Unveiling the Earning Potential of Option Alpha

Navigating the realm of options trading can be both exhilarating and daunting. Amidst the complex strategies and market intricacies, a question that inevitably arises is, “How much can I make trading options?” While there’s no definitive answer, understanding the factors that influence earnings can empower you to make informed decisions. In this comprehensive guide, we delve into the potential earnings and returns associated with option alpha, equipping you with the knowledge to embark on your trading journey.

Image: tradingdl.com

Navigating the Dynamics of Option Pricing

To grasp the earning potential of option alpha, it’s crucial to understand the dynamics of option pricing. Options derive their value from the underlying asset, such as a stock or commodity. Traders analyze various factors, including the asset’s current price, volatility, time to expiration, and interest rates, to determine the fair value of an option.

The key concept in option pricing is “optionality.” This premium paid for the right but not the obligation to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The option’s price reflects the perceived value of this flexibility.

Types of Option Alpha and Their Earning Potential

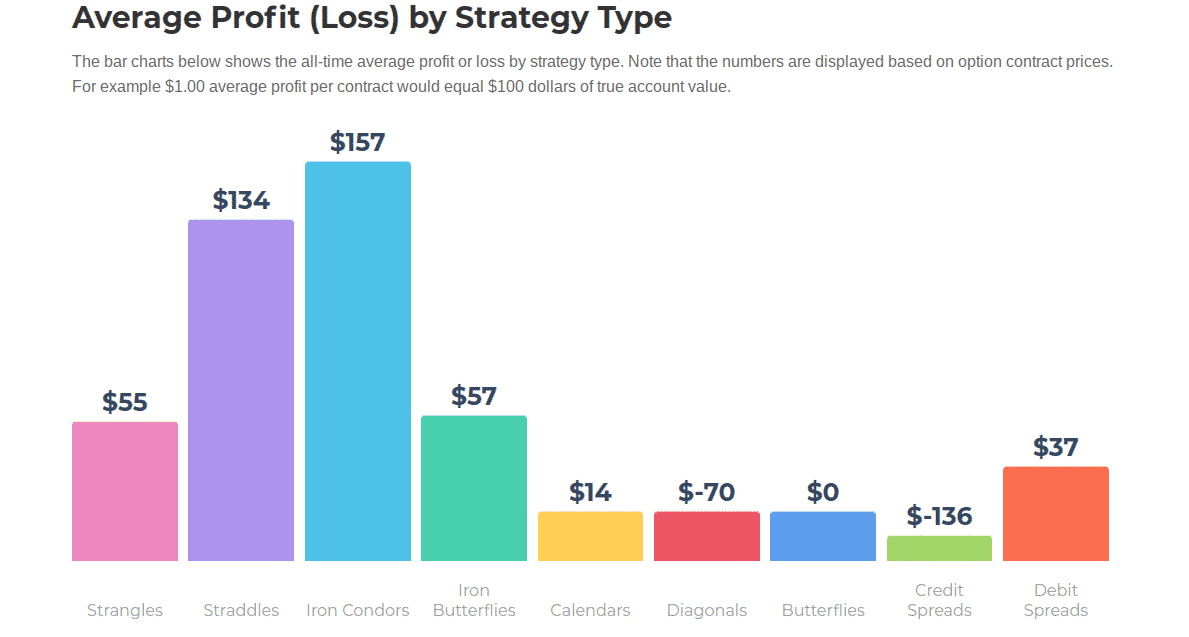

The earnings potential of option alpha depends on the specific strategy employed. Here are common types of option alpha:

1. Covered Call: A covered call involves selling (writing) a call option while owning the underlying asset. This strategy generates income from the premium received for selling the option, but it also caps potential gains on the underlying asset.

2. Cash-Covered Put: Similar to a covered call, a cash-covered put involves selling a put option while holding cash to cover the purchase price of the underlying asset if the option is exercised. This strategy provides a steady income stream but limits potential gains.

3. Naked Option Selling: A naked option sale entails selling an option without owning (in the case of a call) or being short (in the case of a put) the underlying asset. This strategy has a higher risk but also the potential for higher returns.

4. Calendar Spread: A calendar spread involves buying and selling options with different expiration dates but the same strike price. This strategy aims to profit from the decay in time value as the nearer-term option approaches expiration.

Factors Influencing Option Alpha Earnings

Several factors influence the earnings potential of option alpha:

a. Market Volatility: High volatility generally increases option premiums, leading to higher potential earnings, but it also magnifies the risk.

b. Time to Expiration: Premiums decay as options approach their expiration date, which can affect earning potential.

c. Underlying Asset Price: The price of the underlying asset directly impacts option values and earning potential.

d. Interest Rates: Changes in interest rates can affect the value of options with distant expirations.

Image: optionstradingiq.com

Managing Risk for Sustainable Earnings

While options trading offers earning potential, managing risk is paramount for sustainable returns. Consider the following risk management strategies:

a. Position Sizing: Limit the size of your option positions to align with your risk tolerance and account balance.

b. Diversification: Spread your capital across multiple option strategies and underlying assets to reduce risk.

c. Stop-Loss Orders: Use stop-loss orders to limit potential losses if market movements turn adverse.

Option Alpha How Much Can I Make Trading Options

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.plafon.id

Conclusion: Maximizing Your Option Alpha Earnings

Trading options can be a lucrative endeavor, but realizing its full potential requires a deep understanding of the factors that influence earnings. By embracing a comprehensive approach that encompasses option pricing dynamics, strategy selection, risk management, and a disciplined trading mindset, you can enhance your chances of success in the world of option alpha. Remember to approach options trading with a well-researched plan, embrace continuous learning, and seek guidance from reputable sources to navigate the complexities of this dynamic market.