Online options trading has emerged as a captivating avenue for investors seeking to enhance their financial acumen and navigate the ever-fluctuating markets. It offers a unique blend of risk and reward, providing opportunities for both seasoned traders and aspiring individuals to explore the complexities of speculative trading. Let’s delve into the world of online options trading, deciphering its intricate mechanics and unraveling the strategies to optimize your trading experience.

Image: www.youtube.com

Online options trading empowers traders with the ability to speculate on the future price movements of underlying assets, which may include stocks, indices, commodities, or currencies. Unlike traditional stock trading, options contracts grant traders the right, not the obligation, to buy or sell a specific asset at a predetermined price and date. This flexibility enables traders to harness market opportunities while mitigating potential losses.

Understanding Options Trading: A Gateway to Speculation

To comprehend the intricacies of online options trading, it is essential to grasp the fundamental concepts that govern this realm. Options contracts are characterized by two key components: the option premium and the strike price. The option premium represents the cost of purchasing the contract, while the strike price is the predetermined price at which the underlying asset can be bought (in the case of a call option) or sold (in the case of a put option).

The duration of an options contract is also a crucial factor, typically expiring within a predefined time frame ranging from weekly to monthly. As the expiration date approaches, the value of an option contract diminishes, eventually reaching zero at its expiry. It is important to note that options contracts carry the potential for both substantial profits and significant losses, making it imperative for traders to exercise sound risk management strategies.

Mastering Options Strategies: Unveiling the Secrets

Navigating the world of online options trading requires a comprehensive understanding of the various strategies employed by traders to capitalize on market movements. One of the most basic strategies is the “covered call,” where an investor holds a stock and sells a call option with a higher strike price against it. This strategy generates income by collecting the option premium while maintaining the potential for stock appreciation.

Another popular strategy, known as the “put credit spread,” involves selling a put option at a lower strike price while simultaneously purchasing another put option with a higher strike price. This strategy benefits from premium collection and capitalizes on the stability or decline of the underlying asset’s price.

Navigating the Market: Tips for Success

While options trading presents lucrative opportunities, it is not without its challenges. To enhance your chances of success, consider the following tips:

- Educate yourself: Delve into the world of options trading through reputable resources, books, and online courses to equip yourself with the necessary knowledge.

- Start small: Begin your options trading journey with small trades to gain experience and minimize potential losses.

- Manage your risk: Employ sound risk management strategies such as stop-loss orders and position sizing to safeguard your capital.

- Stay informed: Keep abreast of market news, economic data, and company announcements that may impact the value of your options contracts.

- Seek professional guidance: Consider consulting with a financial advisor or experienced trader for personalized advice and risk assessment.

Image: www.pinterest.com

Frequently Asked Questions: Unraveling the Unknown

To further clarify the intricacies of online options trading, here are answers to some frequently asked questions:

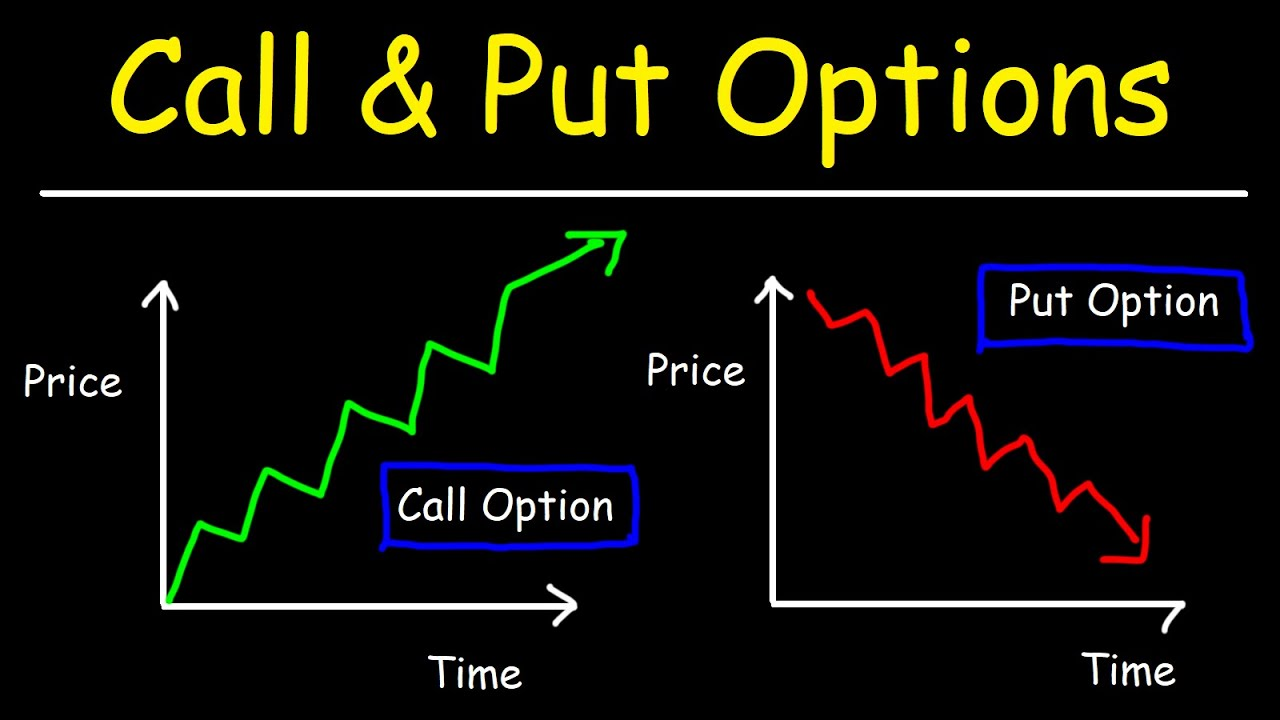

- Q: What is the difference between a call and a put option?

- A: A call option grants the right to buy an underlying asset, while a put option confers the right to sell.

- Q: How do I determine the profitability of an options contract?

- A: Profitability hinges on the difference between the option premium and the intrinsic value of the contract, factoring in the strike price and the underlying asset’s price.

- Q: Are options contracts more risky than stocks?

- A: Options carry higher risk compared to stocks due to their time decay and the potential for significant losses.

Harnessing the Power of Options Trading: A Call to Action

Online options trading offers a captivating and dynamic financial instrument for those seeking to speculate on market movements. By mastering the fundamentals, embracing prudent strategies, and minimizing risk, you can unlock the potential of this lucrative investment avenue. Whether you are a seasoned veteran or an aspiring trader, the world of online options trading beckons you to explore its complexities and seize the opportunities that await.

As you delve deeper into this intriguing realm, we invite you to engage in further exploration through our comprehensive resource library, webinars, and exclusive trading tools. Our commitment to empowering traders extends beyond this article, enabling you to navigate the nuances of online options trading with confidence and harness its potential to elevate your financial aspirations. Embark on this exciting journey today and seize the opportunities that await.

Online Options Trading Explained

Image: tradewithmarketmoves.com

Are you ready to unleash the power of online options trading and embark on a journey of speculative adventure?