Options trading has emerged as a popular investment strategy, allowing investors to potentially enhance their returns and manage risk. This detailed tutorial will guide you through the intricacies of online option trading, providing a comprehensive understanding of its basics, strategies, and real-world applications.

Image: www.interactivebrokers.hu

Understanding Options: A Basic Introduction

Options are financial contracts that grant an option buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a particular date (expiration date). They provide investors with flexibility and leverage, enabling them to capitalize on market movements without directly owning the underlying asset.

Types of Options: Calls and Puts

Call options give the holder the right to buy an underlying asset at a predetermined strike price, while put options grant the right to sell. Call options are typically purchased when investors anticipate an increase in the underlying asset’s price, whereas put options are used when a decline is expected.

Key Concepts in Option Trading

- Expiration Date: The date on which the option contract expires, after which it becomes worthless.

- Strike Price: The predetermined price at which the option holder can buy or sell the underlying asset.

- Premium: The price paid to acquire an option, representing the potential reward for the option writer and the cost for the option buyer.

- Volatility: A measure of the underlying asset’s price fluctuations; high volatility increases option premiums.

- Theta Decay: The natural decrease in an option’s value as time passes towards expiration.

Image: stewdiostix.blogspot.com

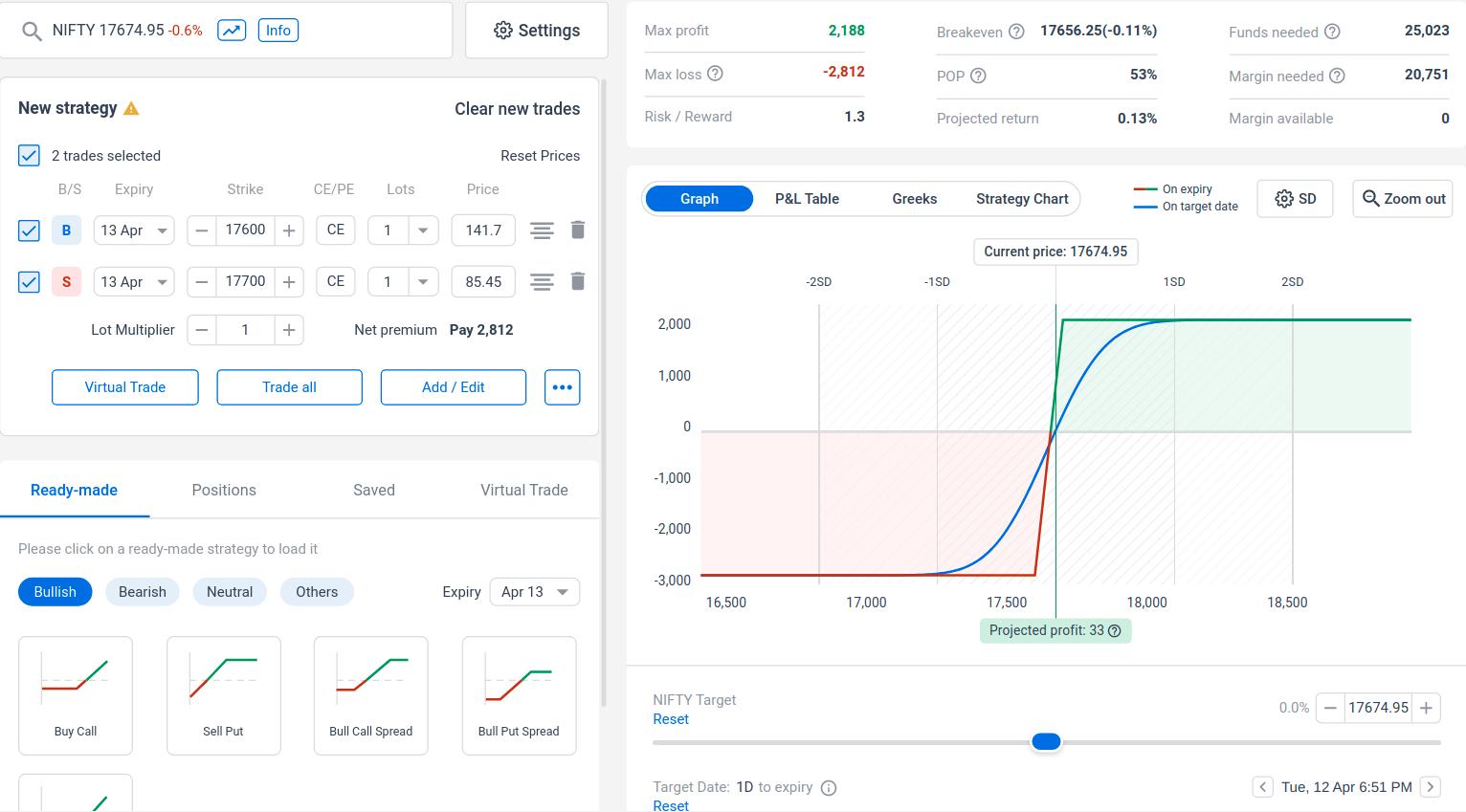

Option Trading Strategies

- Covered Call: Selling a call option when holding the underlying asset.

- Cash-Secured Put: Selling a put option while holding cash to cover the potential obligation to buy the asset.

- Bear Put Spread: Selling a higher strike price put option and buying a lower strike price put option.

- Iron Condor: Selling a bullish call spread and a bearish put spread with the same expiration and different strike prices.

Real-World Applications of Option Trading

- Hedging: Protecting against potential losses in an existing investment portfolio.

- Income Generation: Selling options to receive premiums, generating income from market movements without selling the underlying asset.

- Speculation: Capitalizing on short-term price fluctuations to make profits.

Tips for Successful Option Trading

- Education: Understand the complexities of options trading before entering the market.

- Risk Management: Always limit your risk by trading within your means and understanding the potential for loss.

- **Volatility Assessment: Monitor market volatility and adjust your strategies accordingly.

- Proper Research: Conduct thorough research on the underlying asset and the options market.

- Discipline and Patience: Exercise discipline in your trading decisions and be patient in waiting for favorable market conditions.

Online Option Trading Tutorial

Image: www.youtube.com

Conclusion

Option trading offers investors a versatile and potentially lucrative investment strategy. However, it requires a thorough understanding of the concepts, strategies, and risks involved. By following the guidance outlined in this tutorial, you can navigate the online option trading market with confidence, unlocking its potential for enhancing your investment returns and managing risk effectively. Remember, investing always carries a degree of risk, and it’s essential to consult with a financial advisor before making any investment decisions.