Introduction

Navigating the complexities of the global corn market requires a strategic mindset, and option trading has emerged as a potent tool for astute investors seeking to capitalize on this lucrative market’s intricate dynamics. Option trading in corn futures contracts provides access to sophisticated strategies, empowering individuals to offset risk, manage volatility, and maximize profit potential.

Image: www.wattagnet.com

To delve into the realm of corn option trading, it’s imperative to grasp the underlying concept. Options are financial contracts granting buyers the right, but not the obligation, to buy or sell a specified quantity of corn at a predefined price, known as the strike price, on or before a predetermined date, known as the expiration date. By exercising these rights strategically, investors can tailor their positions to specific market conditions and exploit market inefficiencies.

Types of Option Trading Strategies

Option trading encompasses a wide spectrum of strategies, each designed to suit particular investor goals and market scenarios. Some of the most commonly employed strategies include:

a. Calls: Buying a call option grants the right to buy corn at a strike price at or before its expiration date. This strategy is often employed when bullish on corn prices and anticipates potential market gains.

b. Puts: Buying a put option confers the right to sell corn at the strike price on or before the expiration date. This approach is typically adopted when pessimistic about market conditions and seeks to mitigate potential losses.

c. Spreads: Spreads involve the simultaneous purchase and sale of options with different strike prices and expiration dates. This sophisticated strategy can enhance return potential and fine-tune risk management.

Factors Influencing Corn Prices

A comprehensive understanding of the factors driving corn price fluctuations is critical for successful option trading. The most influential factors include:

a. Supply and Demand: The balance between corn production and consumption plays a pivotal role in price determination. Bumper harvests and low demand can lead to lower prices, while adverse weather conditions and increased demand can exert upward pressure.

b. Government Policies: Government policies, including subsidies, tariffs, and acreage controls, have a significant impact on corn production and prices.

c. Global Economic Conditions: Corn is a global commodity, and macroeconomic factors such as inflation, economic growth, and global trade policies influence its prices worldwide.

d. Weather Conditions: Unfavorable weather conditions during critical growth stages can impact corn yields, leading to price fluctuations.

Strategies for Effective Option Trading

Engaging in corn option trading requires a disciplined approach and a solid understanding of market dynamics. To optimize success, consider the following strategies:

a. Define Trading Goals: Clearly establish your investment objectives, risk tolerance, and time horizon before embarking on option trading.

b. Research and Analysis: Conduct thorough research to gain insights into corn market dynamics, seasonal trends, and potential trading opportunities.

c. Choose Appropriate Strategies: Select option trading strategies based on market conditions and personal goals. Consider whether to trade calls, puts, or spreads.

d. Manage Risk: Implement prudent risk management measures by setting stop-loss and take-profit levels, limiting position sizes, and diversifying portfolio holdings.

e. Monitor and Adjust: Regularly monitor market conditions and adjust option positions accordingly to capitalize on favorable opportunities and mitigate potential losses.

Image: mpgtrading.blogspot.com

Option Trading For Corn

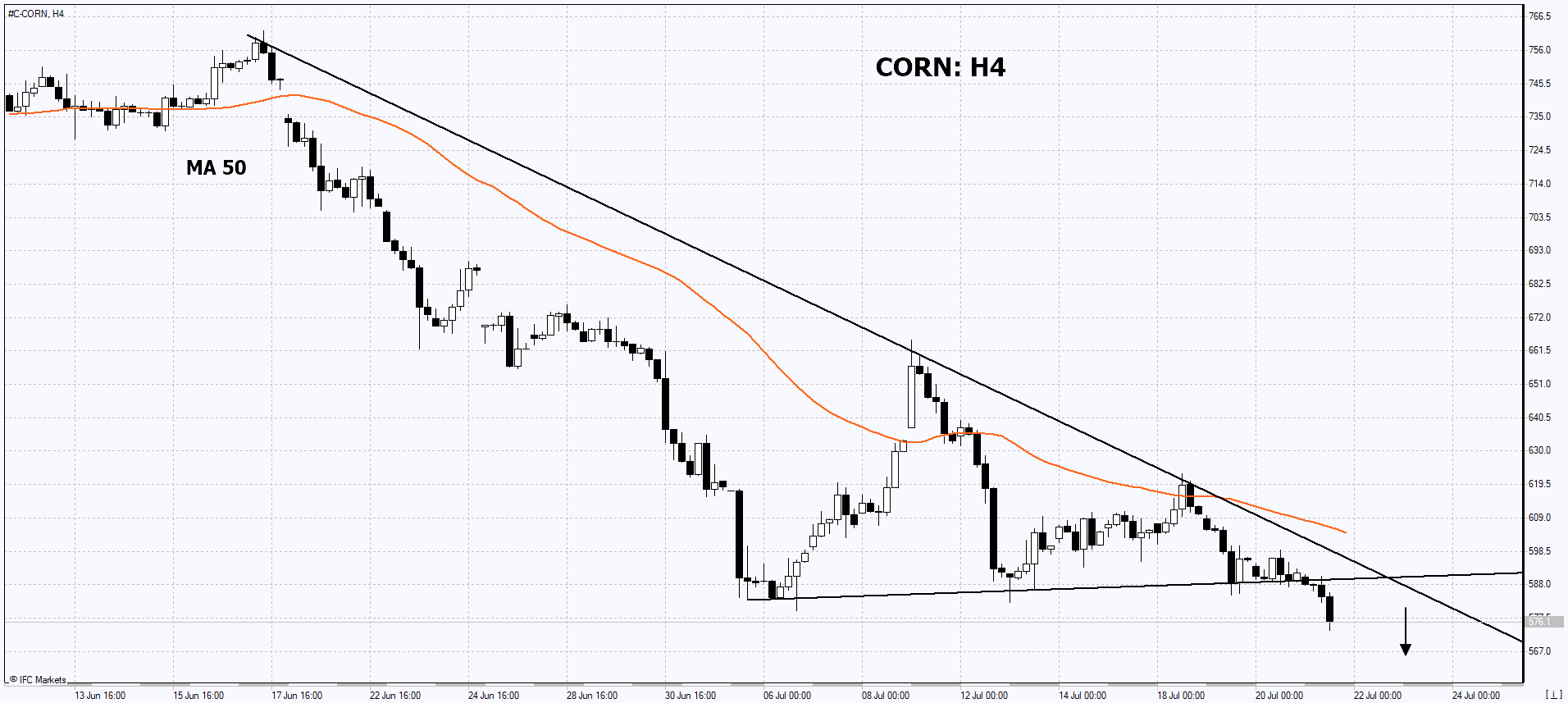

Image: www.ifcmarkets.co.in

Conclusion

Option trading in corn futures contracts offers investors a valuable tool for navigating market complexities and unlocking profit potential. It empowers individuals to tailor their strategies to specific market conditions, manage risk effectively, and maximize investment returns. By implementing the principles outlined in this article, investors can approach corn option trading with confidence and enhanced strategic capabilities. Remember, option trading involves potential risks and requires a thorough understanding of market dynamics. Approach it with careful consideration and a structured approach to optimize outcomes.