Introduction

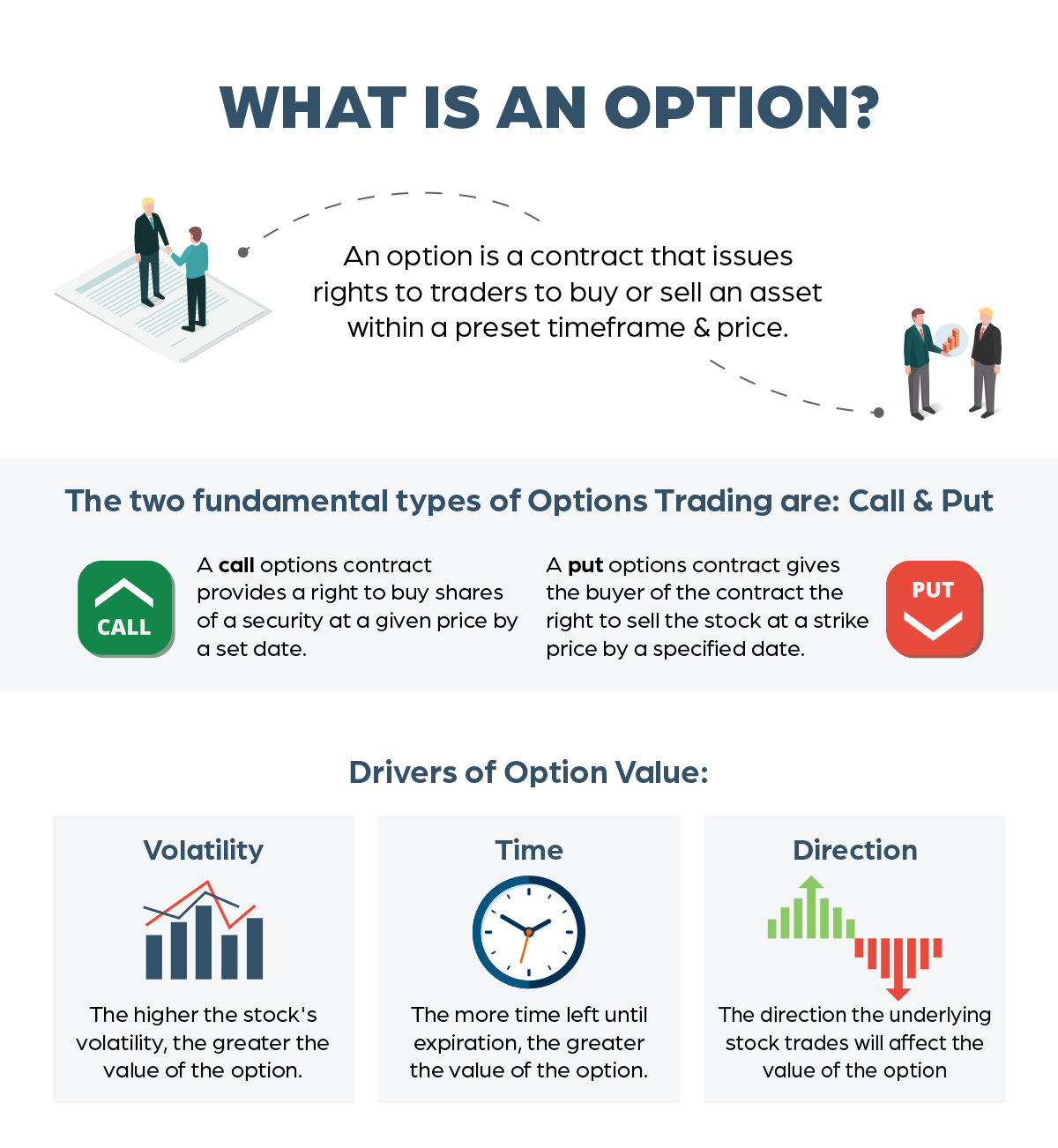

In the realm of financial investing, options stand as a captivating tool that empowers traders to navigate market uncertainties, speculate on price movements, and potentially reap substantial rewards. Option trading, a specialized form of investing, involves contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. With its versatility and risk-reward dynamics, options have become a cornerstone of modern trading strategies, unlocking a wealth of opportunities for astute investors.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

Understanding the Basics

Options contracts are standardized agreements traded on exchanges. They come in two primary flavors: call options, which grant the right to buy an asset, and put options, which confer the right to sell. Each contract specifies an underlying asset (e.g., stocks, indices, commodities), a strike price (the desired buy/sell price), an expiration date (when the contract expires), and a premium (the cost to acquire the contract). The intricate interplay of these elements forms the foundation of option trading, presenting both potential profits and risks.

Options as Leverage Tools

Unlike futures contracts, options offer tremendous leverage, allowing investors to control significant market exposure with minimal capital outlay. This characteristic makes options an attractive option for speculative trading, where they provide the flexibility to capitalize on market moves without committing substantial funds. However, it’s crucial to exercise caution as leverage can magnify both profits and losses.

Real-World Applications

Options trading finds diverse applications in the financial markets:

Image: ss501loverss.blogspot.com

Hedging Strategies:

Options serve as powerful hedging tools, mitigating risk exposure for investors with existing asset positions. By purchasing put options, investors can protect against potential losses in their underlying assets.

Speculative Strategies:

Traders can employ options to speculate on market trends. Call options allow for potential profit if the asset price rises above the strike price, while put options offer profit potential in falling markets.

Income Generation:

Selling (writing) options premiums can generate income, albeit with defined risk parameters. This strategy involves granting others the right to buy (via call options) or sell (via put options) the underlying asset at a predetermined price.

Advanced Concepts and Strategies

Option trading extends beyond the basics, offering sophisticated strategies and concepts to enhance profitability:

Option Pricing Models:

Investors leverage option pricing models like the Black-Scholes-Merton model to estimate the fair value of option contracts. These models incorporate variables such as volatility, time to expiration, strike price, and interest rates.

Implied Volatility:

Options traders closely monitor implied volatility (IV), which gauges market expectations of future price fluctuations. High IV suggests greater market uncertainty and potential for larger price swings, influencing option pricing.

Options Spreads:

Options spreads involve combining multiple options contracts of different strike prices and/or expiration dates. Spread strategies offer enhanced risk-reward profiles, allowing traders to tailor their positions to specific market scenarios.

Option Trading A

Image: www.ifmcinstitute.com

Conclusion

Option trading presents a captivating and multifaceted domain in the world of finance. Its ability to hedge against risks, speculate on market movements, and generate income through options premiums makes it a valuable tool for both experienced traders and those seeking to expand their investment horizons. To harness the full potential of option trading, it’s essential to approach the topic with a keen understanding of the fundamental principles and the ability to adapt to the ever-changing market dynamics. By combining strategic thinking with disciplined risk management, traders can unlock the potential of options and navigate the financial markets with increased confidence and potential for success.