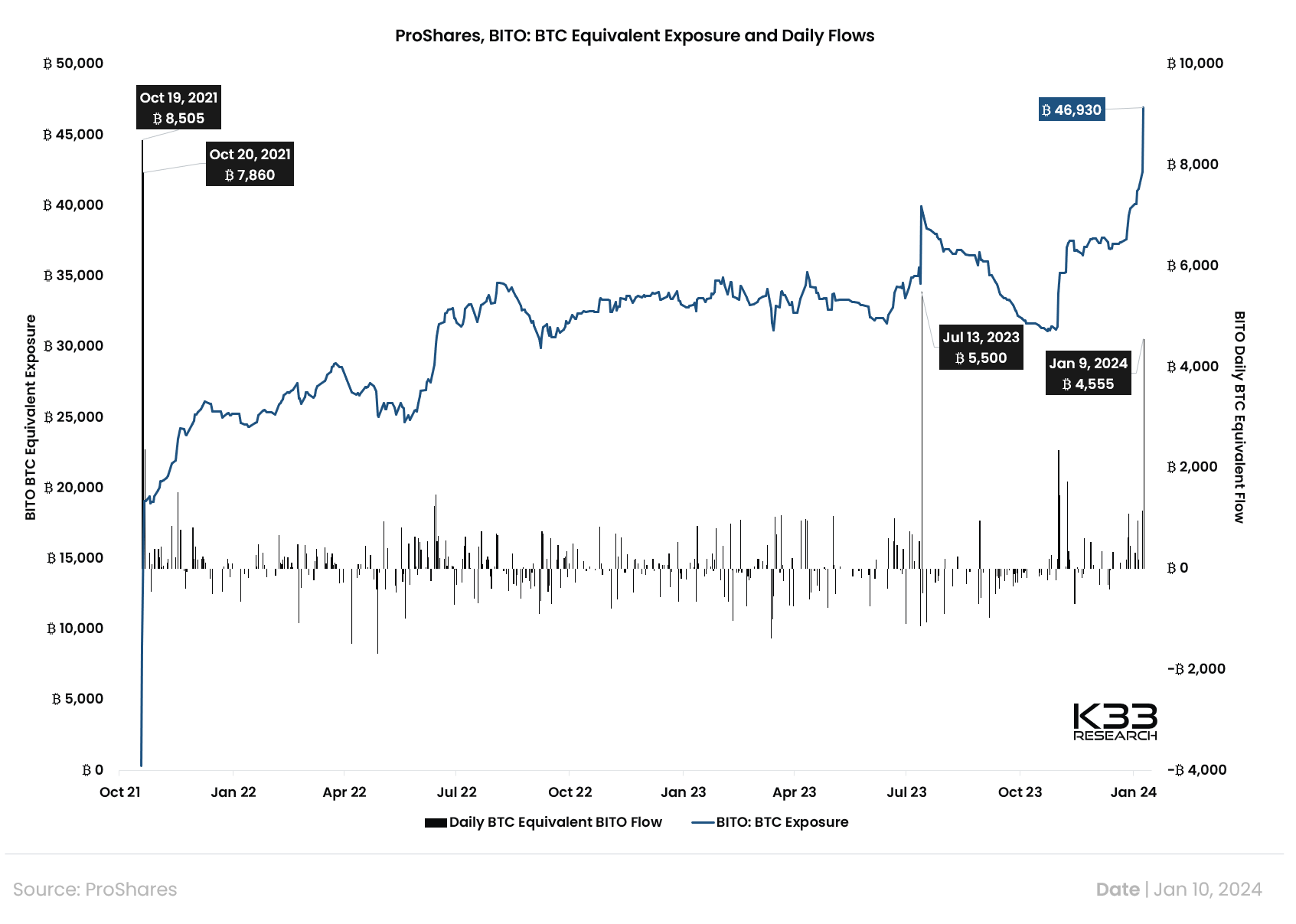

BITO options, first launched in October 2021, are standardized contracts that grant the buyer the right, but not the obligation, to buy or sell a specific amount of Bitcoin at a predetermined price on a defined date in the future. Unlike investing directly in Bitcoin, options trading provides investors with a structured framework to manage risk and explore various market strategies.

Fundamentals of Options Trading: Navigating Contractual Agreements

An options contract consists of a buyer and a seller. The buyer of an option pays a premium to the seller in exchange for the option to buy or sell the underlying asset at a specific price known as the strike price. The expiration date sets the timeframe in which the buyer can exercise their right to buy or sell. Understanding these fundamental concepts is crucial before venturing into BITO options trading.

Exploring BITO Option Strategies: Unlocking Market Potential

BITO options trading offers a versatile range of strategies that cater to different market scenarios and risk tolerances. From simple call and put options to more complex spreads and multi-leg strategies, the possibilities are vast. By familiarizing yourself with these strategies and their potential rewards and risks, you can tailor your approach to align with your investment goals.

Image: bitcoinethereumnews.com

Practical Applications: Empowering Informed Decisions

The beauty of BITO options trading lies in its versatility and adaptability. Investors can use options to gain exposure to Bitcoin without directly purchasing the cryptocurrency. Whether you seek to hedge against potential downside risks or capitalize on market volatility, BITO options can empower you with informed decisions and tailored risk management.

Staying Informed: Maximizing Success in a Dynamic Market

Success in BITO options trading demands ongoing research and market monitoring. Keep abreast of Bitcoin price movements, market news, and economic data that could impact the underlying asset. This vigilance enables you to adjust your strategies and make timely decisions based on changing market conditions.

Battening Down the Hatches: Managing Risks in Options Trading

Options trading, while lucrative, carries inherent risks. It’s crucial to implement prudent risk management measures to safeguard your capital. Understand the potential outcomes of each strategy, set clear stop-loss limits, and allocate funds wisely to minimize potential losses.

Bito Options Trading

Image: reviewguruu.com

Conclusion: Empowering Investors in the Digital Age

BITO options trading has revolutionized the way investors engage with the Bitcoin market. By equipping yourself with a comprehensive understanding of BITO options, you unlock a world of new opportunities and enhance your ability to adapt to volatile market conditions. Embrace the potential of BITO options trading and embrace the transformative power of this cutting-edge instrument.